Cisco Set to Release Q1 Fiscal 2026 Earnings Report,

AI and Subscription Model Emerge as New Growth Engines

Maxco Futures – Technology giant Cisco Systems Inc. (NASDAQ: CSCO) is preparing to release its first-quarter fiscal 2026 earnings report, as market attention focuses on its ongoing business transformation toward a subscription-based revenue model and deeper integration of artificial intelligence (AI).

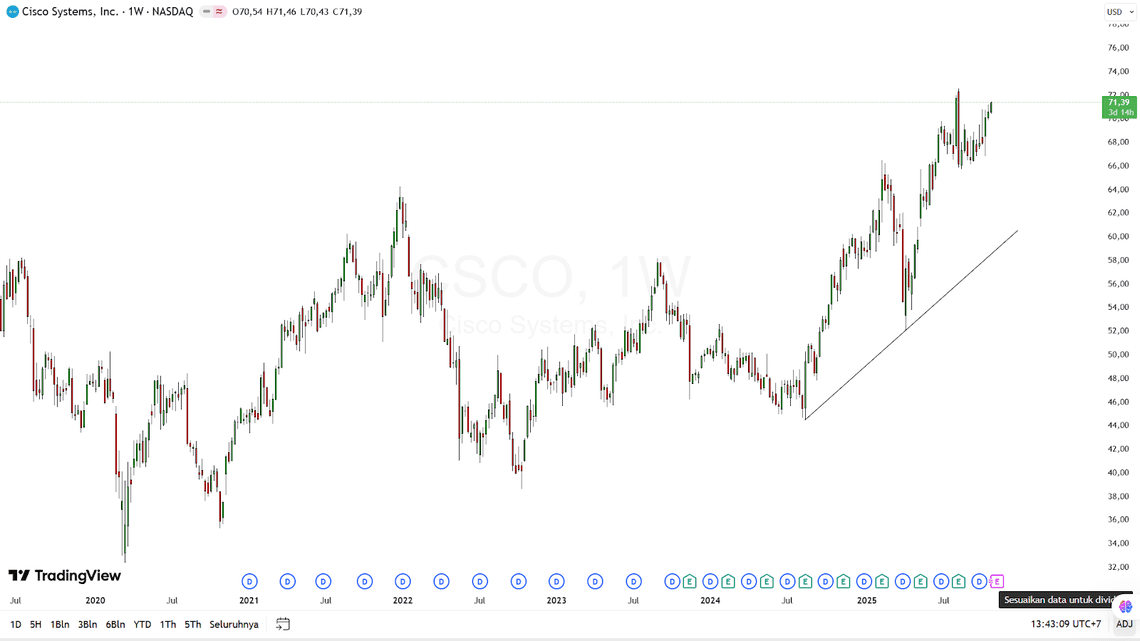

Headquartered in San Jose, California, and boasting a market capitalization of approximately $279 billion, Cisco is increasingly focused on expanding its presence in cybersecurity, cloud computing, and AI infrastructure solutions. Strategic moves such as the acquisition of Splunk and its partnership with NVIDIA have strengthened Cisco’s foothold in the modern data center ecosystem. Meanwhile, its stock performance — up over 26% in the past year — reflects growing investor optimism about the company’s long-term growth trajectory.

