Stable Amid Cost and Volume Challenges

Atlanta, Tuesday, July 22, 2025 – Coca-Cola Co (NYSE: KO) today released its second-quarter 2025 financial report, showing solid performance despite facing challenges from sales volume and cost pressures. These results have garnered global market attention as Coca-Cola serves as an important barometer of consumer spending and global brand strength.

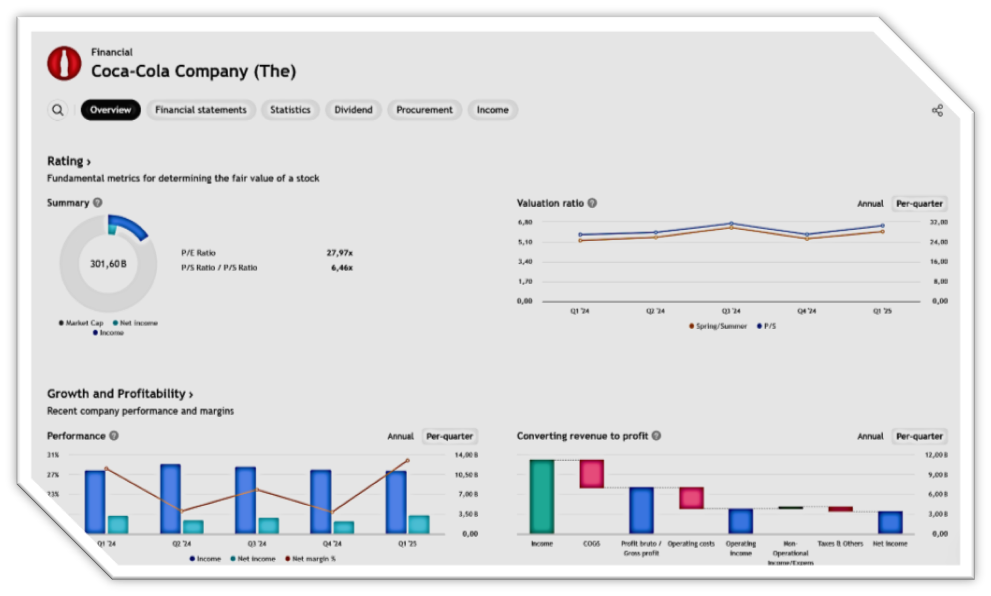

According to the report released before the New York market opened, Coca-Cola posted earnings per share (EPS) of $0.83, in line with analyst expectations as forecast by Wall Street consensus. This result represents a slight decline from the same period last year (Q2 2024), which reported EPS of $0.84, reflecting margin pressure from raw material inflation and currency fluctuations.

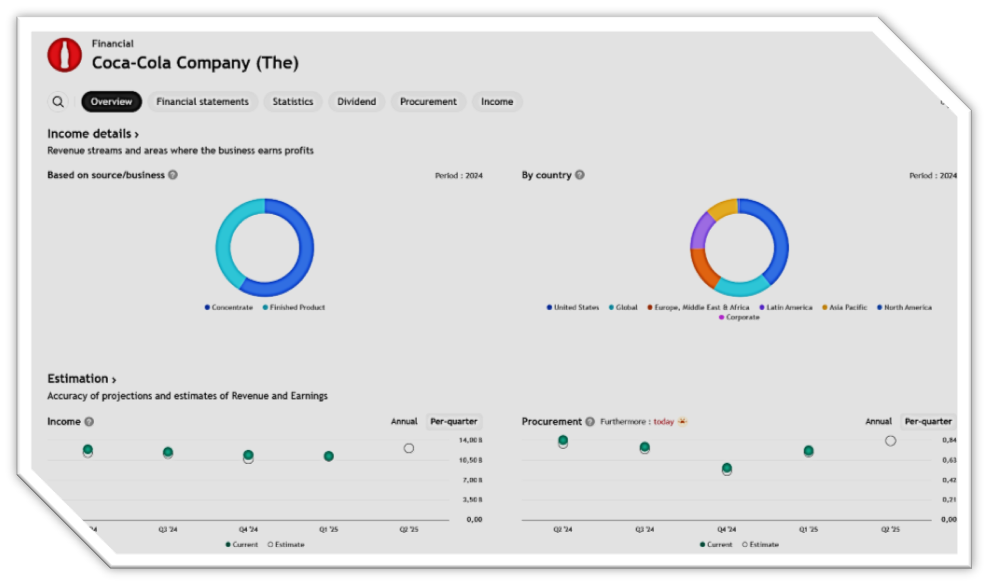

Although EPS met expectations, investor focus has shifted to volume growth dynamics and the company’s price-mix strategy. During the quarter, Coca-Cola reported flat volume growth, particularly in North America, where sales were affected by extreme weather patterns and weaker consumer sentiment. Conversely, growth in emerging markets such as Southeast Asia and Africa remained on a positive trend.

Management stated that pricing and product management strategies (price/mix) continued to be key revenue drivers, with consumers still accepting moderate price increases. A combination of operational efficiency and product innovation, such as low-sugar beverages and the re-launch of heritage brands, helped maintain market position amid global challenges.

However, investors remain cautious about several forward-looking risks. These include pressure from input cost inflation, geopolitical tensions in some distribution areas, and potential currency weakness in emerging markets, all of which are expected to affect the second half of the year.

In a post-release press conference, CEO James Quincey reaffirmed that Coca-Cola remains on a long-term growth path, maintaining its 2025 organic revenue growth target at +6%, and committing to preserve healthy operating margins through strict cost management and investment in core brands.

Analyst Estimates & Context

- Consensus EPS is projected at US $0.83 per share, slightly below (~1.2%) Q2 2024’s result of US $0.84.

- Revenue consensus was not mentioned in the primary sources, though Q1 revenue stood at approximately US $11.13 billion—down ~0.7% year-on-year.

Key Issues to Monitor

- Sales Volume – In Q1 2025, volume grew only 2%, falling short of long-term targets. Regions like North America faced pressure from extreme weather and weakening consumer sentiment.

- Pricing & Mix – According to Coca-Cola, its “price-mix” strategy successfully supported margins and volume despite FX and inflation challenges.

- Input Costs – Rising raw material costs and higher operating expenses could impact margins, even with operational efficiencies.

Today’s Report Highlights

- Actual EPS vs. Consensus: US $0.83

- Organic revenue growth – Did the company maintain its 5–6% target?

- Volume vs. price-mix – How much of revenue growth was driven by sales volume versus pricing/mix?

- Forward guidance – Any revisions to full-year organic revenue or margin targets?

Pre-Release & Market Sentiment

- Outlets like Yahoo Finance projected the Q2 report would be released pre-market today.

- Comments regarding the return to cane sugar usage and global pricing policies could influence investor perception.

Conclusion

Focus areas include actual EPS, organic revenue, and updated forward guidance. KO’s stock price could be sensitive to positive/negative surprises in EPS and management’s commentary on cost pressures or inflation. If Coca-Cola beats EPS expectations and affirms optimistic guidance, short-term sentiment may improve; otherwise, a miss could trigger sell-offs.

Earning Projection Prediction

WHAT THE ANALYST STATED