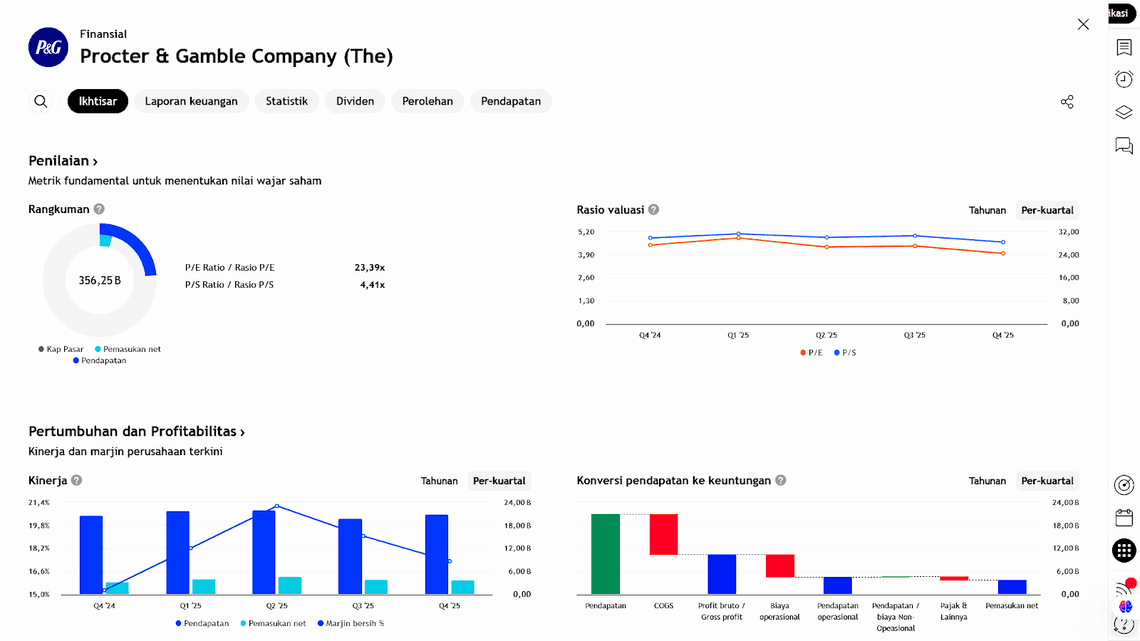

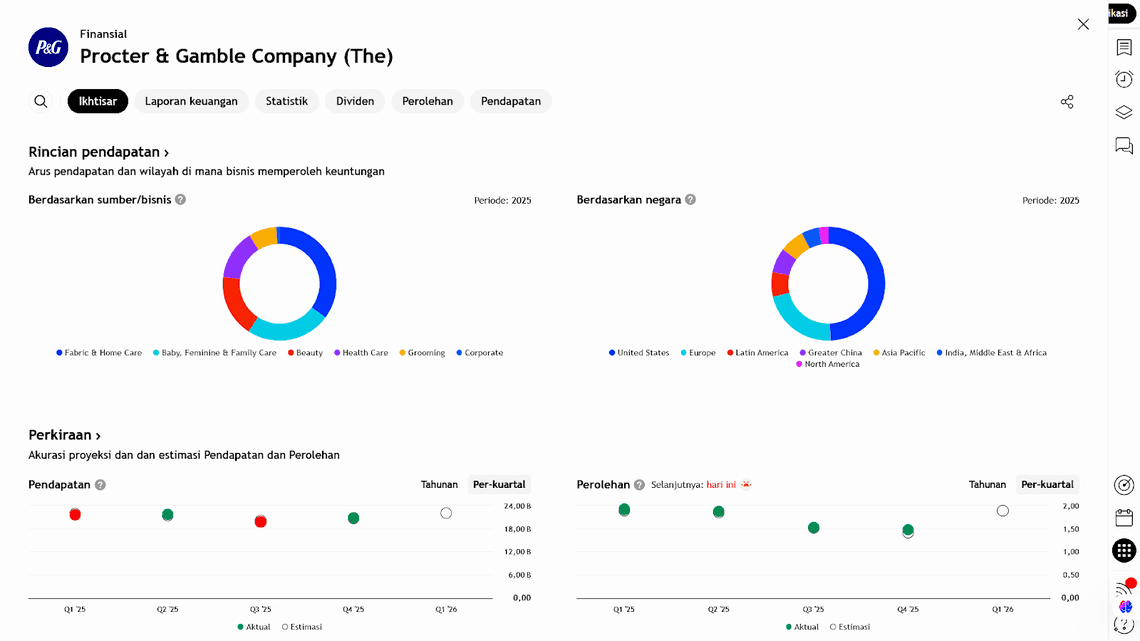

Procter & Gamble Co. (P&G) delivered a resilient performance in its fiscal third quarter of 2025, reflecting strength in brand power and operational efficiency despite ongoing global market pressures. The consumer goods giant reported earnings slightly above expectations, though revenue came in marginally below forecasts — underscoring the balance between pricing gains and softer demand in several categories.

Organic sales continued to grow, driven by strategic pricing initiatives and cost efficiencies, while total sales declined due to foreign exchange impacts and volume slowdowns across key product lines. Although operating margins improved, management trimmed its full-year guidance, signaling caution toward the global economic outlook and subdued consumer spending trends.

CEO Jon Moeller reaffirmed that P&G remains focused on product innovation, brand leadership, and operational discipline to sustain long-term competitiveness amid a challenging macro environment.

