Maxco Futures — U.S. President Donald Trump has officially signed a bill ending the longest government shutdown in American history, which lasted 43 days and brought much of the federal government’s operations to a standstill.

Prolonged Budget Stalemate

The shutdown began over a month ago due to a deadlock between the White House and Congress regarding the national budget proposal. For nearly six weeks, thousands of federal employees went unpaid, while many others were furloughed or temporarily dismissed.

This resulted in widespread disruptions across public services and social programs — from airport delays and immigration processing slowdowns to postponed research and health inspections.

Congress Approval

The final step to end the crisis came after the U.S. Senate approved a stopgap spending bill to reopen the government.

The bill then passed the House of Representatives with 222 votes in favor and 209 against. Interestingly, six Democrats sided with Republicans to accelerate the resolution of the impasse.

Following the approval by both chambers, President Trump signed the bill in the Oval Office, restoring funding for federal agencies and allowing government employees to return to work and receive back pay within the coming days.

In his statement, Trump described the move as an effort to “restore governmental stability and provide certainty to the American people,” while emphasizing that the long-term budget debate — particularly over border security funding — remains unresolved.

Economic and Social Impact

The 43-day shutdown has left a significant economic toll.

According to the Congressional Budget Office (CBO), the deadlock cost the U.S. economy billions of dollars, primarily due to reduced household spending from delayed paychecks.

Public trust in government also declined, as many Americans viewed the prolonged standoff as a failure of political leadership to reach a timely and effective compromise.

While the reopening brings relief, analysts warn that another fiscal standoff remains possible unless Congress and the White House can agree on a long-term funding plan.

For millions of Americans, this decision offers relief — but also serves as a reminder that government stability depends on dialogue and compromise among political leaders.

Market Reactions

Both Forex and Gold traders are now refocusing on upcoming U.S. economic data releases, particularly labor market and retail growth reports, as indicators of the next direction for markets.

We believe investors will adopt a more realistic stance toward growth expectations following recent volatility.

Gold prices remain speculative, with upside potential still present after the metal rallied sharply overnight and in early Asian trading, touching an intraday high of 4220.

Technically, gold has shown continued bullish momentum after breaking above its intraday resistance at 4147/4149 yesterday. Meanwhile, comments from Federal Reserve officials hinting at a possible rate cut in December have reinforced investor appetite for gold as a hedging instrument.

Investors are now looking for strategic entry levels in anticipation of a Fed rate cut scenario, though short-term intraday corrections remain possible as part of a natural pullback pattern.

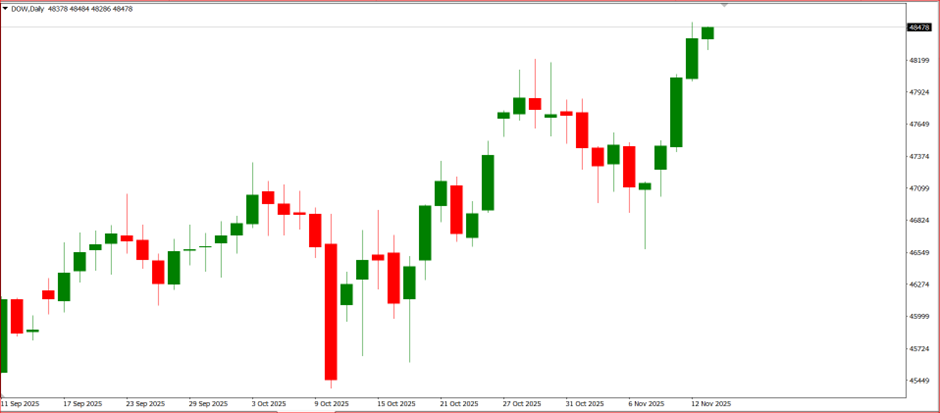

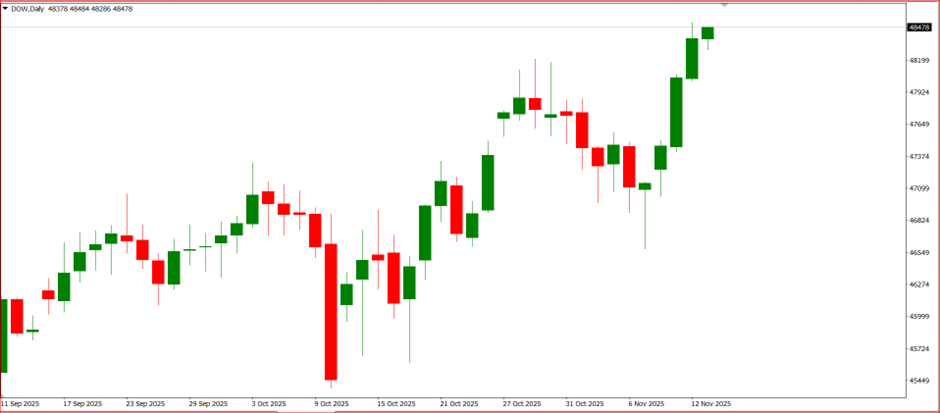

On the equity side, Dow Jones Futures hit a new high at 48,523 overnight following optimism over the end of the record-long government shutdown.

The rally reflects renewed market confidence in the normalization of public services and continued speculation that weaker economic data could strengthen the case for a Federal Reserve rate cut in December.

Ade Yunus, ST WPA

Global Market Strategies