Coca-Cola (NYSE: KO) is scheduled to report its earnings today before the market opens. Here’s what investors need to know ahead of the announcement.

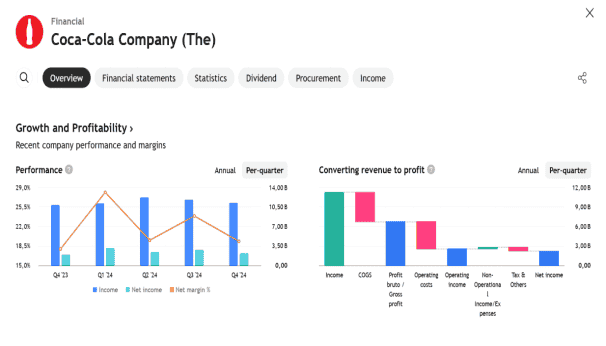

In the previous quarter, Coca-Cola beat analysts’ revenue expectations by 6.5%, reporting $11.4 billion in revenue, a 4.2% year-over-year increase. It was a strong quarter for the company, with solid performance in both organic revenue growth and EBITDA, both of which exceeded estimates.

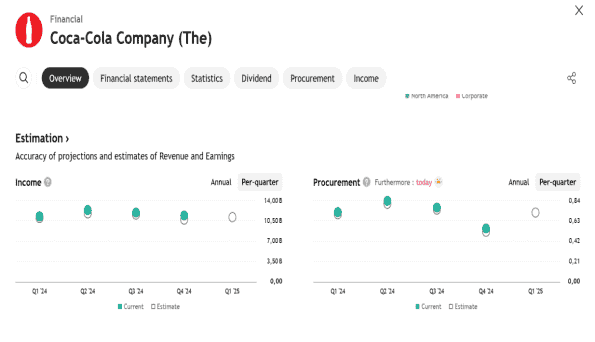

For the upcoming quarter, analysts expect Coca-Cola’s revenue to remain flat year-over-year at $11.15 billion, a slowdown compared to the 2.5% growth in the same period last year. Adjusted earnings per share (EPS) are projected at $0.72.

Most analysts have reaffirmed their estimates over the past 30 days, suggesting expectations of stability ahead of the earnings release. Coca-Cola has a strong track record of outperforming Wall Street forecasts—beating EPS estimates every quarter over the past two years, with an average beat of 3.4%.

Looking at competitors in the beverage, alcohol, and tobacco segment, some have already released their Q1 results, offering a benchmark for expectations.

- Boston Beer posted 6.5% annual revenue growth, beating analyst forecasts by 4.1%, pushing the stock up 2.8%.

- Philip Morris reported a 5.8% revenue increase, exceeding estimates by 2.6%, with shares rising 3.7% post-release.

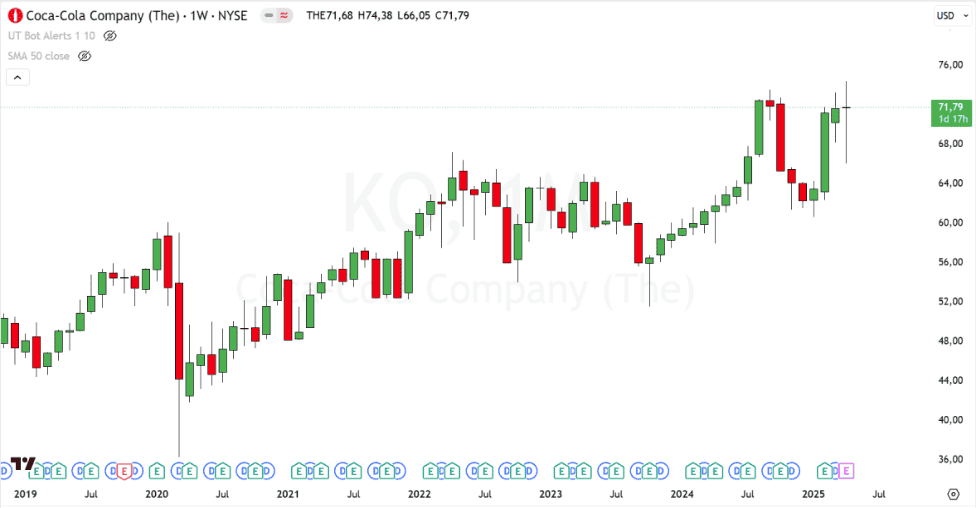

Despite global economic challenges and market uncertainty, Coca-Cola shares have surged approximately 19.7% over the past three months, approaching their 52-week high. This strong momentum highlights the company’s defensive characteristics and enduring brand strength, making it a compelling choice for stability-seeking investors.

A key driver behind Coca-Cola’s performance is its diversified brand portfolio and strategic investments. The company has expanded into categories such as water, sports drinks, and low/no-sugar alternatives, helping drive growth even amid broader macroeconomic pressures.

Conclusion:

Coca-Cola’s Q1 earnings report is expected to reflect a healthy blend of resilience and strategic growth, leveraging brand equity and operational efficiency to navigate a complex global environment. Despite persistent challenges, Coca-Cola’s timeless appeal and consistent dividend payouts continue to make it a smart pick for long-term investors seeking stability in a volatile market.

Earning Projection Prediction

WHAT THE ANALYST STATED