MAXCO FUTURES – Amazon.com Inc. once again draws Wall Street’s attention ahead of its third-quarter earnings report, scheduled for release this week. With its market capitalization nearing an all-time high and expectations mounting around its cloud computing and artificial intelligence (AI) businesses, the tech giant faces a crucial test to prove that its massive investments in digital infrastructure can deliver sustainable long-term growth.

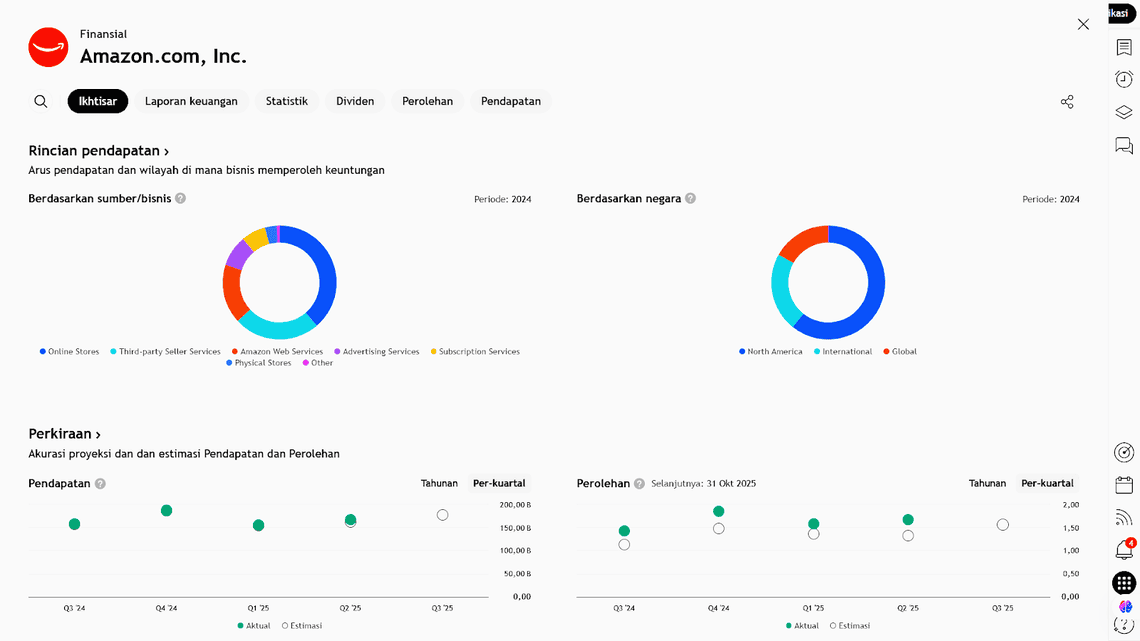

Analysts are zeroing in on Amazon Web Services (AWS) — the company’s cloud unit and key profit driver — as the main barometer of Amazon’s underlying strength. After pouring billions of dollars into expanding data center capacity and integrating generative AI technologies, investors are now demanding concrete proof that these initiatives are translating into a new phase of growth.

Yet, beneath the optimism lies pressure on margins and intensifying competition from Microsoft Azure and Google Cloud, which have heightened anticipation for the upcoming results. For the market, this earnings release is not merely a set of numbers — it’s an assessment of how effectively Amazon can balance its AI ambitions with long-term profitability.

