“Cisco Systems (CSCO): Positive Momentum Ahead of Earnings Release,

Investors Await Fresh Growth Signals”

Ahead of its upcoming quarterly earnings announcement, Cisco Systems Inc. (NASDAQ: CSCO) once again takes center stage in the technology market. As a global leader in networking and digital infrastructure solutions, Cisco’s financial results this quarter will serve as a key barometer for investment trends across the enterprise technology and AI-driven networking sectors.

Investor optimism has been rising amid expectations that the company will maintain steady revenue growth momentum, even as the broader industry undergoes a major transformation toward artificial intelligence infrastructure.

This quarter’s main focus is on how effectively Cisco has integrated its strategic acquisition of Splunk Inc., and to what extent its AI networking and cybersecurity segments can contribute to medium-term growth.

With shares up more than 20% year-to-date, and options markets pricing in an expected post-earnings move of around ±7%, Cisco’s results are set to act as a crucial catalyst for overall tech sentiment heading into the end of fiscal year 2025.

Cisco Systems Inc. (NASDAQ: CSCO)

Date: November 12, 2025

Sector: Information Technology – Networking & Infrastructure

Current Price: USD 72.11

Consensus Target: USD 76.96

Consensus Rating: Hold / Moderate Buy

1. Executive Summary

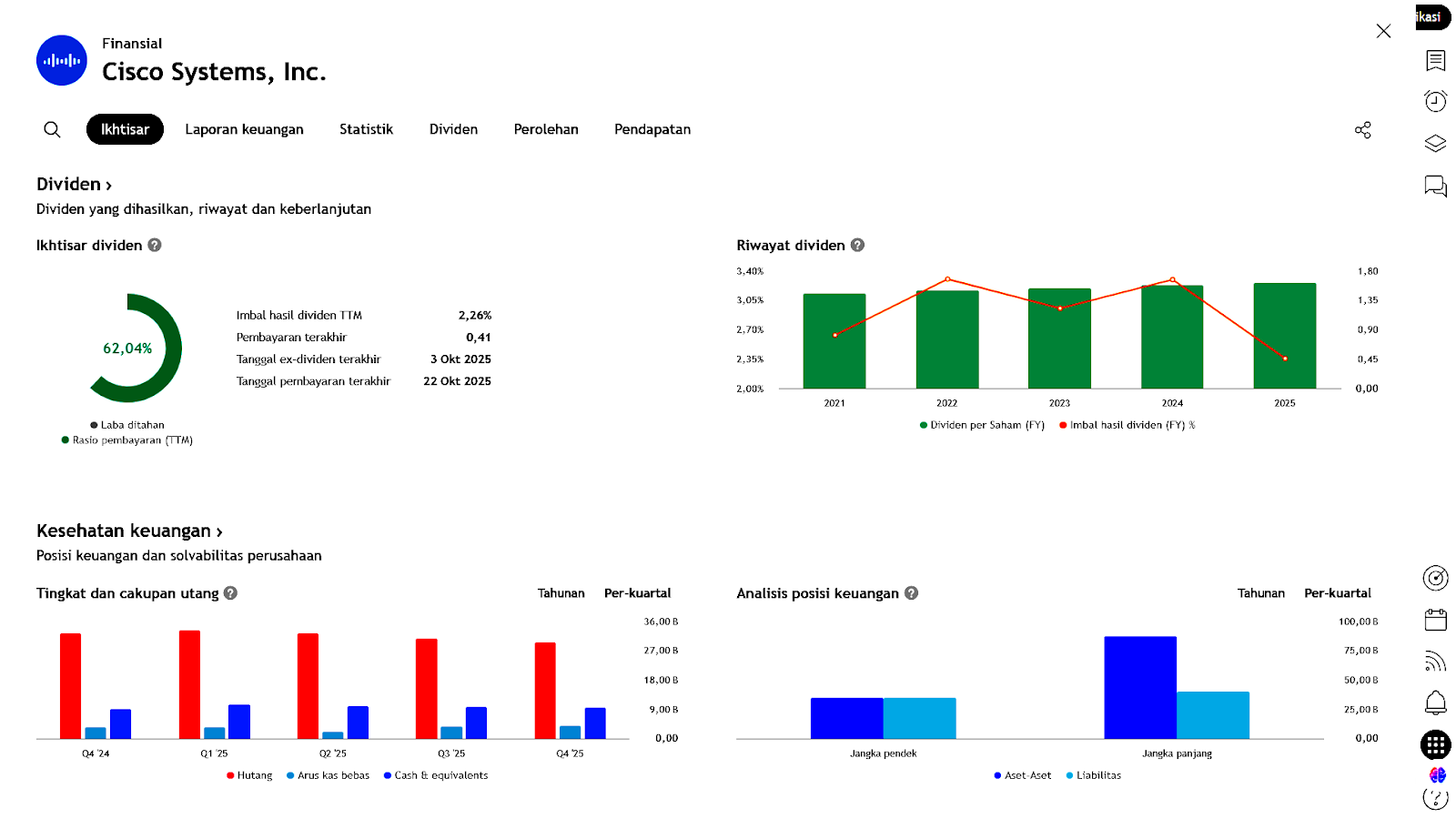

Cisco Systems will release its latest quarterly results on Wednesday afternoon (U.S. time). The market is watching closely to see whether the recovery in networking and IT service demand continues after a solid previous quarter.

