As McDonald’s Corp. prepares to release its third-quarter earnings report for 2025, the fast-food giant once again finds itself in the spotlight on Wall Street. Analysts expect moderate profit growth amid a challenging macroeconomic backdrop that continues to pressure consumer spending power and intensify price competition across the quick-service restaurant (QSR) industry.

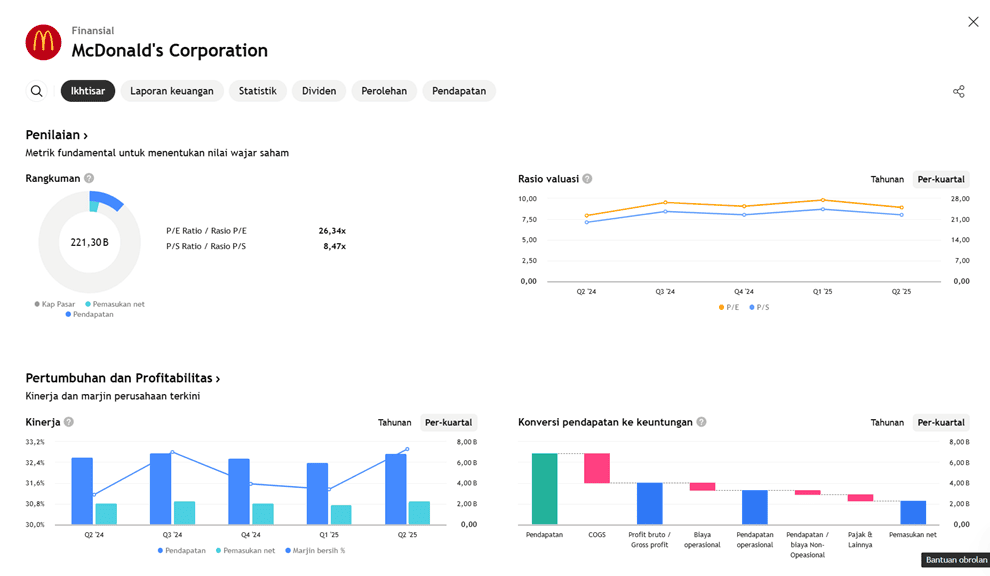

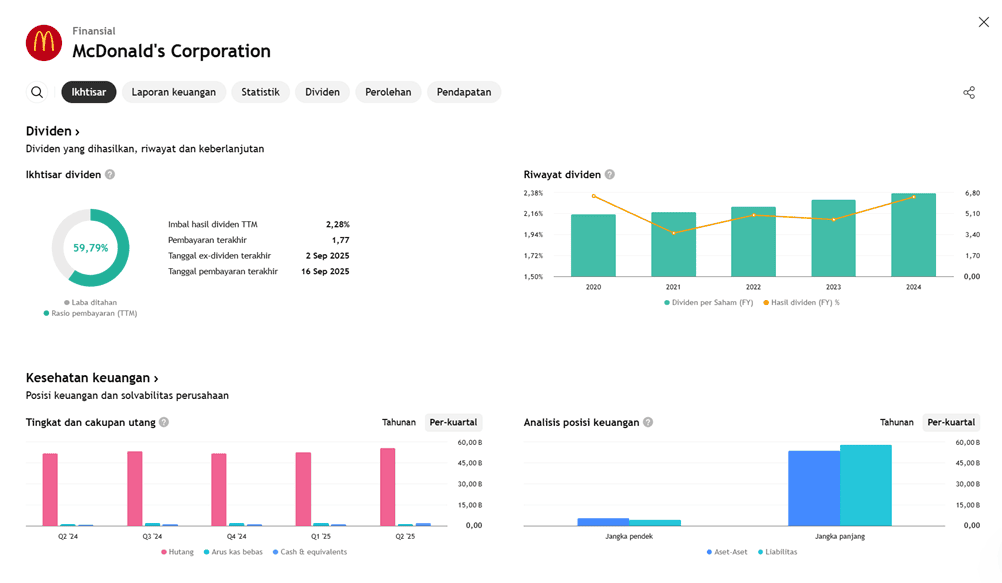

Earnings per share (EPS) for McDonald’s are projected to rise about 4% year-over-year, supported by its “value menu” strategy such as the $5 Meal Deal, ongoing menu innovation, and growth in loyalty program memberships. Despite this, McDonald’s shares have underperformed the S&P 500 so far this year — reflecting investor caution regarding profit margins and global operating costs.

