MAXCO FUTURES – The U.S. dollar extended its gains on Thursday morning in Asia, supported by fading market bets on further interest rate cuts by the Federal Reserve. Investors interpreted the latest signals from Fed Chair Jerome Powell as an indication that monetary easing may be delayed until next year, while the Bank of Japan (BOJ) remains cautious in tightening policy, keeping the yen on the defensive.

The U.S. dollar index held near a two-week high against a basket of major currencies following Powell’s remarks, which were viewed as hawkish by market participants. He emphasized that although inflation continues to cool, the U.S. economy remains strong enough to justify delaying aggressive rate cuts. Markets now see only about a 68% chance of a December rate cut — sharply lower from nearly 100% before the latest FOMC meeting.

This situation widens the policy gap between the Fed and the BOJ. On Thursday, Japan’s central bank kept its benchmark interest rate around 0.5%, reiterating its intention to raise borrowing costs gradually if supported by economic data. However, only two policymakers backed the move — the same as last month — signaling that normalization will remain a slow process.

The yen briefly weakened to around ¥153 per dollar, nearing the intervention level that previously sparked market concern. Japanese officials were reported to be on “high alert” against excessive volatility but have yet to indicate any direct intervention.

Meanwhile, commodity-linked currencies such as the Australian and New Zealand dollars edged higher, helped by a rebound in China’s yuan, which hit its strongest level in nearly a year against the greenback. Market sentiment also improved following reports of a meeting between U.S. President Donald Trump and Chinese President Xi Jinping, fueling hopes for potential trade stability, though no concrete details were announced.

In the bond market, the yield on 10-year U.S. Treasuries held above 4.25%, reflecting confidence that the U.S. economy remains resilient despite two rate cuts earlier this year. The Fed’s cautious tone added pressure on Asian risk assets while supporting the dollar as a key safe-haven currency.

Market Outlook

We believe the latest developments highlight that the global rate-cut cycle will not occur in unison. The Fed appears patient, waiting for more convincing signs of disinflation, while the BOJ is still weighing its first steps out of the negative rate era. This policy divergence could extend the U.S. dollar’s dominance over Asian currencies, including the yen and the Korean won.

“Powell seems to be keeping his options open — he hasn’t ruled out rate cuts but doesn’t want the market to get ahead of itself,” said a Tokyo-based FX analyst. “That’s enough to keep the dollar strong through the fourth quarter.”

Global Implications

For Asian investors, the combination of a stronger dollar and weaker yen poses new risks for capital flows and trade. Regional currencies are likely to remain under pressure, while dollar-denominated assets regain appeal. If the Fed delays easing until 2026, as some market participants are beginning to expect, FX volatility could spike toward year-end.

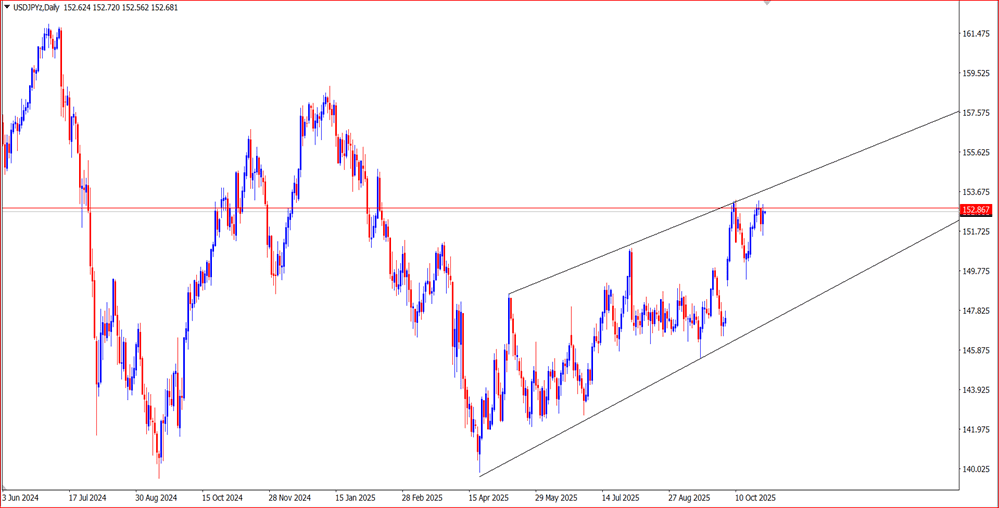

Technical Outlook (USD/JPY)

The USD/JPY movement around 153–154 represents a medium-term daily selling interest zone, with potential downside targets near 147, 143, and 139. Meanwhile, the swing range may still extend toward 154–157.

Disclaimer ON

Ade Yunus, ST, WPA

Global Market Strategies