Analyst expectations suggest moderate revenue growth and earnings stability, indicating confidence in Cisco’s ability to sustain profitability amid fierce industry competition.

2. Previous Quarter Performance

- Revenue: USD 14.67 billion (+7.6% YoY), in line with consensus expectations.

- Next-Quarter Guidance: Slightly above analyst projections.

- Billings: Consistent with market estimates.

- Track Record: Cisco has beaten Wall Street revenue expectations in 8 consecutive quarters, with an average upside of +0.6%.

Interpretation:

These results highlight management’s efficiency and margin stability amid its transition toward a subscription-based and cloud-service model.

3. Current Quarter Expectations (FQ1 2026E)

- Projected Revenue: USD 14.76 billion (+6.7% YoY)

- EPS (non-GAAP): USD 0.98

- Comparison: In the same quarter last year, Cisco’s revenue declined 5.6%, marking a strong rebound in corporate networking demand.

- Consensus Stability: Analyst forecasts have remained steady over the past 30 days, reflecting confidence in Cisco’s near-term outlook.

4. Industry Comparison

Several companies within the IT Services & Other Tech sector have already reported their quarterly results, offering insights into overall sector momentum:

| Company | Revenue Growth (YoY) | Beat vs Estimates | Stock Reaction |

|---|---|---|---|

| Applied Digital | +84.3% | +17.6% | +16.1% |

| IonQ | +222% | +47.8% | +3.7% |

The sector average has declined 1.3% over the past month, signaling cautious sentiment ahead of earnings season.

In contrast, Cisco’s shares rose 6.9%, indicating strong investor optimism for the upcoming report.