Earnings Expectations and Consistent Momentum

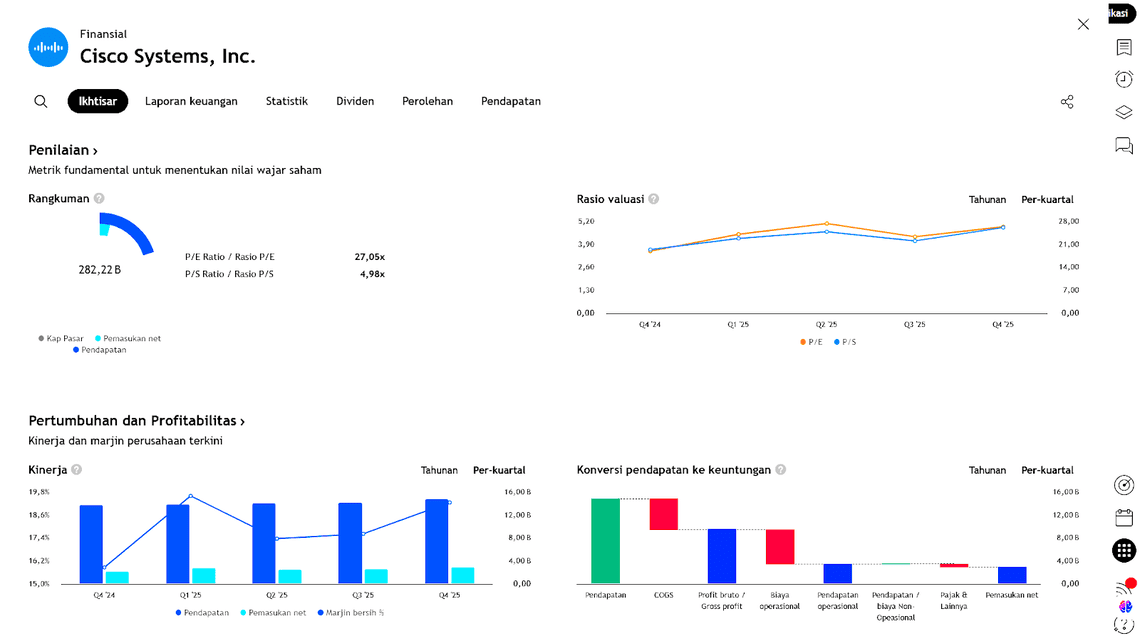

Ahead of the upcoming earnings release, analysts project earnings per share (EPS) of $0.80, representing a 6.7% increase from $0.75 in the same period last year. Cisco’s consistency remains a key highlight, as the company has outperformed Wall Street expectations for four consecutive quarters, underscoring the effectiveness of its efficiency and revenue diversification strategies.

For the full fiscal year 2026, consensus forecasts call for EPS of $3.32, up 8.1% from $3.07 in fiscal 2025, with growth expected to continue toward $3.59 in 2027 as Cisco expands its business in digital security and AI-based infrastructure solutions.

Stock Performance and Market Position

Over the past 52 weeks, Cisco’s stock has gained 26.2%, outpacing the S&P 500 Index’s 16.9% increase, though slightly lagging behind the Technology Select Sector SPDR Fund (XLK), which rose 28.1% in the same period.

