Key Points :

- Meta is estimated to release its first quarter results after the market closure on Wednesday.

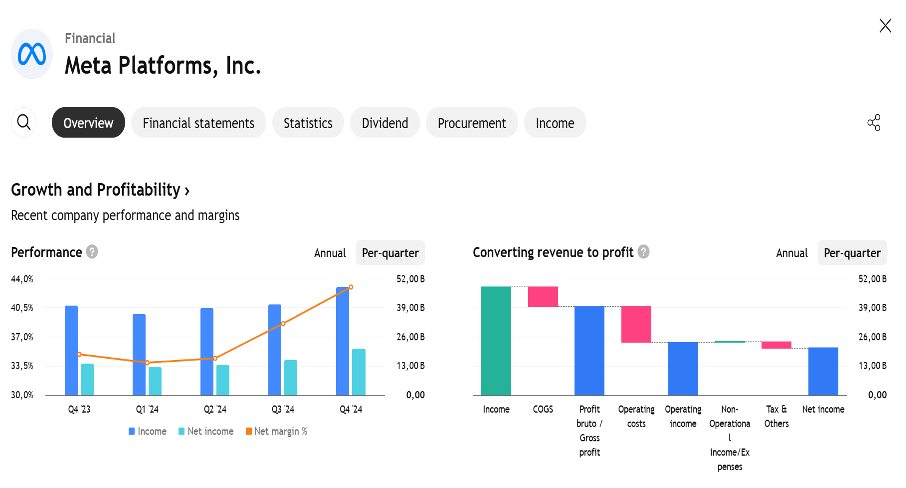

- Analysts are optimistic about the tech giant, with revenues and profits expected to rise by more than 10% compared to the previous year.

- Ongoing legal and regulatory concerns could negatively impact Meta’s business.

Meta Platforms (META) is scheduled to report first-quarter results after the market closes on Wednesday, and analysts remain optimistic about the Facebook parent company amid uncertainty over tariffs and legal disputes.

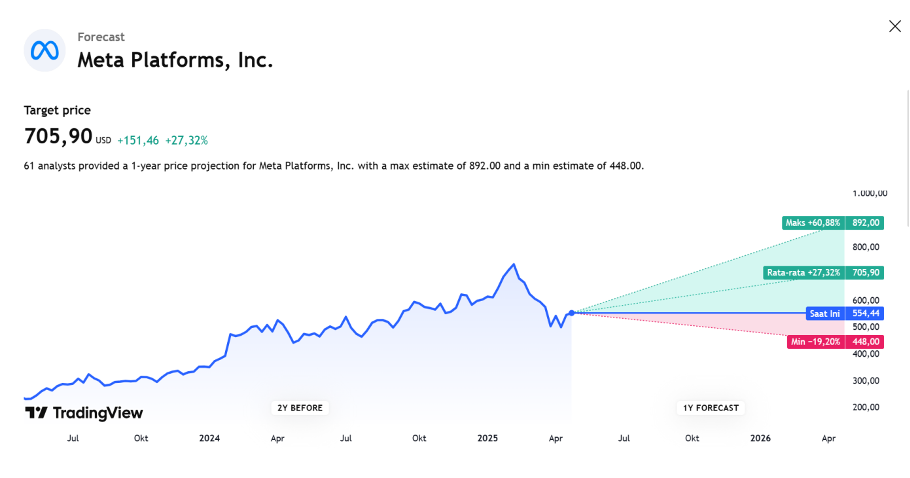

Of the 27 analysts monitoring the stock tracked by Visible Alpha, 25 have a “buy” recommendation, while only two have a “hold” rating. The average target price of the stock is close to $687, which is a premium of about 24% over Tuesday’s closing price of close to $555.

