Visa Set to Announce Earnings Report, Investors Await Signals from the Core Engine of the Digital Economy

Maxco Futures – October 27, 2025

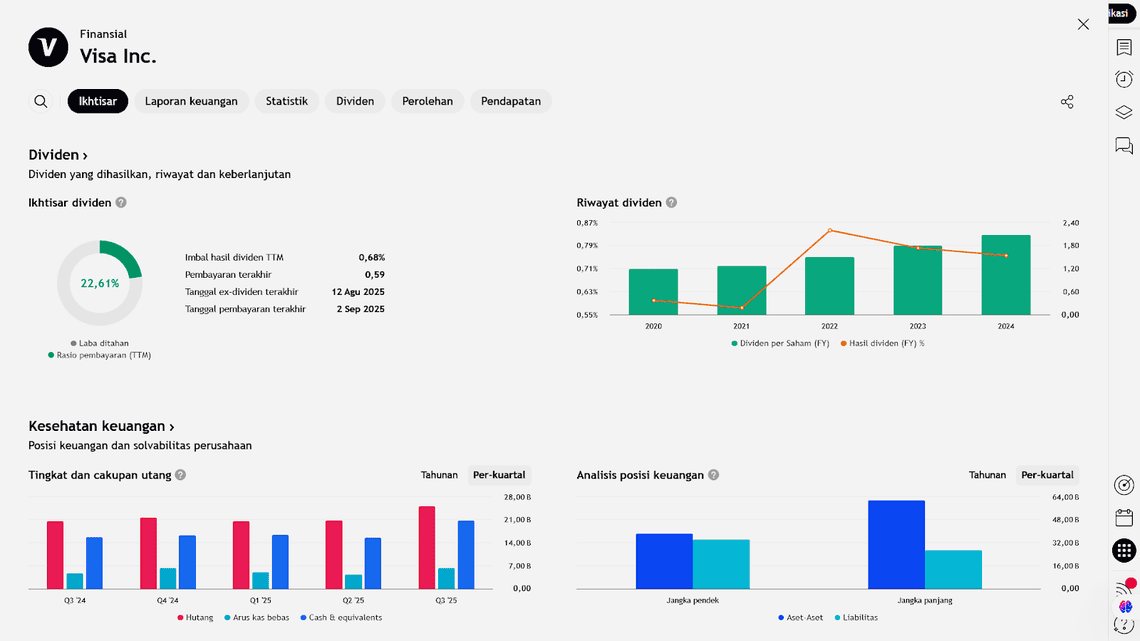

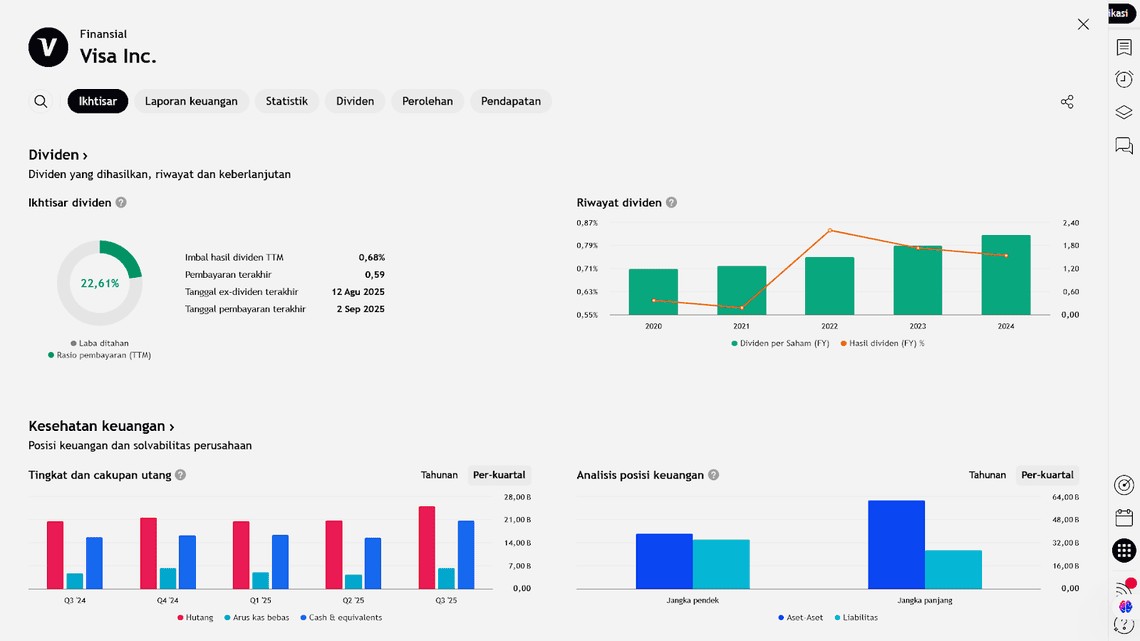

Visa Inc. (NYSE: V) is set to take center stage in global financial markets as the world’s largest payment company prepares to release its quarterly earnings report on Tuesday evening New York time. With a market capitalization exceeding US$700 billion, Visa is often viewed as a key barometer of global economic health — reflecting consumer spending trends, cross-border trade flows, and the strength of digital transactions amid a rapidly evolving financial landscape.

