The US Dollar Index (DXY) edged slightly higher to around 98.40 in early Asian trading on Wednesday (Sept 3, 2025), supported by cautious market sentiment and rising geopolitical risks, particularly the Russia–Ukraine conflict, which fueled safe-haven flows into the dollar.

However, expectations of a potential Fed rate cut this month limited further gains. Markets are now pricing in a 91% probability of a 25 bps rate cut at the September meeting, up from 85% a week earlier. This aligns with weaker US labor data, as July’s Nonfarm Payrolls (NFP) showed slower job growth than expected, strengthening the case for monetary easing.

The upcoming August NFP report on Friday will be in focus, with projections of only 75k job additions and the unemployment rate rising to 4.3%.

Adding pressure to the dollar, trade uncertainty resurfaced after a US appeals court ruled that President Trump’s broad import tariffs were unlawful. Trump has vowed to appeal the decision to the Supreme Court.

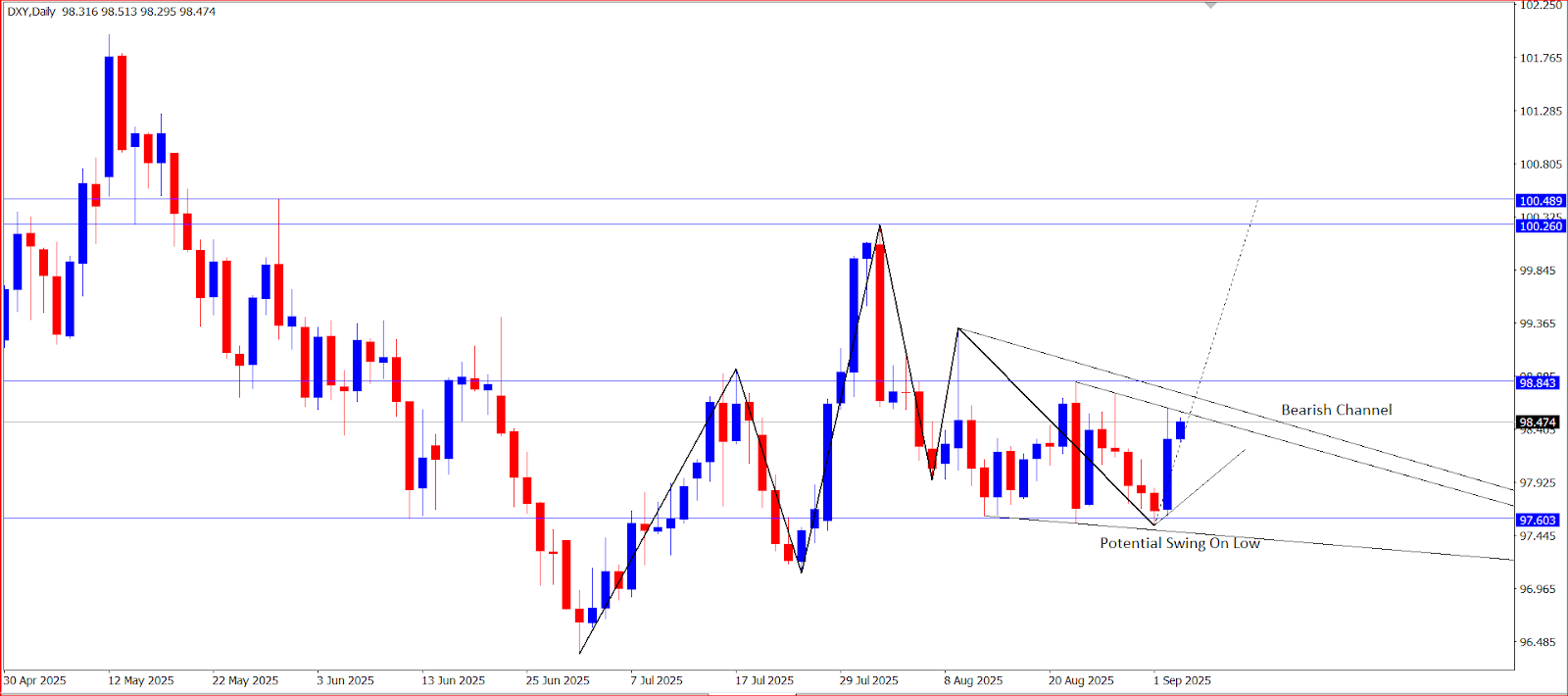

From a technical perspective, DXY is hovering around 98.46 after touching a daily high of 98.59 in the previous session. The bearish trendline remains a key test area, with the nearest resistance at 99.32 and support at 97.53.

Disclaimer ON

Want to learn more about the world of trading? Join Maxco Masterclass Trading every Friday!