The company’s strong performance in the previous quarter provided a base of optimism, with solid revenue and same-store sales growth. However, the upcoming Q3 report will serve as a critical test of McDonald’s pricing and promotional strategy to sustain momentum amid consumers’ heightened price sensitivity in an inflationary environment.

With elevated market expectations and a relatively stable valuation, the earnings report will likely be a key short-term catalyst for MCD stock — determining whether it confirms a sustained recovery or signals a broader slowdown in the global fast-food sector.

Key Highlights

- Earnings Release Date:

McDonald’s Corporation (ticker: MCD) will report Q3 2025 earnings before market open on Wednesday, November 5, 2025. - Earnings Estimates:

Analysts forecast adjusted EPS of US$3.37 for Q3 2025, up ≈4.3% from US$3.23 a year earlier.

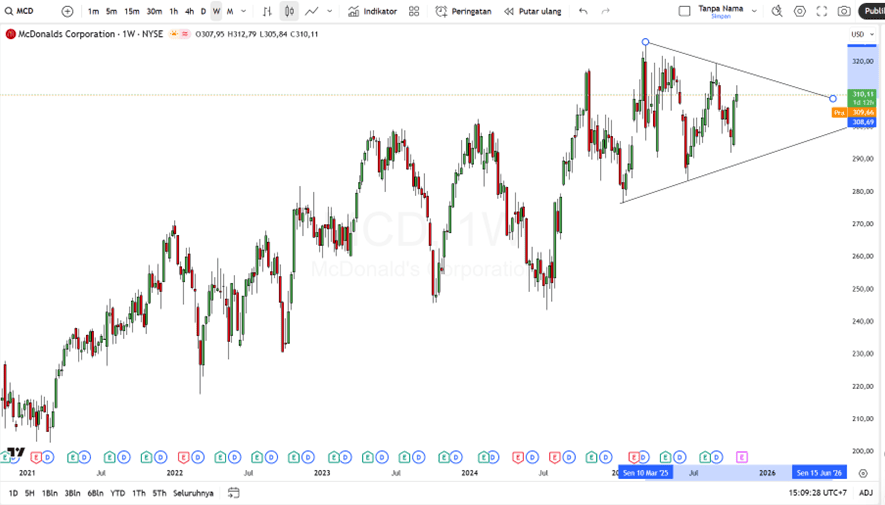

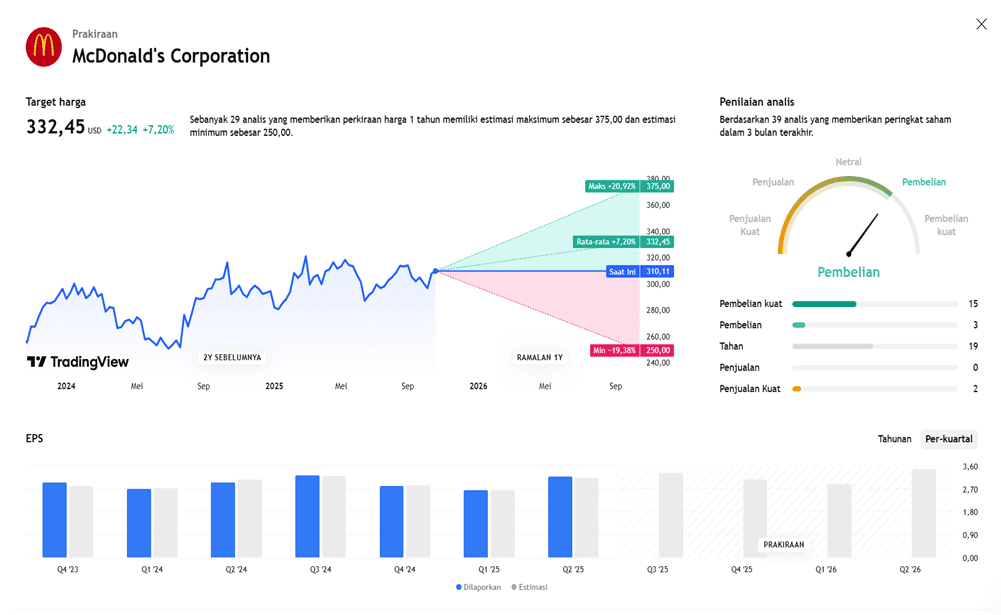

For full-year 2025, adjusted EPS is projected at US$12.34 (up ≈5.3% YoY), and for 2026, estimates rise to US$13.37 (up ≈8.4%). - Stock Performance:

Over the past 52 weeks, MCD shares are down ~2.3%, underperforming both the S&P 500 (+13.6%) and the consumer staples sector (+17.5%). - Previous Quarter (Q2 2025):