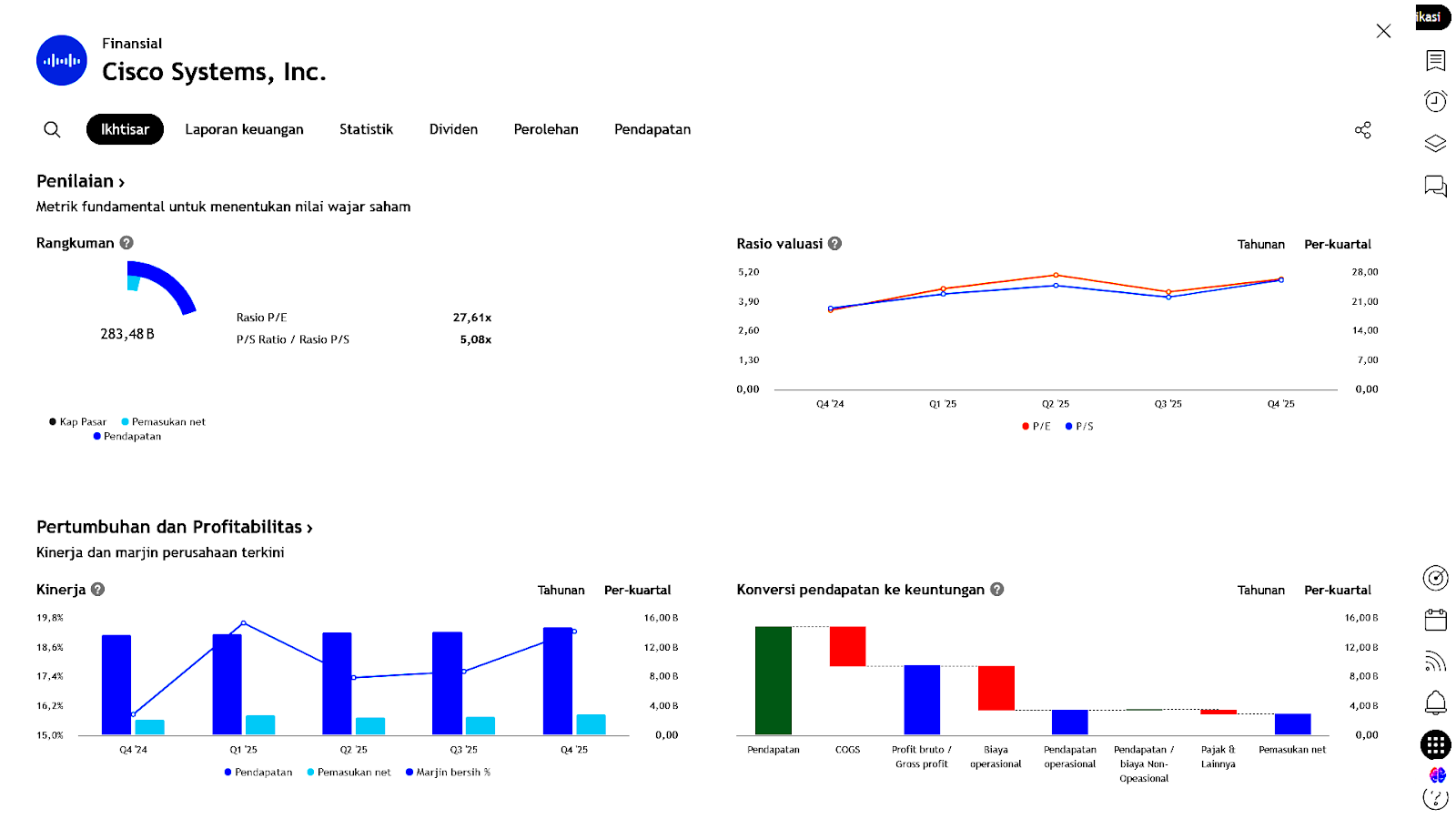

5. Valuation and Forward Outlook

- Current Price: USD 72.11

- Consensus Target Price: USD 76.96

- Upside Potential: +6.7%

Short-term catalysts:

- Earnings outperforming expectations, particularly in security and AI-driven networking.

- Stronger-than-expected FY2026 management guidance.

- Continued corporate IT infrastructure spending amid U.S. economic stabilization.

Key risks:

- Slower enterprise and public sector IT spending.

- Margin pressure due to the shift toward subscription-based services.

6. Conclusion

Cisco is expected to deliver another solid quarterly performance, likely exceeding market expectations once again — though upside potential may be limited given its recent price appreciation.

With the stock trading near consensus target levels, Cisco is rated neutral to mildly positive, making it more suitable for a medium-term hold position while awaiting updated financial guidance from management.

