BOJ’s December 9 Interest Rate Decision Becomes Key Driver

Maxco Futures – The Japanese yen weakened again at the start of the week after Prime Minister Sanae Takaichi announced plans to abandon the annual budget target and replace it with a more flexible multi-year spending framework — a move that marks the biggest shift in Japan’s fiscal direction in more than a decade.

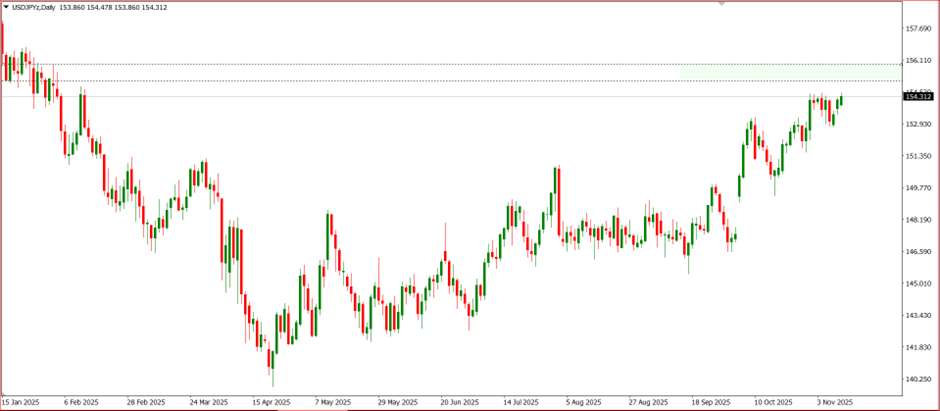

The yen fell for the second consecutive day, with the USD/JPY pair rising around 0.4% to ¥154.03 in early Monday Asian trade, after closing near ¥153.41 on Friday. This movement reflects a combination of domestic policy pressure and a stronger U.S. dollar amid global risk-on sentiment.

Takaichi’s approach is viewed as a signal that the government aims to stimulate economic growth through increased public spending, even though it risks further weakening Japan’s already fragile fiscal position. The plan also suggests that the strict budget discipline long associated with Japanese bureaucracy may be relaxed temporarily to support household consumption and sluggish industrial activity.

Meanwhile, financial markets remain focused on the Bank of Japan (BOJ), which previously hinted at the possibility of a rate hike in December. However, those expectations have become less certain. Market participants now estimate roughly a 50% chance of a 25-basis-point hike, amid uncertainty over whether Takaichi’s expansionary fiscal policy will reduce the urgency for the BOJ to act aggressively.

Globally, the U.S. Dollar Index (DXY) rose about 0.2%, supported by optimism that Senate negotiations to end the government shutdown will soon yield an agreement. The dollar’s strength added further pressure on the yen, which has lost more than 12% against the greenback so far this year.

Maxco Futures assesses that investors are now awaiting clearer details on Takaichi’s proposed multi-year spending framework, as well as additional signals from the BOJ ahead of next month’s policy meeting. Inflation data, wage growth, and unemployment levels will be key drivers of yen movement in the near term.

USD/JPY Outlook

USD/JPY is currently trading in the 154.20–154.40 range, with daily bullish momentum appearing to dominate once again. Previously, institutions and traders identified selling interest between 153.70 and 154.30. At this stage, USD/JPY may move toward the 155.10–155.90 zone, which serves as the daily selling interest area.

If the BOJ keeps rates unchanged in December 2025, it could open limited downside potential for the yen against the USD. However, if the BOJ proceeds with a rate hike, the yen may test its lower targets at 151, 149, and 147.

Ade Yunus, ST, WPA

Global Market Strategies