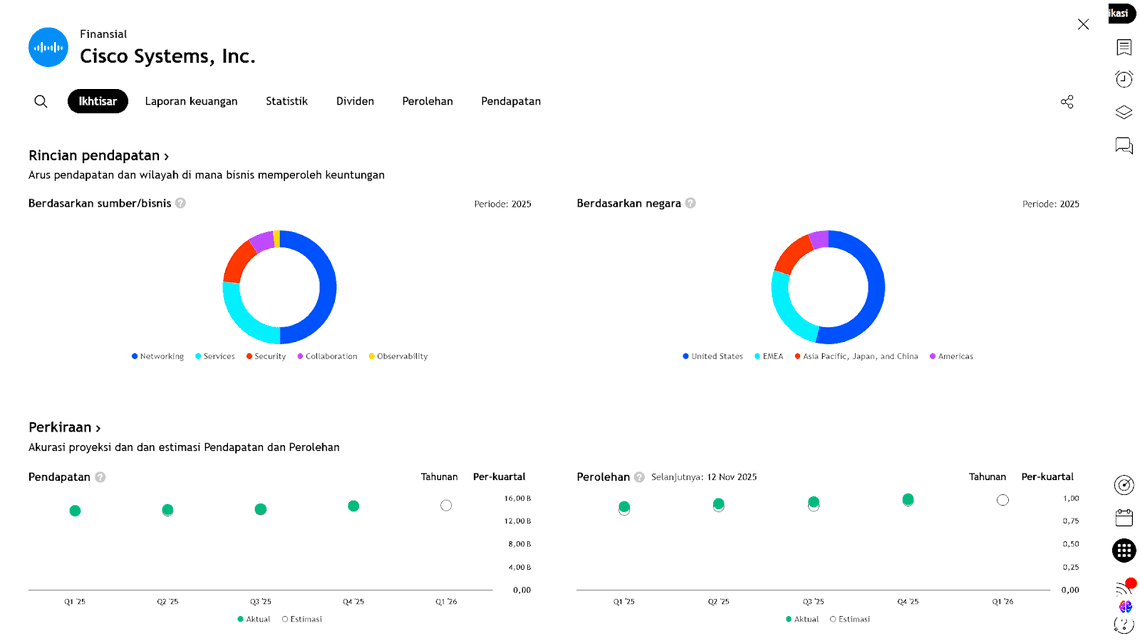

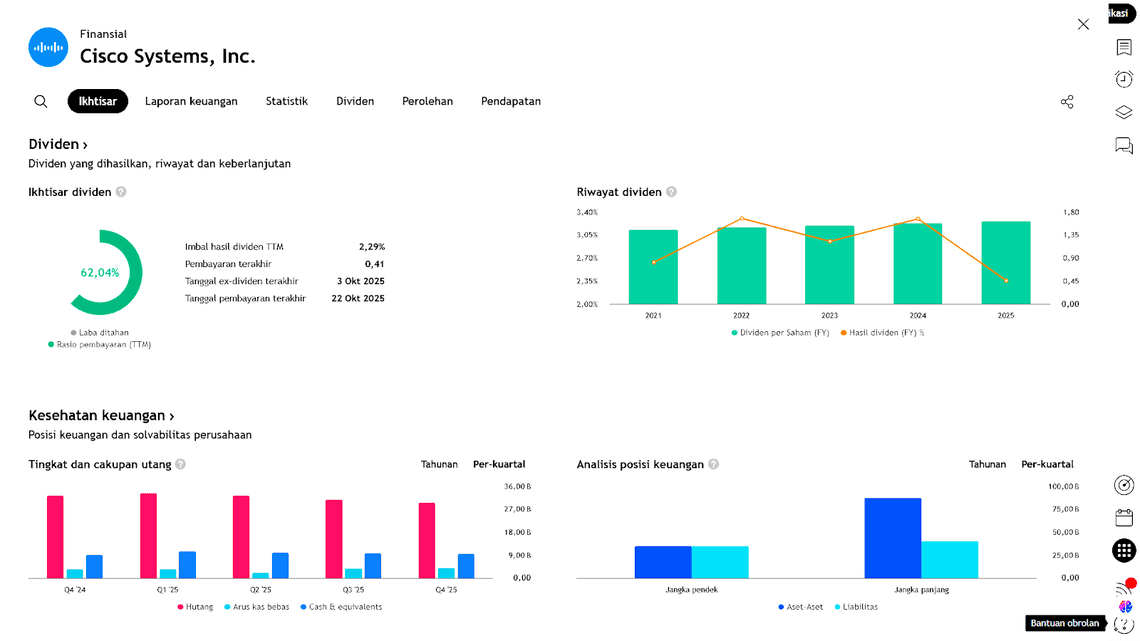

Nonetheless, Cisco’s performance reflects stability and resilience in the enterprise technology sector, particularly as more than half of its total revenue now comes from recurring subscriptions, offering predictable cash flows and greater visibility for investors.

AI and Subscription Revenue as Core Growth Pillars

Cisco’s transformation toward a subscription-driven business model is proving to be a major growth catalyst, with recurring revenue now accounting for over 50% of total revenue. This shift has been reinforced by the $28 billion acquisition of Splunk, a leading data analytics company, expanding Cisco’s capabilities in real-time data management and observability-driven network security.

