The two major card payment networks in the United States are expected to post results for the first three months of 2025, as consumer spending remains solid and may be boosted by cardholders seeking to get ahead of trade tariffs.

Mastercard (NYSE: MA) will report first quarter (Q1) earnings as it follows the standard quarter calendar. Meanwhile, Visa (NYSE:V) calls the same time period – January 1, 2025 to March 31, 2025 – as the second fiscal quarter (Q2). Visa will report financial results after markets close on Tuesday, while Mastercard will report before markets open on Thursday.

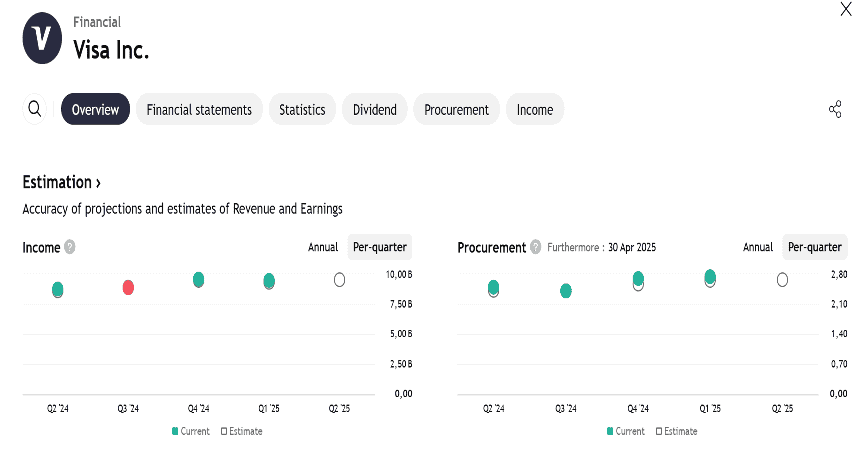

According to analysts’ average estimates, Visa is expected to post adjusted earnings per share (EPS) of $2.68 for Q2, up 6.8% year-on-year (Y/Y), while its revenue is expected to grow 8.8% Y/Y to $9.55 billion. Mastercard’s adjusted EPS is expected to increase 7.8% Y/Y to $3.57, on revenue growth of 12% Y/Y to $7.13 billion.

Earlier, two smaller networks, American Express (AXP) and Discover Financial (DFS), had revealed their results for January to March 2025. American Express network volumes rose 5% Y/Y to $439.6 billion, while Discover volumes fell 3% Y/Y to $147.4 billion.

Visa’s payment volume for Q2 FY2025 is estimated at $3.40 trillion according to Visible Alpha consensus, an increase of 7.2% Y/Y. Mastercard’s gross volume for Q1 is estimated at $2.49 trillion, an increase of 8.6% Y/Y based on VA estimates.

Citi analyst, Andrew Schmidt, expects Visa and Mastercard to post results that “match or exceed” expectations when they report their latest quarterly earnings on Tuesday.

Both card networks have a solid track record of beating consensus estimates. Mastercard’s revenue and EPS have exceeded analysts’ average estimates in the last 12 quarters. Visa’s EPS has also exceeded expectations in all of the last 12 quarters, while its revenue has only missed once.

Schmidt highlighted that cross-border transactions are a key focus due to news of slowing inbound travel to the US, a weakening US dollar, high currency volatility and global exposure.

SA analyst Ken Taylor will monitor Mastercard’s Value Added Services (“VAS”) and commercial payments growth in Q1 results. “Both VAS and commercial payments and solutions are growing faster than consumer payments, making them key drivers of the business and share price,” he wrote in a preview of the company’s earnings report.

Citi’s Schmidt commented, “Earnings comments are likely to point to increased economic uncertainty, but a major change in the forward outlook is currently seen as less likely.”

For reference, Visa said in January that it expects FY2025 EPS to grow in the range of a dozen percent and revenue to increase in the double-digit range.

SA analyst Ken Taylor adds on Mastercard’s outlook, “I want to make sure that the company’s long-term prospects remain as strong as I believe they are, and that the reasons I own this stock are not compromised.”

SA analyst Luca Socci will also focus on Visa’s prospects, especially regarding the uncertainty of tariff impacts. “For Visa, this may mean its international business could be slower than expected,” he writes. These tariffs will not only affect tourism, but also impact global e-commerce, which accounts for about 40% of Visa’s cross-border volume.

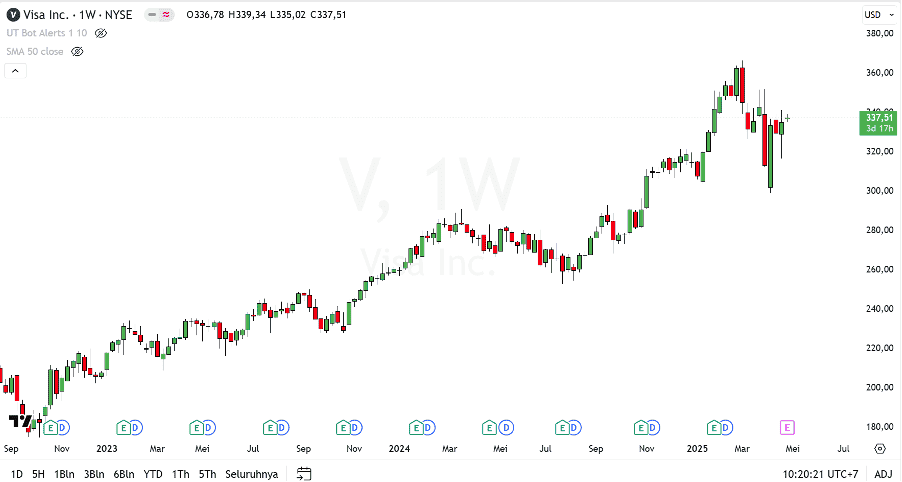

Ahead of their earnings report, Visa shares edged up 0.1% and Mastercard shares fell 0.5% in Monday afternoon trading.

