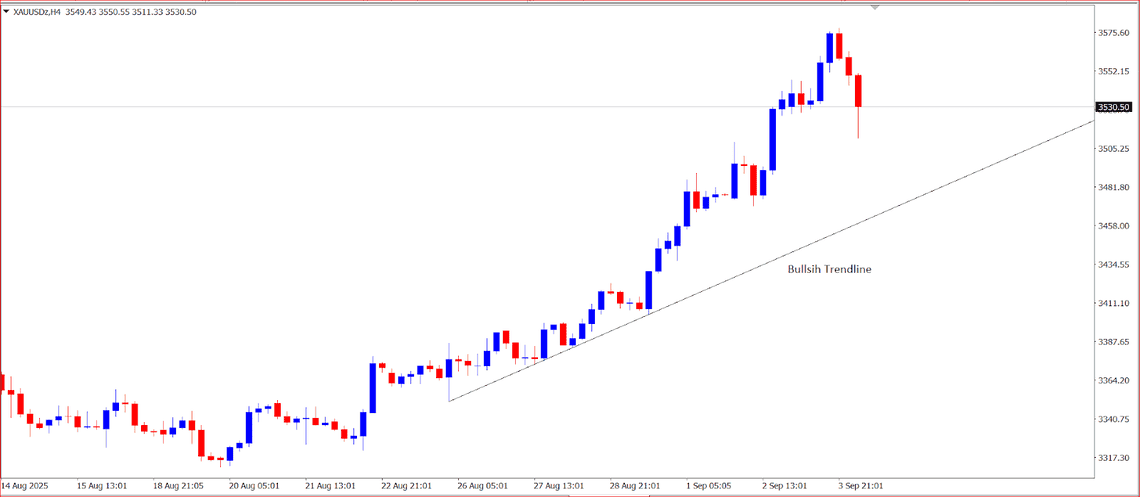

Gold prices (XAU/USD) edged lower in Thursday morning trading (September 4, 2025), after recently hitting a new all-time high. Spot gold briefly touched US$3,578.50 per troy ounce before retreating around 1.3% to US$3,512.

This pullback followed a sharp rally over the past few days, driven by a weakening U.S. dollar and growing speculation of a Federal Reserve interest rate cut. However, this morning the gold market’s direction shifted slightly due to a combination of technical and fundamental factors.

Intraday Gold (H4):

Profit-Taking After Record High

The surge to record highs triggered a wave of profit-taking among investors. This is a common occurrence when prices reach a new psychological threshold. More cautious investors chose to lock in gains, pushing gold prices slightly lower.

Market Focus: U.S. Jobs Data

Beyond technical factors, market participants are now focusing on the upcoming August Non-Farm Payrolls (NFP) report, scheduled for release later this week.

- Previous data (July): Job openings fell to 7.181 million — the lowest level in 10 months.

- Implication: This suggests a softening U.S. labor market, which strengthens the case for a Fed rate cut.

According to CME FedWatch, the probability of a 25 basis point rate cut at the Fed’s September meeting has surged to 97%. This expectation typically supports gold, as lower interest rates make non-yielding assets like gold more attractive.

However, with the key data release approaching, the market is likely to remain cautious. Investors are awaiting confirmation from labor data, resulting in limited gold movement in the short term.

External Pressures: Stronger Dollar and Rising Bond Yields

Gold is also facing external pressure from a strengthening U.S. dollar and rising Treasury yields.

- Stronger dollar: Makes gold more expensive for holders of other currencies.

- Higher yields: Increase the appeal of income-generating assets like bonds, reducing demand for gold.

Medium-Term Outlook Remains Positive

Despite this morning’s correction, the medium-term outlook for gold remains bullish, supported by three key factors:

- Expectations of a Fed rate cut in September.

- Global economic uncertainty, which enhances gold’s appeal as a hedge.

- Investor demand for safe-haven assets, especially amid stock market volatility and geopolitical risks.

That said, short-term movements will continue to be influenced by the direction of the U.S. dollar, bond yields, and upcoming labor market data.

Ade Yunus

Global Market Strategies