Key Highlights

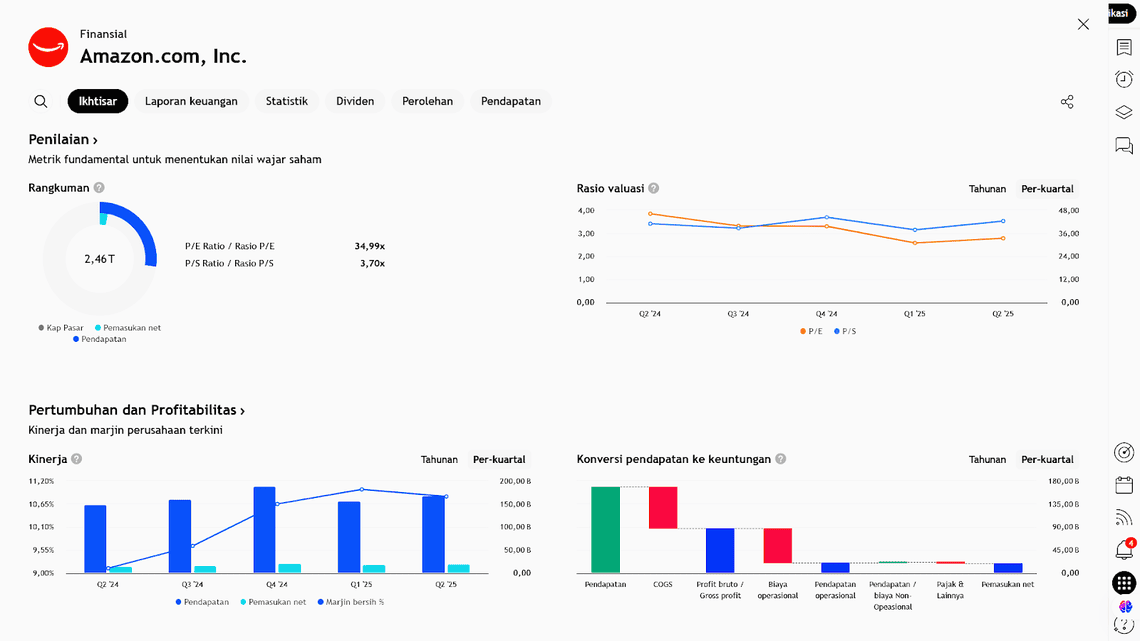

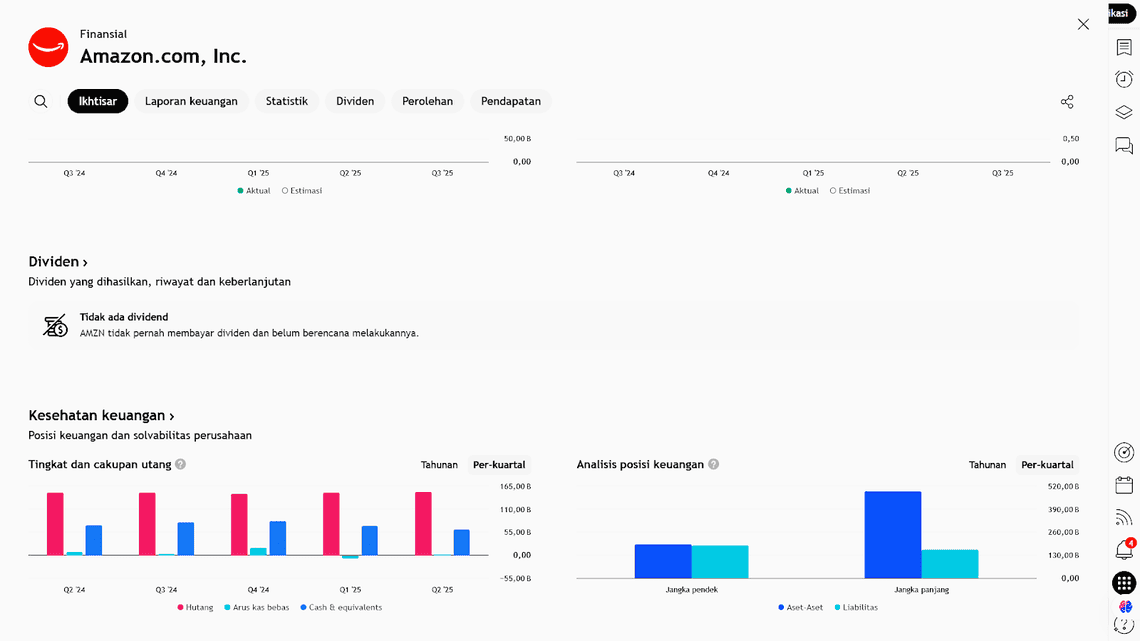

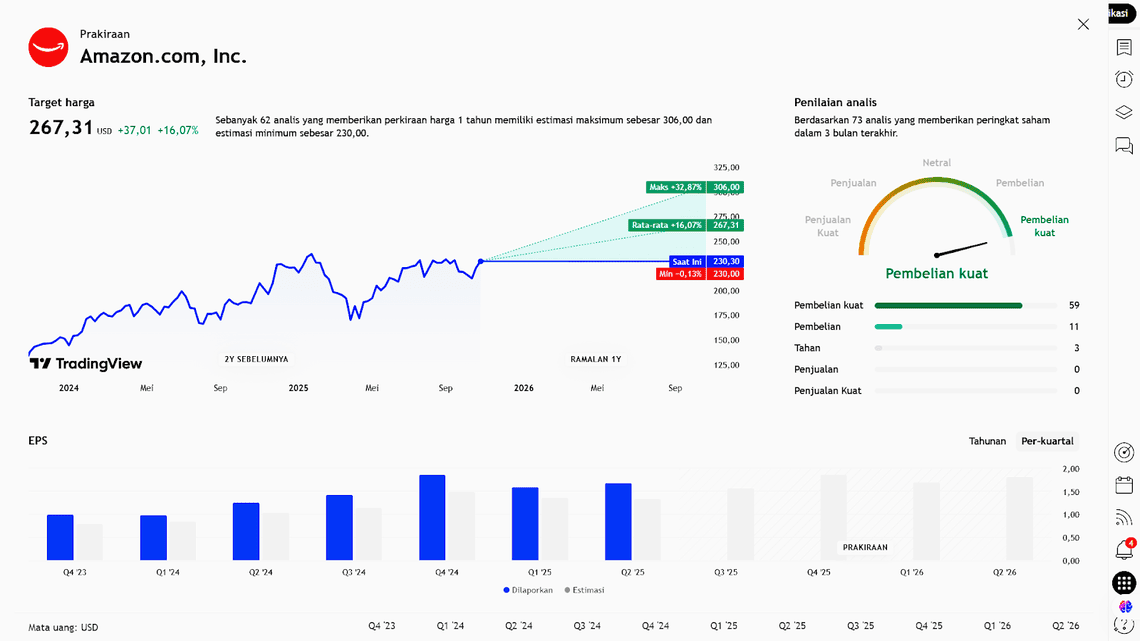

- Amazon is expected to report Q3 FY2025 earnings (for the period ending September 2025) with EPS around US$1.57 per share (+10% YoY) and revenue growth of about 12%.

- The main market focus remains on the AWS division and how the company manages large-scale AI investments while maintaining profitability.

- Despite solid revenue growth, there are concerns that AWS margins may be under pressure due to heavy AI infrastructure spending and fierce competition.

What to Watch

- AWS Growth: Can AWS accelerate growth to the 18–20% range from around 17% previously? This will likely determine overall market sentiment.

- Capital Expenditure & AI: Amazon’s capital spending last quarter reached approximately US$31.4 billion, largely devoted to cloud and AI infrastructure.

- Margins & Profitability: Even with rising revenue, margins may narrow if infrastructure costs remain high or AWS fails to achieve greater efficiency.

- Guidance vs. Expectations: Results meeting or exceeding market forecasts could reinforce confidence; weaker guidance, however, may trigger selling pressure.

- Beyond Cloud: Amazon’s e-commerce and advertising segments remain crucial in supporting overall margin stability and revenue diversification.

Why This Matters for Market Watchers

For those who follow daily market movements and earnings updates:

- Amazon’s Q3 results could set the tone for the broader tech sector, particularly in cloud and AI-related stocks.

- If Amazon demonstrates tangible progress from its AI investments (e.g., accelerating AWS growth with improved margins), it could serve as a positive catalyst not only for Amazon but also for peers across the technology landscape.

- Conversely, disappointing margins or slower AWS growth could signal that investors should exercise caution toward high-valuation tech stocks built around the AI narrative.

- Given Amazon’s weight in major indices, its results and forward guidance may significantly influence broader market sentiment — including the indices you monitor daily.