Key Highlights

- Earnings per Share (EPS):

P&G reported EPS of US$0.50 for Q3 FY2025, beating analyst expectations of US$0.43. - Revenue:

Quarterly revenue reached US$6.25 billion, slightly below the consensus estimate of US$6.41 billion. - Full-Year Guidance:

For fiscal 2025, P&G projects EPS in the range of US$1.62–US$1.66, compared with Wall Street’s consensus of US$1.63.

Implications

While P&G managed to outperform EPS forecasts, the revenue shortfall suggests that volume or pricing growth may not have fully met market expectations.

The slightly broader EPS guidance range indicates confidence in profitability but also reflects caution about top-line growth.

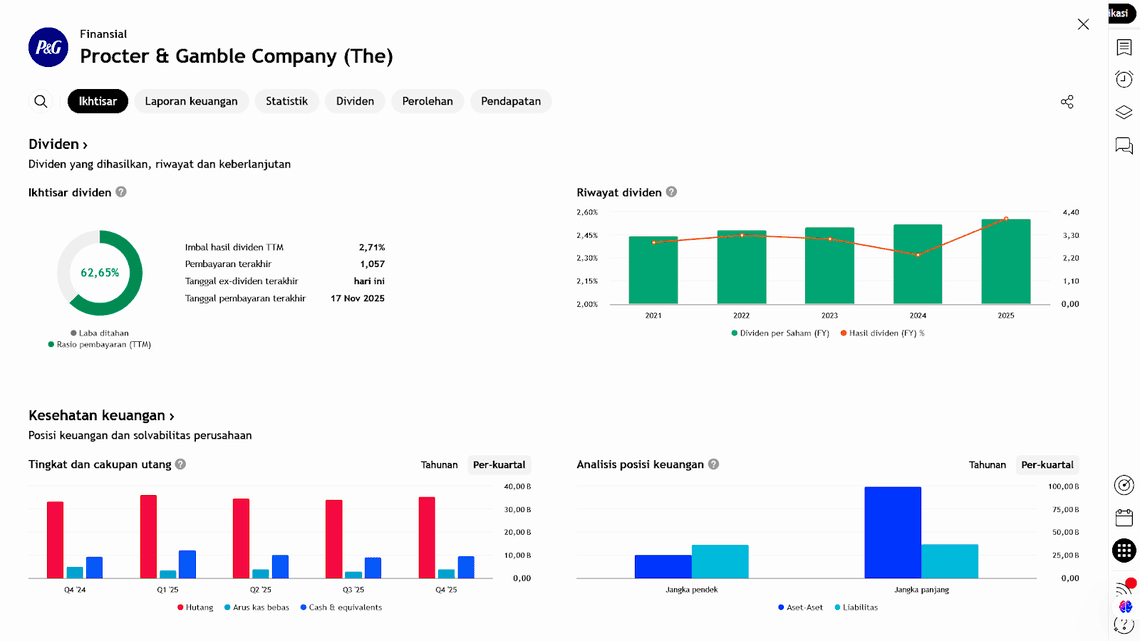

For investors, this mixed performance suggests that P&G’s profitability remains stable, but revenue momentum may still face headwinds — a key consideration for stock valuation going forward.