Moreover, AI integration has become a central theme in Cisco’s 2026 growth narrative. The company has reported surging demand for AI-ready infrastructure solutions, driven by growing enterprise needs for network capacity that supports machine learning models and modern data centers.

Cisco’s cybersecurity division also continues to show positive momentum, with new client additions for platforms such as Secure Access, XDR (Extended Detection and Response), and Hypershield — an AI-powered security solution designed to minimize threats across network and cloud environments.

Strategic Partnership with NVIDIA

A key medium-term growth catalyst for Cisco is its strategic alliance with NVIDIA Corporation (NVDA). This collaboration broadens Cisco’s reach into the AI-ready data center market, combining Cisco’s networking expertise with NVIDIA’s industry-leading GPUs in AI computing.

The partnership is also expected to enhance Cisco’s product margins in the data center segment and solidify its position within the global AI technology supply chain.

Recent Performance and Forward Guidance

In its previous Q4 earnings report on August 13, 2025, Cisco posted an EPS of $0.99, slightly exceeding the consensus estimate of $0.97, while revenue reached $14.7 billion, surpassing expectations of $14.6 billion.

For the current fiscal year, management has guided EPS in the range of $4.00–$4.06 and revenue between $59–$60 billion. This outlook reflects steady growth amid ongoing global economic uncertainty and a strong U.S. dollar, which could potentially pressure export margins.

Analyst Views and Stock Outlook

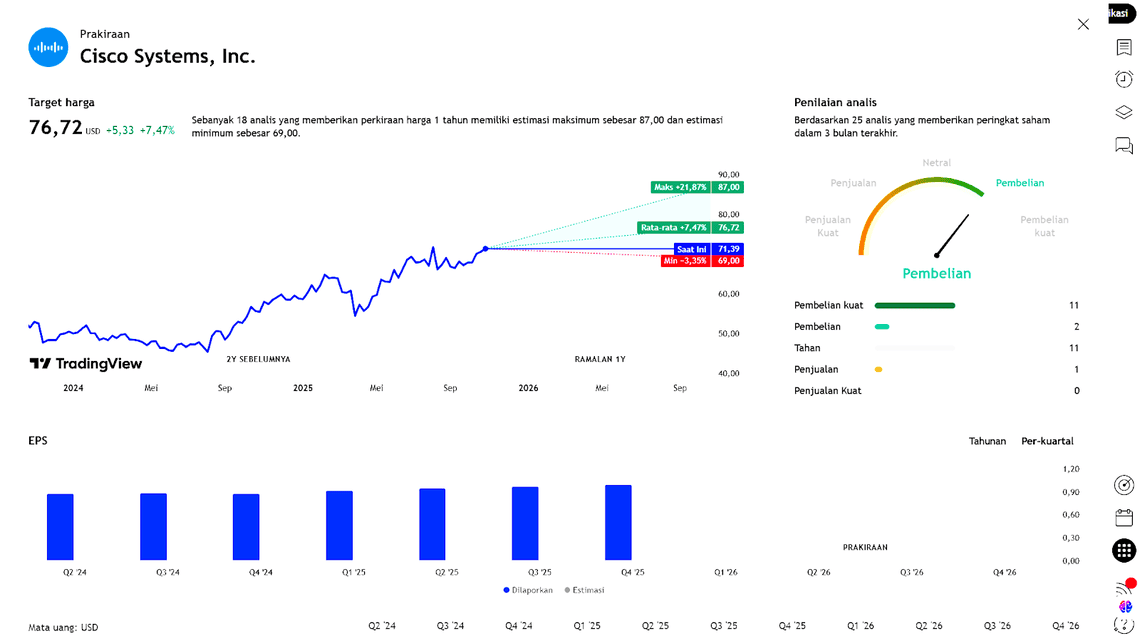

According to data from Barchart and Wall Street analyst consensus, Cisco’s stock holds a “Moderate Buy” rating, indicating a cautiously optimistic sentiment amid elevated valuations. Among 24 analysts covering the stock:

- 11 rate it as “Strong Buy”,

- 1 as “Moderate Buy”, and

- 12 as “Hold.”