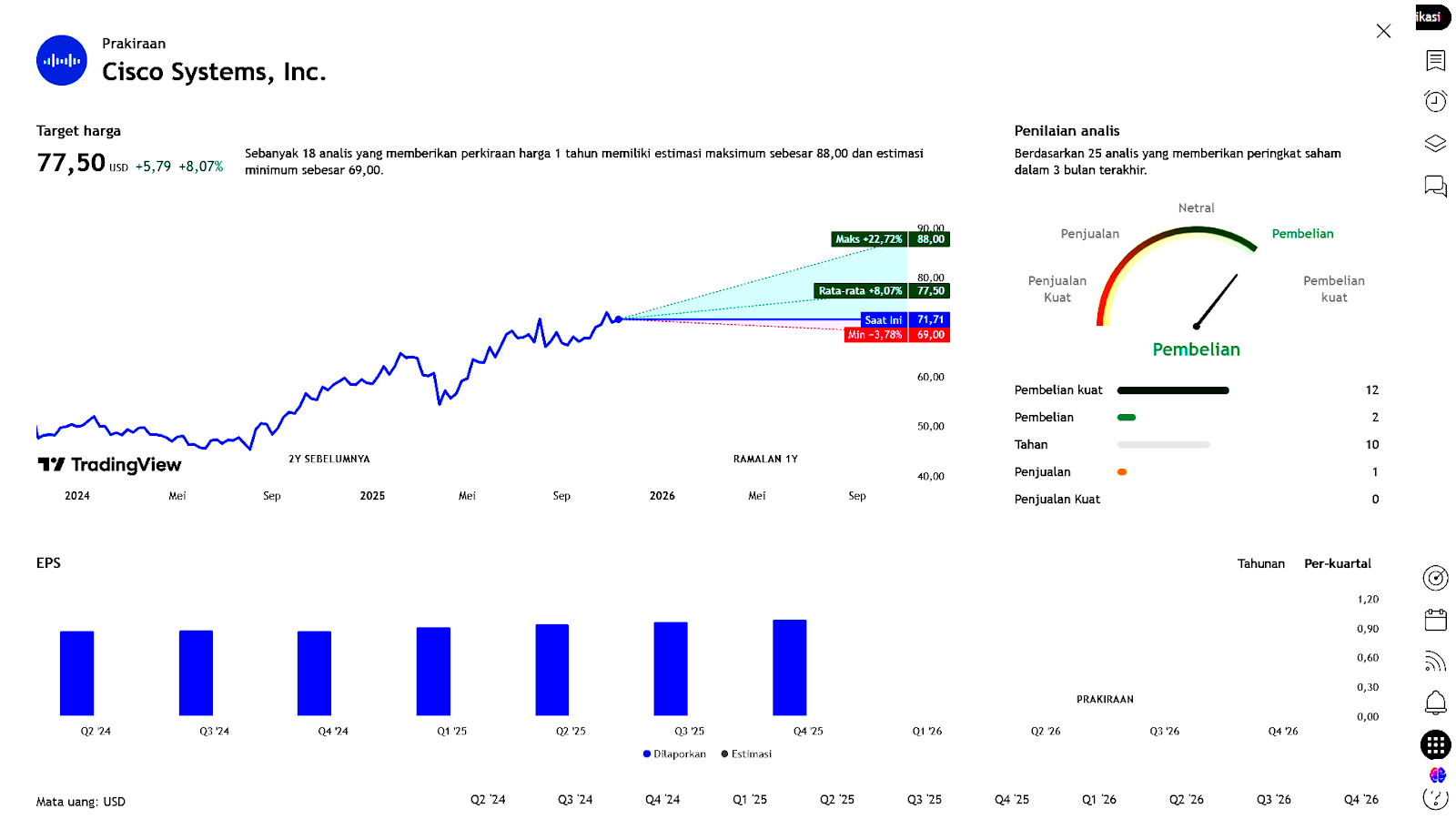

Earning Projection Prediction

WHAT THE ANALYST SAYS

Short – Medium Term Projection

| BUY Cisco | |

| Entry | 69.88 |

| Take Profit | 77.95 |

| Stoploss | 66.81 |

Disclaimer On

Ade Yunus ST, WPA : Global Market Strategies

Geraldo Kofit CSA,CTA,CDMp : Market Analyst