1. Q3 2025 Financial Performance (April–June)

Apple is set to release its Q3 2025 financial report shortly.

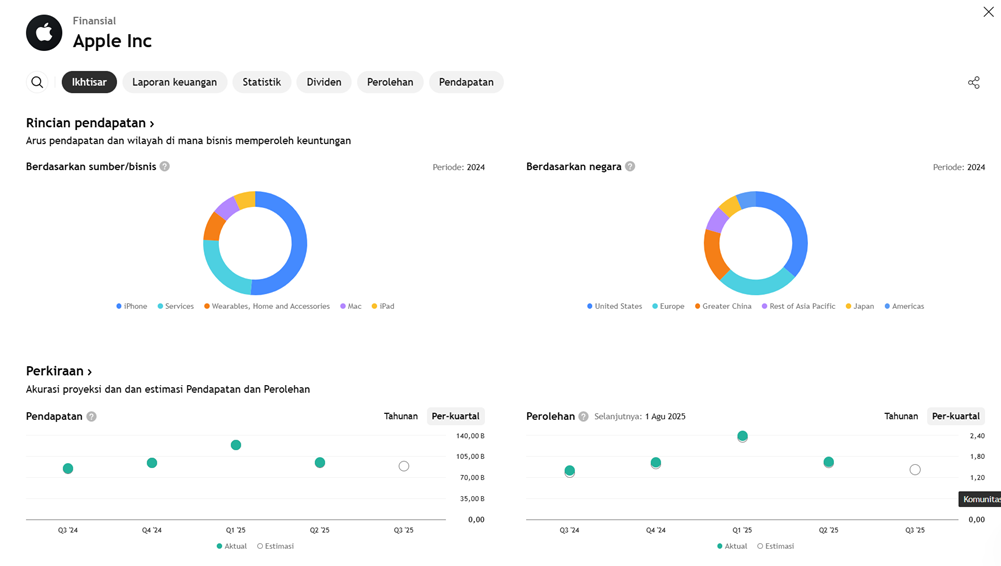

The company projects low single-digit revenue growth, while analyst consensus estimates a 3.7% YoY (year-over-year) increase, with expected revenue of $88.92 billion.

Earnings per share (EPS) are estimated at $1.42, up slightly by 1.43% YoY.

2. Product Segment Breakdown

- iPhone: Forecasted to post sales of $40.61 billion, up 3.3% YoY. This rise is supported by a rebound in sales in China, helped by government subsidies and promotional efforts.

- Mac: Expected to grow 2.2% to $7.16 billion, driven by strong demand for M4-chip-based Macs.

- iPad: Projected to decline 5.3% to $6.78 billion, due to early demand for new models being fulfilled in Q2.

- Services: Continues to be the main growth engine, with revenue projected to grow 11.3% YoY to $26.96 billion.

3. Investor Focus

Investors will be closely watching Apple’s forward-looking guidance, despite the company no longer issuing formal revenue forecasts.

Key attention will be on Apple’s strategy and developments in Apple Intelligence (AI), amid concerns it is lagging behind competitors, despite launching some AI features.

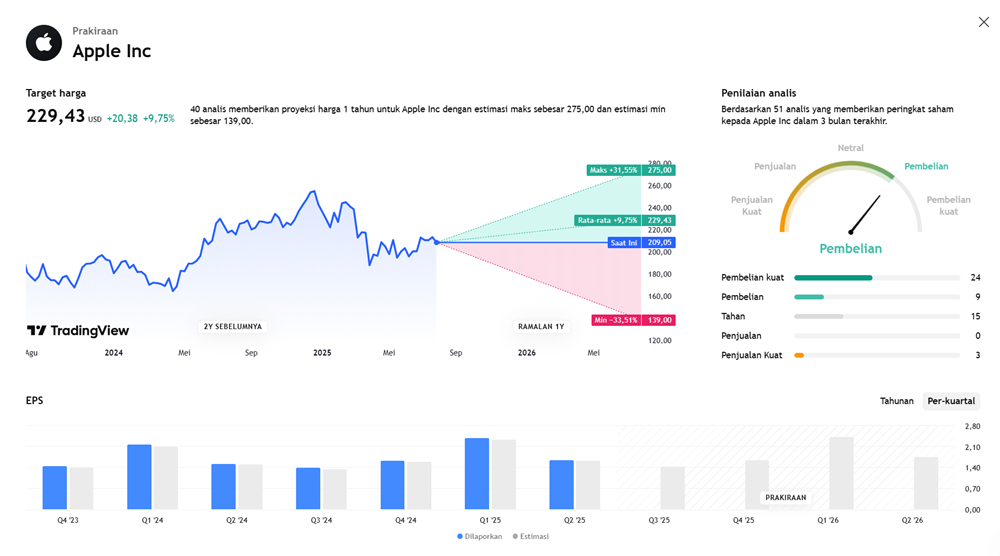

Financial Performance Projections

Analyst Sentiment & Ratings

Among 12 analysts tracked by Visible Alpha:

- 9 rate Apple as a “Buy” or equivalent

- 2 as “Hold”

- 1 as “Sell”

The consensus price target is around $233, suggesting about 10% upside from the then-current price (~$211–212).

Some bullish price targets include:

- Goldman Sachs: $251, citing strong services performance and new AI features (e.g., live translation) expected to boost iPhone demand.

- Morgan Stanley: $235, while warning of risks tied to potential U.S. Section 232 tariffs.

- HSBC: $220 with a “Hold” rating due to regulatory uncertainties.

Revenue and EPS Forecast

June quarter revenue is expected to grow around 4% YoY to approximately $89.5 billion:

- iPhone: ~2% growth, around $40.45 billion

- Services: ~11% growth, around $26.8 billion

EPS is projected at approximately $1.44, up from $1.40 the year prior.

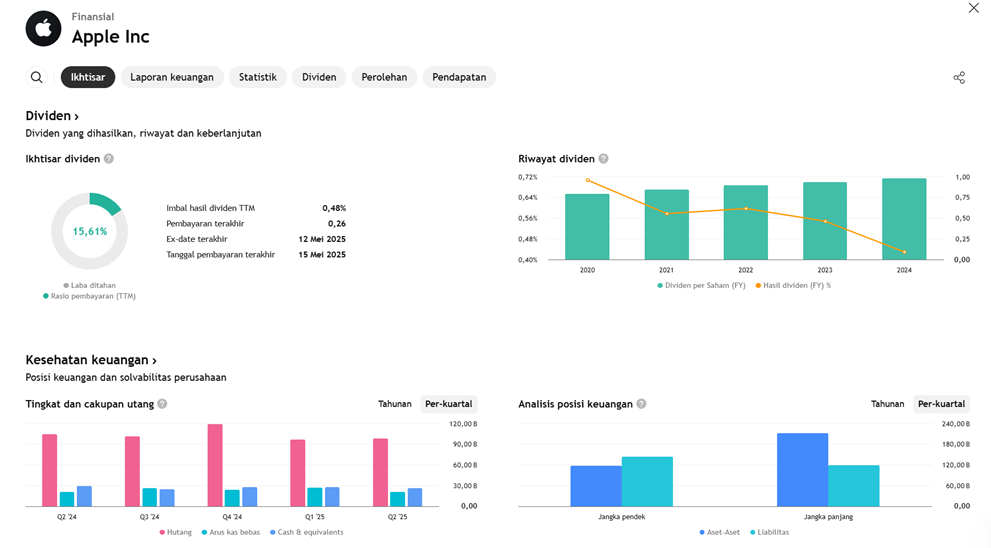

Risks and Considerations

- U.S. import tariffs (estimated at ~$900 million in added costs) remain a key margin pressure, especially for China-produced iPhones.

- The shift of production to India is beginning to offset these impacts, and Apple is expected to reduce tariff-related costs to $900 million or less.

- Apple Intelligence / AI remains a spotlight issue:

- The rollout of AI features has been slow and seen as less aggressive than peers like Alphabet or Meta.

- Siri and other AI functionalities are not yet available in China, raising innovation concerns. Some analysts suggest Apple may need to pursue strategic acquisitions, such as Perplexity AI.

Outlook and Summary

Overall, analysts maintain a moderately optimistic stance; “Buy” ratings dominate with average price targets in the $233–235 range, and some even more bullish.

Apple’s Q3 performance is viewed as stable, driven by service revenue and iPhone sales, especially in China. However, major focus remains on AI updates and trade policy implications.

Analysts like Wedbush’s Daniel Ives see Q3 as merely a “starter course” ahead of the iPhone 17 launch, but stress that AI is the “elephant in the room” — and Apple must act swiftly to stay competitive.

EARNING PROJECTION PREDICTION

WHAT THE ANALYST STATED