Understanding Market Sentiment and Expectations in the Industry

Understanding market sentiment and expectations in the industry is crucial for investors. This analysis discusses the latest insights on Visa.

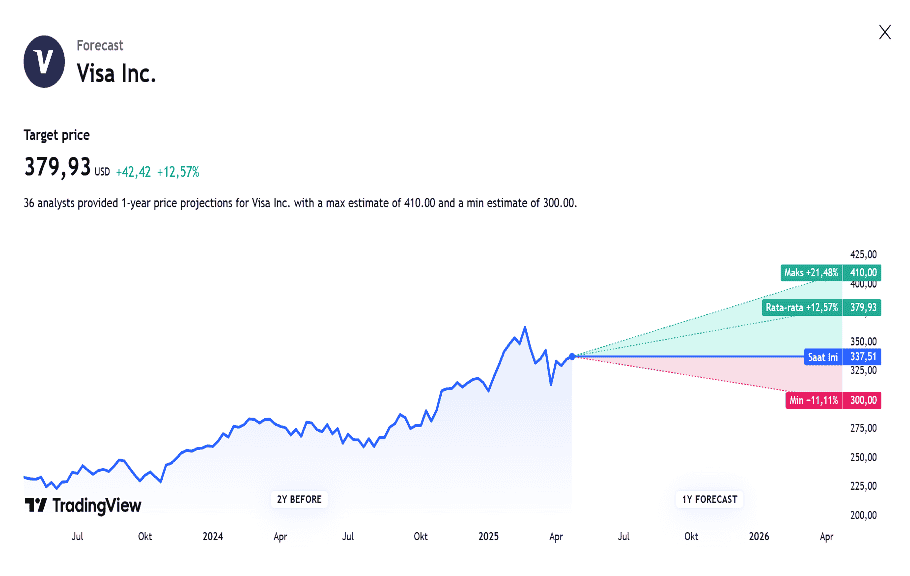

Analysts have assigned Visa 16 ratings, resulting in a consensus rating of Outperform (outperforming the market). The average price target for the next one year stands at $383.5, which suggests a potential upside of 14.42%.

What You Need to Know About Visa

Visa is the world’s largest payment processing service. In fiscal year 2023, Visa processed nearly $15 trillion in total transaction volume. Visa operates in more than 200 countries and processes transactions in more than 160 currencies. Visa’s systems are capable of processing more than 65,000 transactions per second.

Understanding the Numbers: Visa Financials

- Market Capitalization:

Exceeding industry standards, Visa’s market capitalization confirms its dominance in terms of size, demonstrating a strong market position. - Revenue Growth:

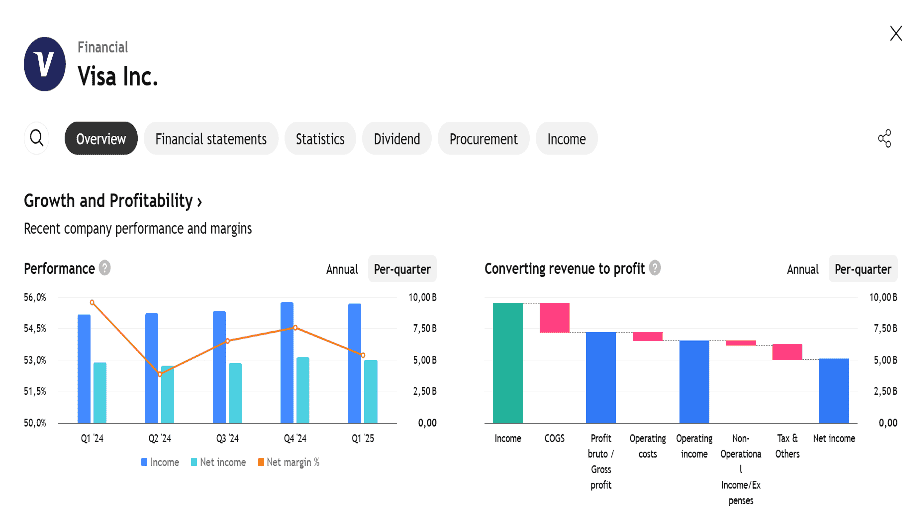

Visa has shown positive results in the last 3 months. As of December 31, 2024, the company recorded a revenue growth rate of approximately 10.15%. This shows a significant increase in the company’s main revenue. However, compared to other companies in the Financial sector, Visa faces challenges as its growth rate is lower than the average of its industry peers.

- Net Margin:

Visa’s net margin surpassed industry standards, highlighting the company’s outstanding financial performance. With a net margin of 53.83%, Visa managed to effectively manage costs and achieve strong profitability.

- Return on Equity (ROE):

Visa’s ROE stood out, surpassing the industry average. With an ROE of 13.56%, the company demonstrated effective use of equity capital and solid financial performance.

- Return on Assets (ROA):

Visa’s ROA also surpassed the industry benchmark, reaching 5.49%. This signifies efficient asset management and strong financial health.

- Debt Management:

With a debt-to-equity ratio of 0.55, which is below the industry average, Visa employs prudent financial strategies, reflecting a balanced approach to its debt management.

EARNING PROJECTION PREDICTION

WHAT THE ANALYST STATED