What to Watch

- Investor Sentiment:

EPS beats typically attract positive investor reactions, but weaker revenue results may temper enthusiasm. - Underlying Drivers:

It will be important to assess whether the revenue decline stems from volume contraction, pricing pressure, rising input costs, or other macro factors — critical for deeper earnings analysis. - Guidance Range:

The relatively wide EPS guidance implies a degree of uncertainty ahead. Investors should monitor future management updates and market commentary for clearer direction.

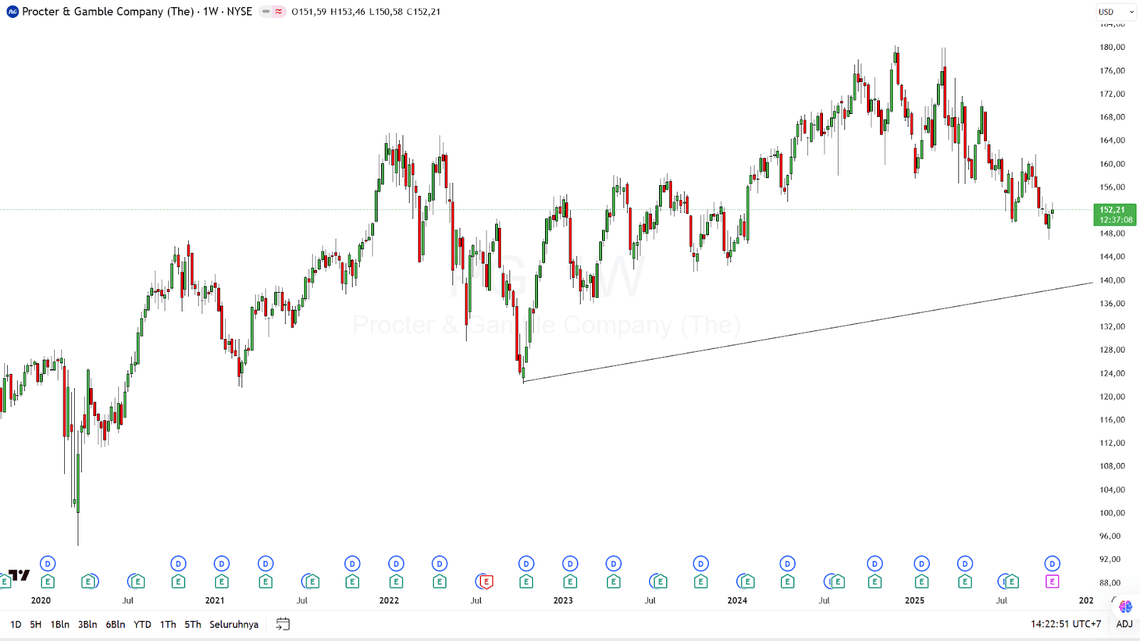

Earning Projection Prediction

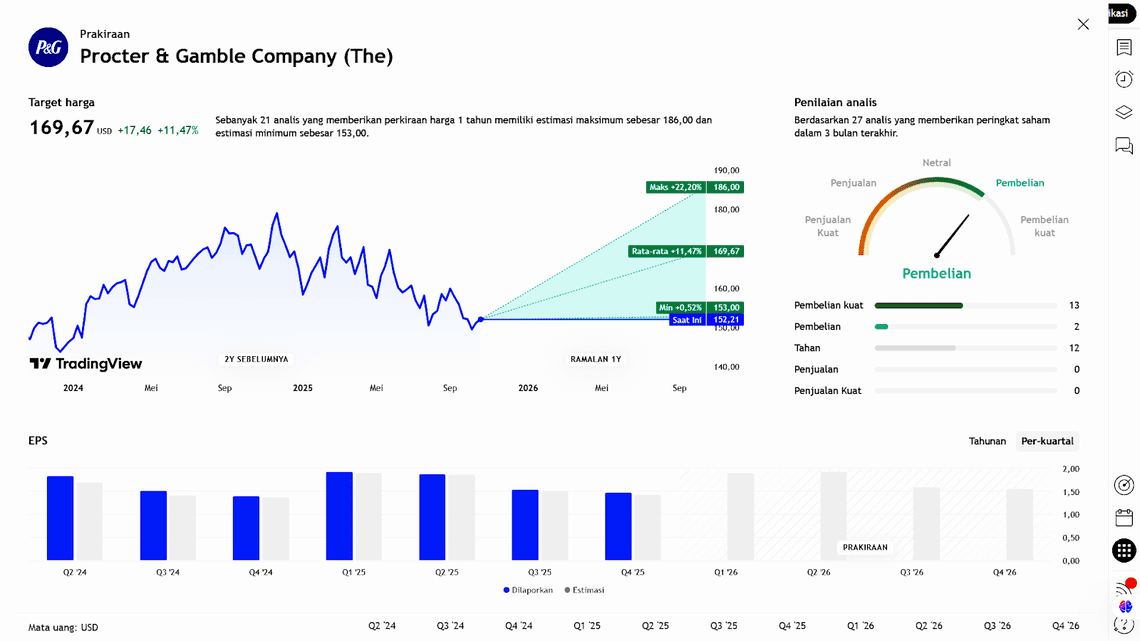

WHAT THE ANALYST SAYS

Short – Medium Term Projection

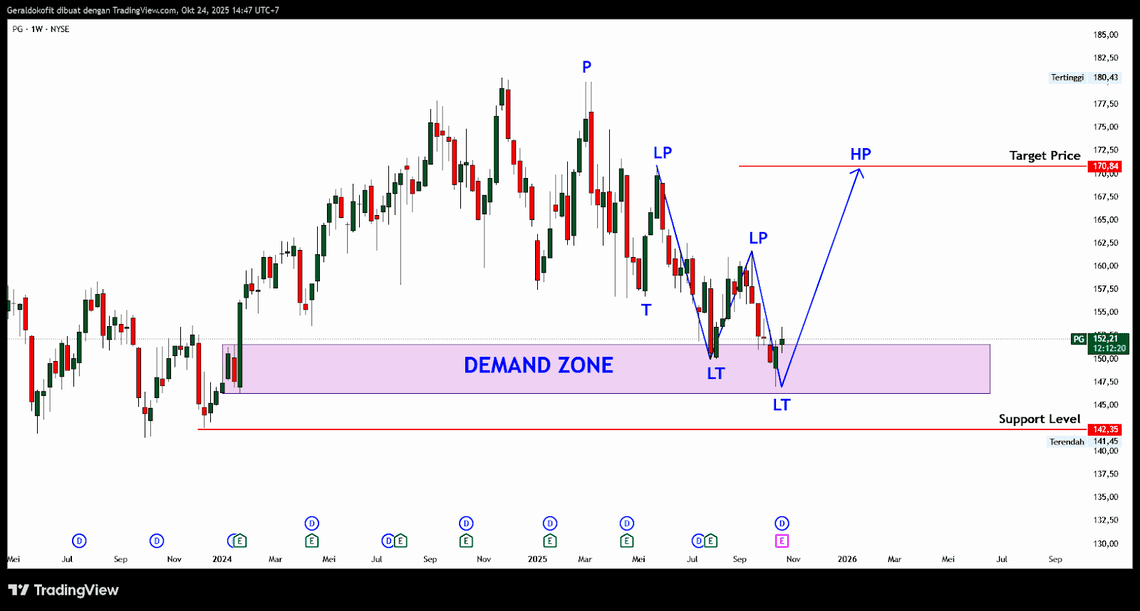

Strategi

| Buy PG | |

| Entry | 152.21 |

| Take Profit | 170.84 |

| Stoploss | 142.35 |

Disclaimer On