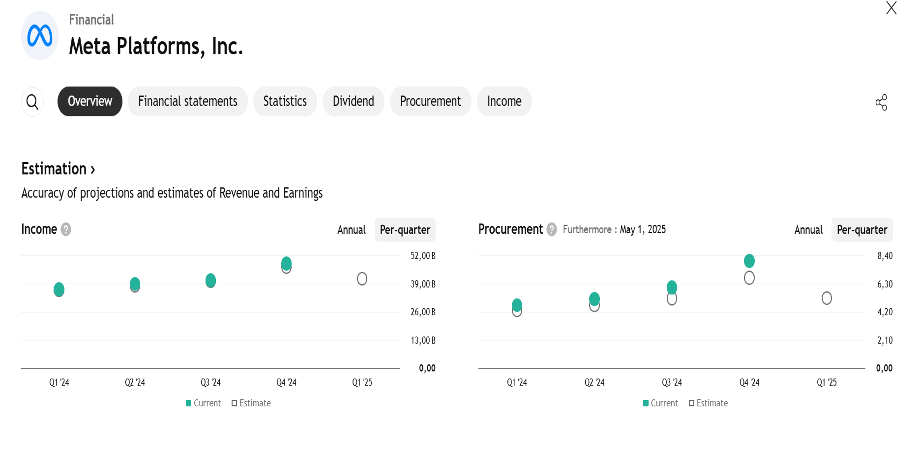

Meta, the parent of Facebook, Instagram, and WhatsApp, is expected to report earnings per share of $5.24 on revenue of $41.35 billion, which represents growth of 11% and 13% over last year, respectively.

Analysts from Morgan Stanley recently wrote that Meta could be impacted by a drop in ad spending from Chinese companies due to tariffs, but they noted that Meta is likely in a better position to handle it than Alphabet (Google’s parent) or Amazon.

Regulatory and Legal Concerns Dominate Recent News

Legal and regulatory disputes continue to haunt Meta, with the European Union last week imposing a 200 million euro ($227.5 million) fine on the tech giant for violating the Digital Markets Act. Meta said that it plans to appeal the fine.

Also this month, the antitrust trial against Meta began. The Federal Trade Commission (FTC) is seeking to force the company to sell or spin off Instagram or WhatsApp, and the agency says Meta has engaged in an “illegal buy-or-sink scheme to maintain its dominance” by acquiring “innovative competitors.”

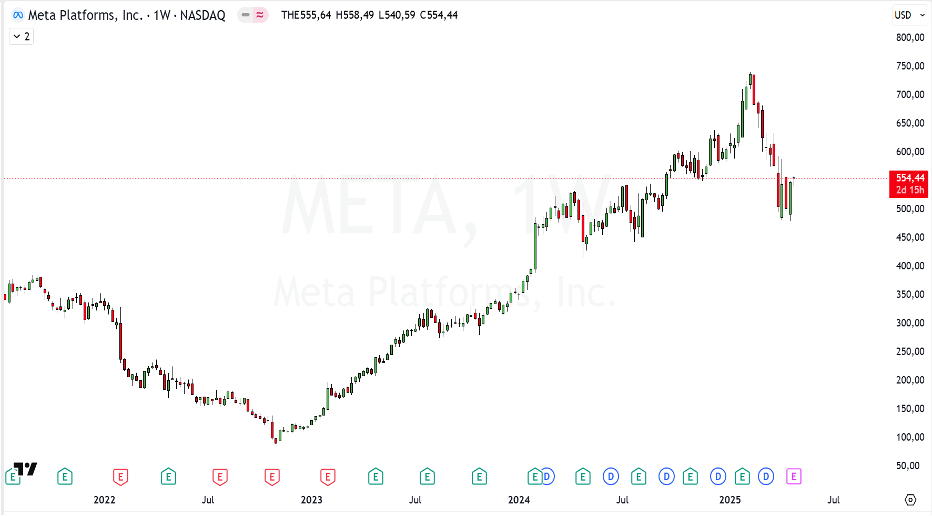

Meta shares have fallen around 5% so far this year, having lost around a quarter of their value since hitting a record high of more than $740 in February, amid significant market turmoil that has also hit other major companies in the Magnificent Seven group.

EARNING PROJECTION PREDICTION

WHAT THE ANALYST STATED