The average price target stands at $76.58, suggesting an upside potential of around 8.4% from current levels.

Analysts note that Cisco’s ability to sustain growth momentum in AI and cybersecurity, supported by Splunk’s contribution, will be crucial in determining its stock trajectory over the next six months. However, competitive pressures from Juniper Networks, Arista Networks, and major cloud providers such as Amazon Web Services (AWS) and Microsoft Azure remain key risk factors.

Conclusion

Cisco is now undergoing a strategic transformation phase, blending its strong networking legacy with advancements in AI and digital security. With a solid recurring revenue base, strategic partnership with NVIDIA, and post-Splunk acquisition expansion, Cisco stands on a robust foundation to deliver steady earnings growth and maintain its leadership in the evolving digital infrastructure landscape.

Earning Projection Prediction

APA YANG DINYATAKAN ANALIS

Short – Medium Term Projection

Strategi

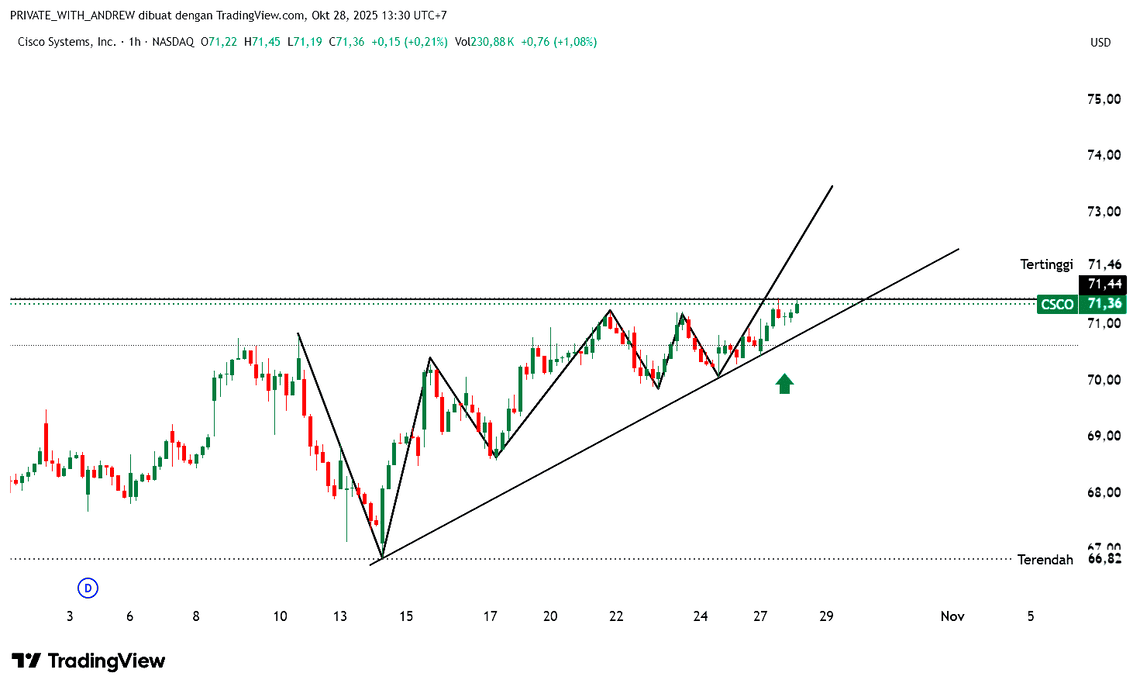

| Buy CISCO | |

| Entry | 71.36 |

| Take Profit | 72.98 |

| Stoploss | 70.20 |

Disclaimer On

Ade Yunus ST, WPA : Global Market Strategies

Andrew Fischer : Market Analyst