A tragic accident involving an Air India Boeing 787 Dreamliner occurred shortly after takeoff in Ahmedabad, India, on Thursday. The crash resulted in the deaths of over 240 people and marks the first fatal accident involving the Dreamliner model since its launch in 2009. While the exact cause remains unknown, aviation authorities have launched a full investigation.

This incident has reignited concerns over Boeing’s product safety, especially following a series of technical issues and fatal crashes involving its 737 MAX line. Although the 787 Dreamliner had previously maintained a relatively strong safety record, this latest tragedy has shaken market confidence in Boeing’s design integrity and quality control processes.

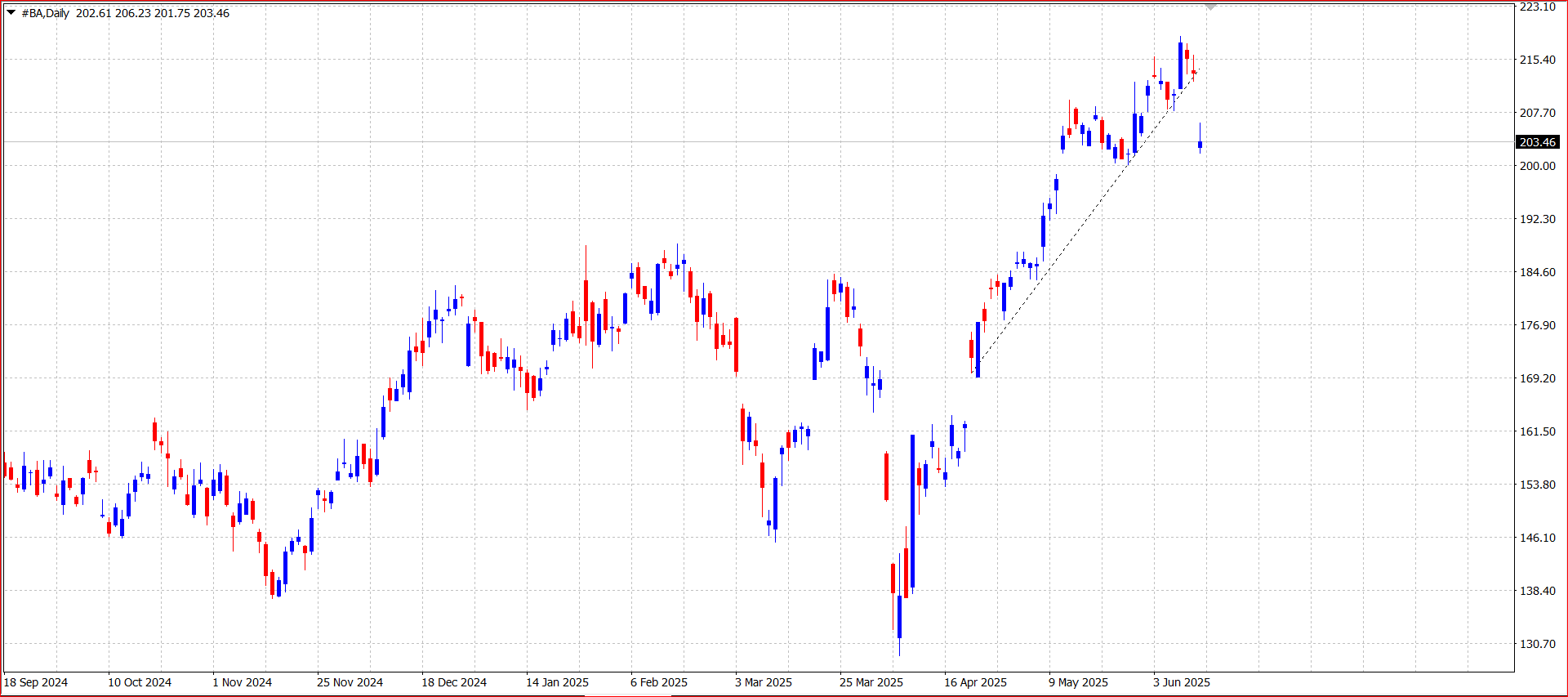

Market Reaction: Boeing Shares Tumble

Following the crash, Boeing’s stock experienced a sharp decline. Shares fell more than 6% in the same day’s trading session amid investor concerns over potential lawsuits, international regulatory scrutiny, and reduced orders from global airlines. Fears of a possible temporary grounding of the 787 model in certain jurisdictions further fueled negative sentiment.

Investors also worry about the long-term reputational damage this incident could inflict, potentially delaying Boeing’s recovery efforts from the 737 MAX crisis and post-pandemic supply chain challenges.

The Boeing Company (NYSE: BA)

Earnings Forecast Revisions and Analyst Commentary

- Zacks Research revised Boeing’s Q1 2026 EPS estimate downward from $0.86 to $0.72.

- Full-year 2026 EPS is now estimated at $1.95. The consensus for 2025 remains a loss of $2.58 per share.

Analyst Ratings and Target Price Updates

- Morgan Stanley maintained an “Equal Weight” rating with a $200 target price.

- Wells Fargo reaffirmed an “Underweight” rating.

- TD Securities downgraded Boeing to “Cautious.”

- Benchmark lowered its target from $250 to $215, but maintained a “Buy” recommendation.

- Melius upgraded Boeing from “Hold” to “Buy.”

Consensus Breakdown:

- 3 analysts: Sell

- 3 analysts: Hold

- 17 analysts: Buy

- 1 analyst: Strong Buy

- Overall consensus: “Moderate Buy” with an average price target of $209.85

Stock Performance

- Last closing price: $203.75 (down 4.8%)

- 50-day moving average: $187.71 | 200-day moving average: $176.42

- 52-week range: Low: $128.88 | High: $218.80

- Market capitalization: $153.63 billion

- P/E ratio: -11.12 (negative, indicating losses)

- Beta: 1.43, indicating high volatility

Q1 2025 Financial Highlights

- Net loss: ($0.49) per share, better than expected loss of ($1.39)

- Revenue: $19.50 billion, up 17.7% year-over-year, nearly in line with the $19.57 billion forecast

Insider Activity

- Executive Vice Presidents David Raymond and Jeffrey Shockey recently sold shares worth $729,151 and $650,198, reducing their holdings by 8.4% and 13.5%, respectively.

Institutional Investors

- Firms such as Empowered Funds LLC, Essex Financial Services, and Sovran Advisors have added or initiated new positions in Boeing shares in the latest quarter.

- Total institutional ownership: 64.82% of outstanding shares

Company Overview

The Boeing Company designs, manufactures, and provides:

- Commercial airplanes

- Defense and space products

- Human spaceflight systems and satellite technologies

- Global maintenance and logistics services