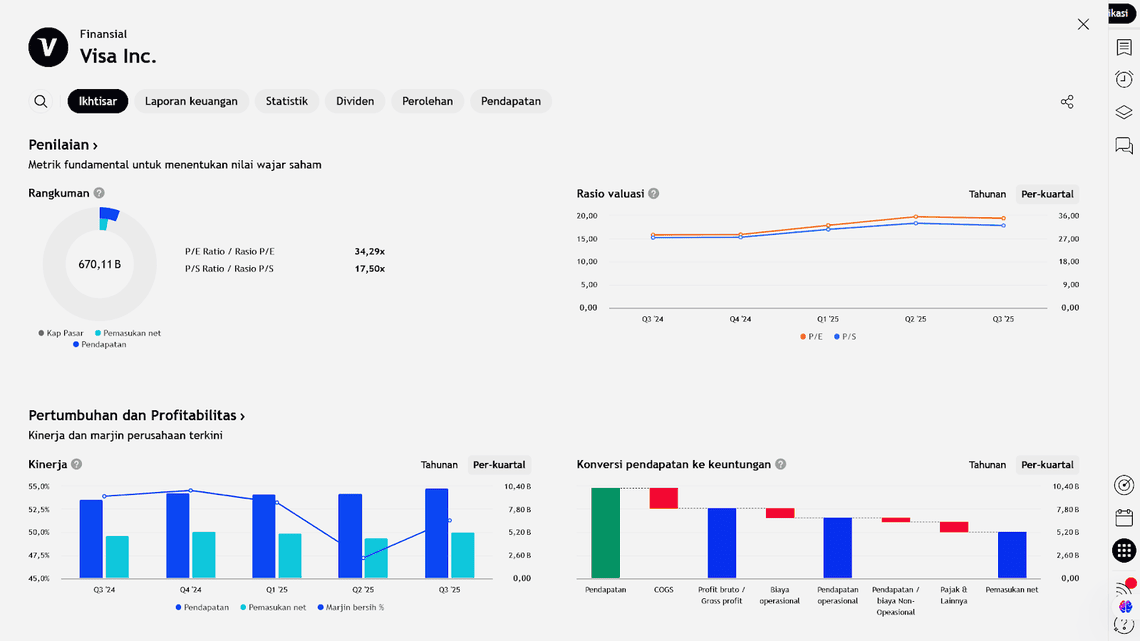

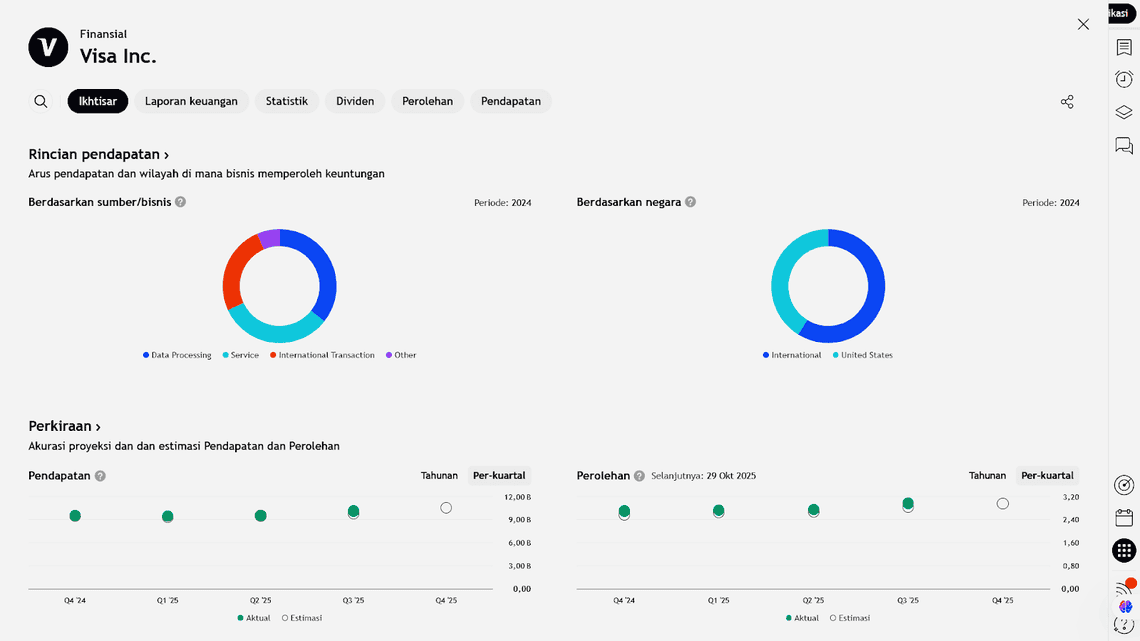

Analysts expect Visa’s revenue to grow about 10% year-over-year, reaching over US$10.6 billion, with earnings per share (EPS) projected around US$2.97. While this still represents solid expansion, the pace marks a slight slowdown compared to the previous period when payment volumes surged in the post-pandemic recovery.

Investors are now watching closely to see whether Visa can sustain its growth momentum amid intensifying competition from fintech players, high interest rates, and global economic uncertainty that has begun to weigh on consumer spending power.

Visa’s performance will also serve as a benchmark for the broader payments sector, including major rivals such as Mastercard and American Express, both striving to protect margins as the world shifts toward digital payments and integrated financial services. With market expectations relatively stable and long-term sentiment remaining positive, this earnings report could become a key catalyst shaping the direction of Visa’s stock — and the global payments industry — in the coming months.

Market Expectations

- Revenue is projected to rise around 10.3% year-on-year, reaching approximately US$10.61 billion.

- Adjusted EPS is expected to come in at around US$2.97.

- For comparison, in the previous quarter, Visa reported US$10.17 billion in revenue, up 14.3% year-over-year.

- Over the past 30 days, analysts have largely reaffirmed their estimates, indicating stable market expectations.

Key Notes & Context

- The 10.3% growth represents a slowdown from 11.7% in the same quarter last year.

- Over the past two years, Visa has missed Wall Street’s revenue expectations only once, with an average beat margin of around 1.2%.

- Among peers, Capital One Financial reported 53.4% year-over-year growth, beating expectations, while Synchrony Financial posted flat growth but slightly exceeded forecasts.

- The average analyst price target for Visa stands at US$392.59, compared to the current share price of around US$347.50.

Implications for Investors

- As Visa rarely disappoints market expectations, this report could be a critical moment to assess whether growth remains on track.

- The slowdown from ~11.7% to ~10.3% may signal some business pressure — potentially from macroeconomic headwinds, consumer spending weakness, or rising competition.

- However, optimistic analyst consensus and strong target prices suggest that markets still believe Visa retains robust fundamentals and sustainable growth potential amid the global shift toward a cashless digital economy.

