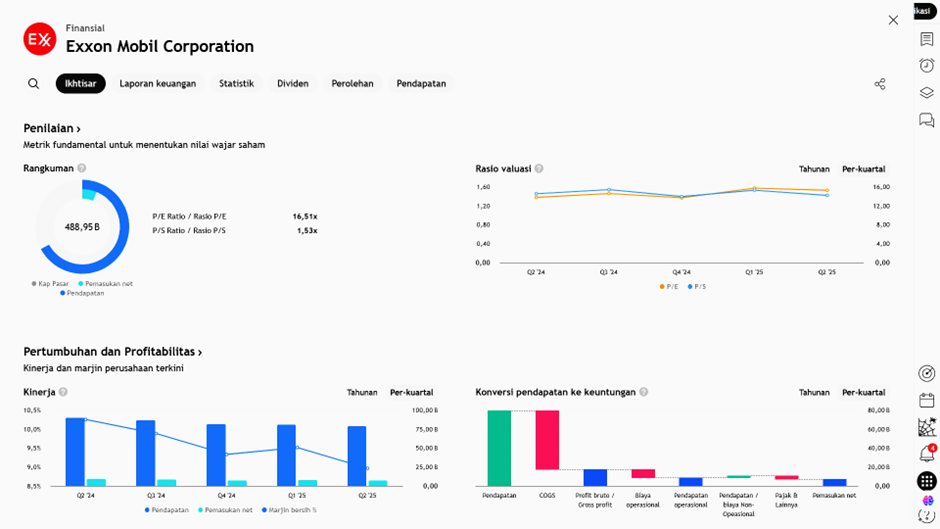

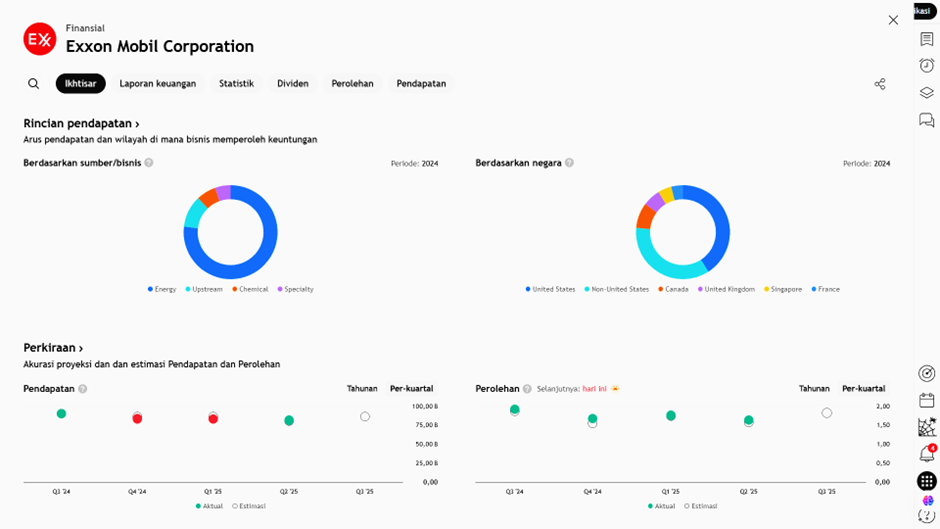

American energy giant Exxon Mobil Corp is set to report its third-quarter performance amid volatile oil prices and tightening industry margins. Markets are watching closely to see whether the momentum from the global energy recovery can still support the company’s profits—or instead confirm the slowdown trend looming over the integrated oil and gas sector.

Analyst expectations point to declines in both earnings and revenue, reflecting pressure on production and weakening downstream margins. Nevertheless, Exxon is seen as being in a more defensive position thanks to its diversified operations and efficiency in refining.

In a global energy landscape shifting toward low-carbon transition and growing geopolitical uncertainty, this Q3 performance will serve as a key barometer for the profitability outlook of the U.S. energy sector heading into 2026.