Earning Projection Prediction

WHAT THE ANALYST SAYS

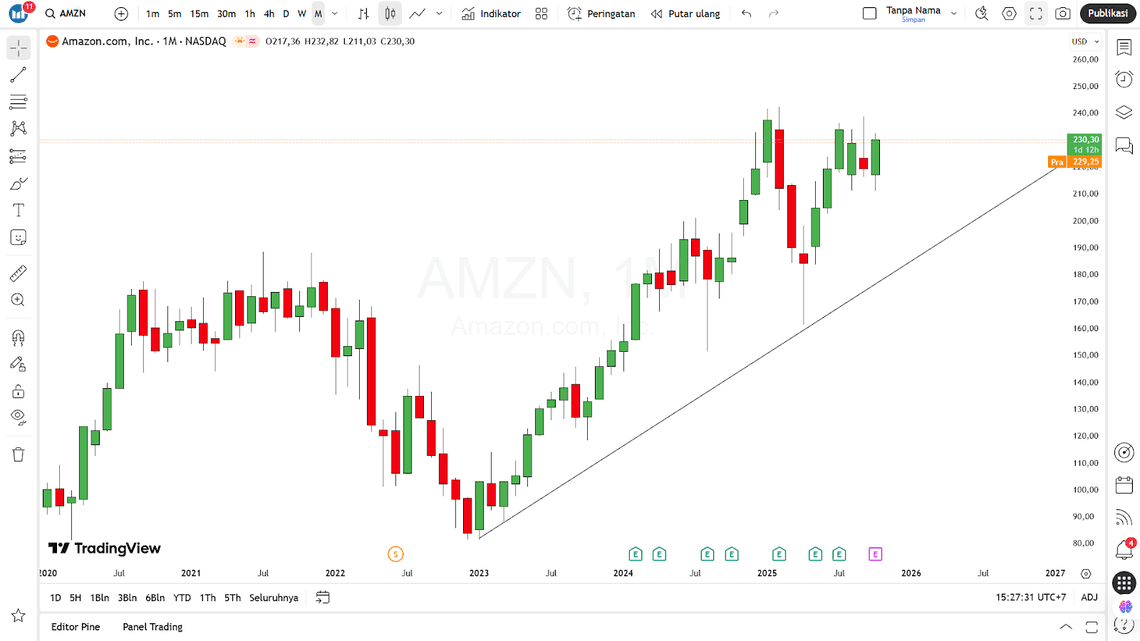

Short – Medium Term Projection

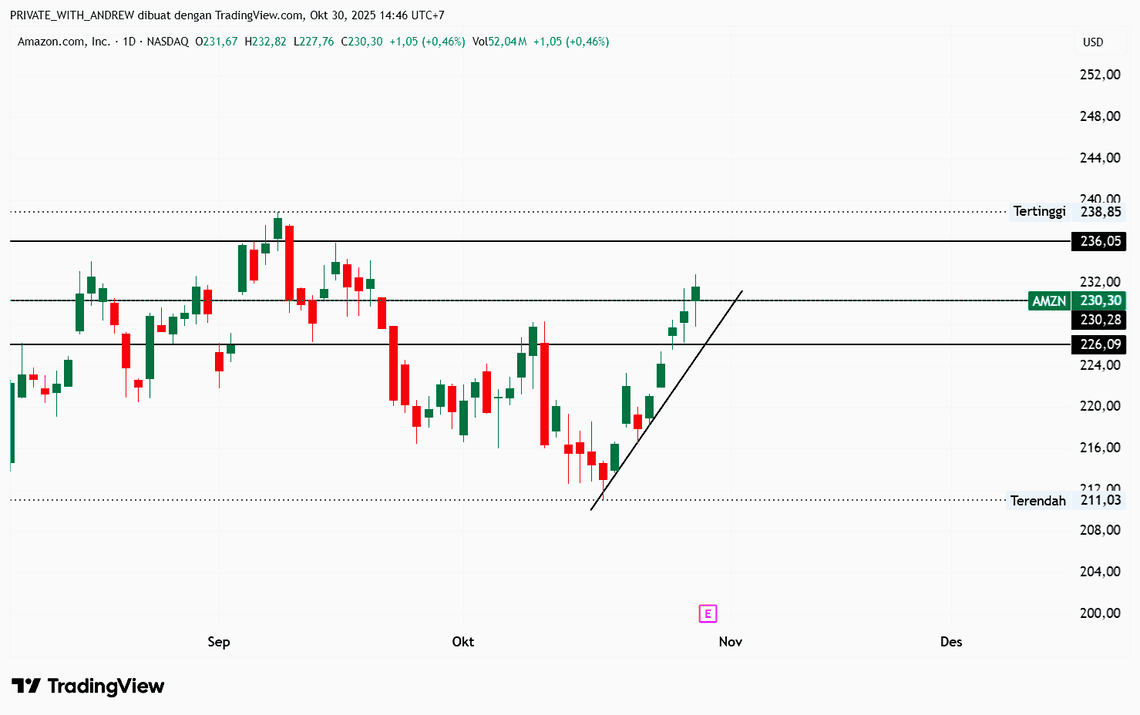

Strategy

| Buy AMZN | |

| Entry | 230.28 |

| Take Profit | 236.05 |

| Stoploss | 226.09 |

Disclaimer On

Ade Yunus ST, WPA : Global Market Strategies

Andrew Fischer : Market Analyst