Earning Projection Prediction

WHAT THE ANALYST SAYS

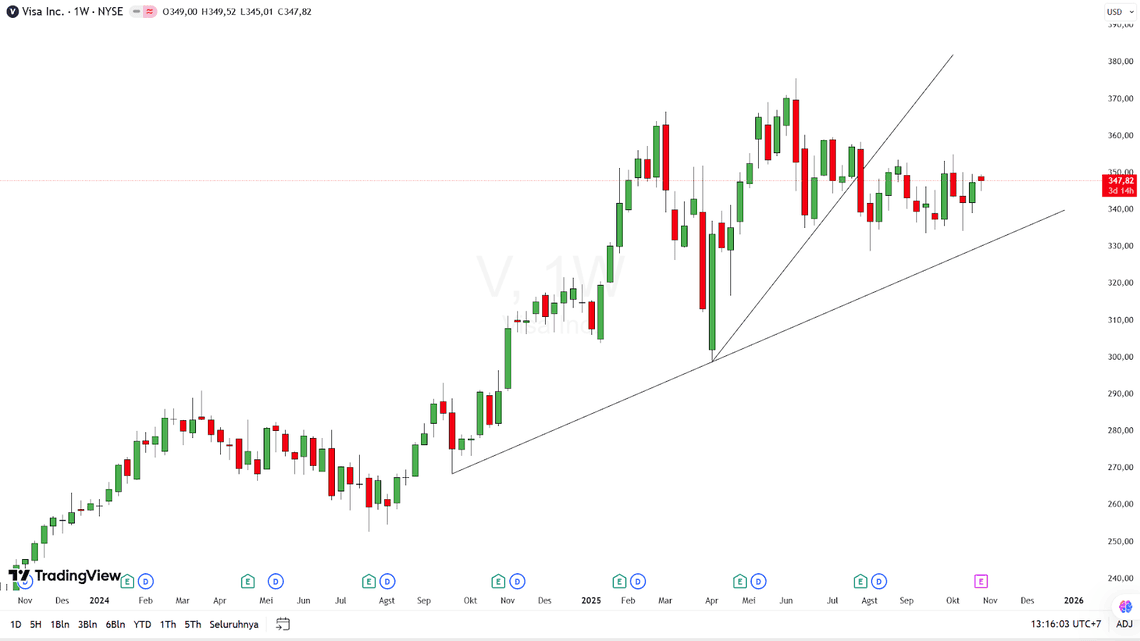

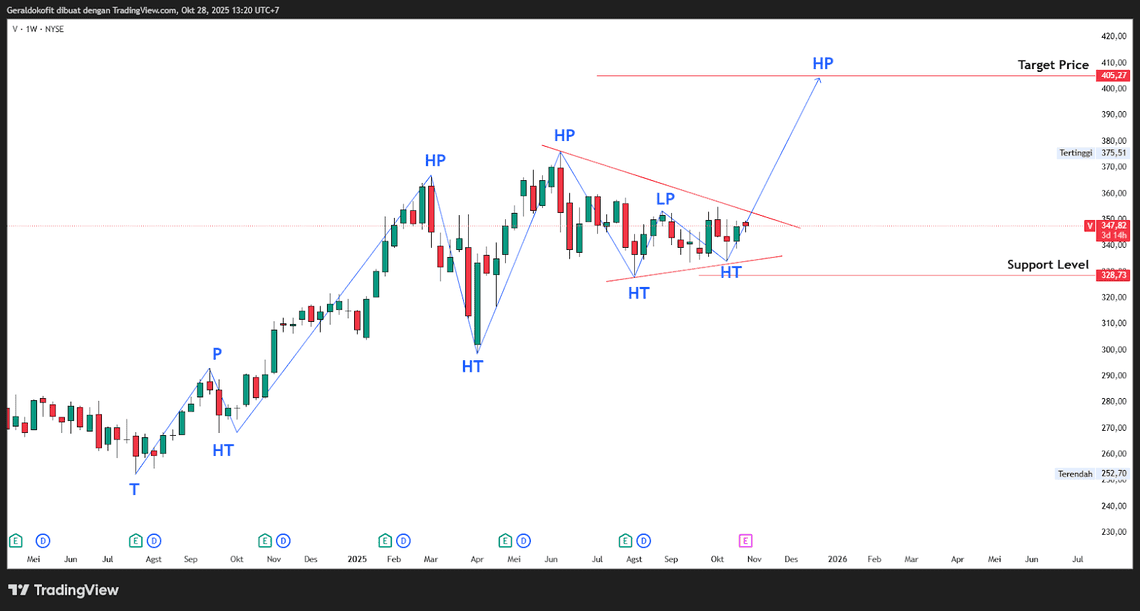

Short – Medium Term Projection

Strategi

| Buy VISA | |

| Entry | 347,82 |

| Take Profit | 405.27 |

| Stoploss | 328.73 |

Disclaimer On

Ade Yunus ST, WPA : Global Market Strategies

Geraldo Kofit CSA,CTA,CDMp : Market Analyst