Key Points

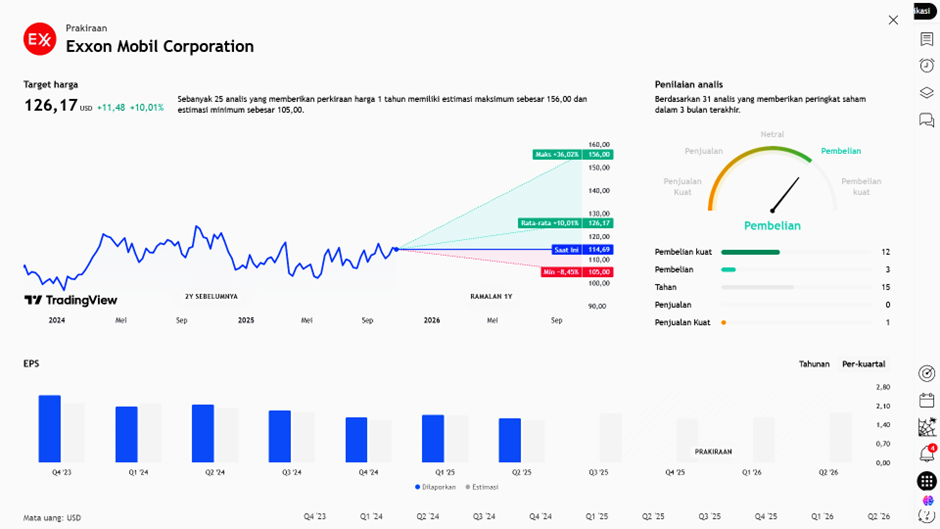

- Exxon Mobil expects its Q3 2025 earnings to rise sequentially, primarily driven by higher oil prices and stronger refining margins.

- Changes in crude oil prices could impact the upstream segment by between −US$100 million and +US$300 million.

- U.S. natural gas prices fell about 12.5% during the quarter, which may affect Exxon’s upstream earnings by −US$200 million to +US$200 million.

- The refining segment is expected to contribute positively, supported by stronger margins — Exxon estimates an earnings increase of US$300 million to US$700 million from this segment compared to the previous quarter.

- However, the company also noted that restructuring costs could reduce earnings by US$400 million to US$600 million.

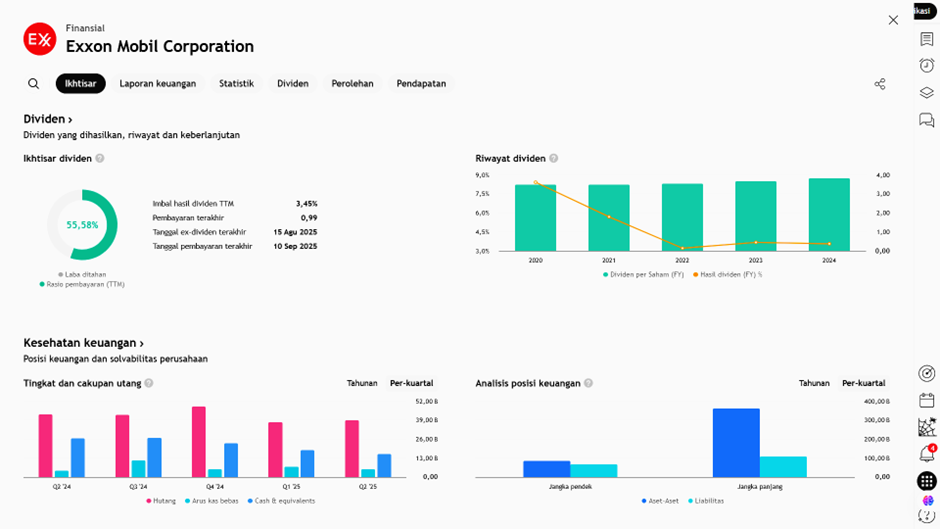

- For the full fiscal year 2025, analysts project a non-GAAP EPS of around US$6.79, down from US$7.79 in fiscal 2024.

Analysis & Notes

The rise in refining margins stands out as a key highlight — with oil prices relatively stable and fuel demand increasing, refining profitability could serve as a major support for Exxon.

However, the upstream segment remains exposed to risks from commodity price volatility — particularly as natural gas prices have declined.

The mention of restructuring costs indicates that Exxon is pursuing efficiency measures or operational adjustments — though these steps also weigh on this quarter’s earnings.

The downward revision in annual EPS estimates suggests that the market anticipates continued pressure from costs and/or slowing energy demand.

Investor Implications

If refining margins remain strong and Exxon manages to contain restructuring costs, Q3 could deliver a fairly solid performance despite a softer upstream segment.

However, investors should stay cautious about commodity price risks — especially natural gas — and monitor how effectively Exxon controls additional expenses.

The company remains a key barometer for the broader energy industry, with its results likely to signal broader trends across the oil and gas sector.

Earning Projection Prediction

What Analyst said

Short – Medium Term Projection

Strategy

| SELL EXXON | |

| Entry | 114.60 |

| Take Profit | 119.92 |

| Stoploss | 111.71 |

Disclaimer On

Ade Yunus ST, WPA

Global Market Strategies

Andrew Fischer

Market Analyst