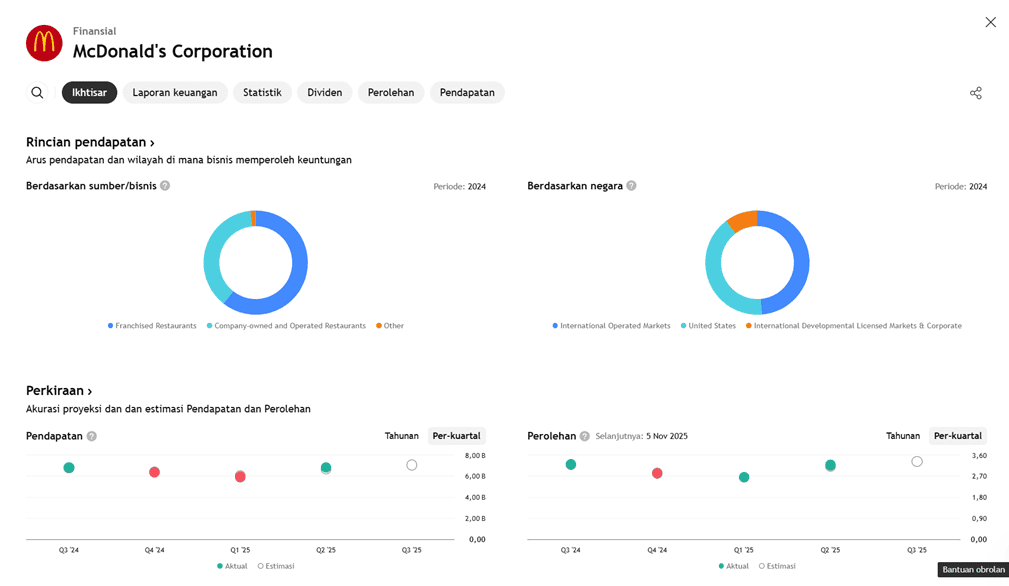

McDonald’s reported adjusted EPS of US$3.19 and revenue of US$6.8 billion, reflecting YoY growth and global same-store sales up 3.8%.

Key drivers included promotions like the “$5 Meal Deal”, new menu items such as McCrispy Chicken Strips, and strong performance from loyalty/subscription programs. - Analyst Ratings:

Consensus rating: “Moderate Buy.”

Out of 35 analysts: 14 Strong Buy, 1 Moderate Buy, 19 Hold, 1 Strong Sell.

Average price target: ~US$337.45, implying ~9.6% upside potential.

Risks & Investor Watchlist

- Consumer Weakness:

Continued pressure on consumer purchasing power — especially among price-sensitive segments — could weigh on sales growth. - Intense Competition:

The fast-food space remains highly promotional, forcing McDonald’s to rely on discounts and value bundles to maintain traffic. - Regional & Licensing Risks:

While the developmental licensed markets contribute significantly to expansion, regional macro and regulatory risks persist. - Operational Metrics:

Investors will closely monitor whether McDonald’s can sustain its same-store sales momentum and operating margin improvements observed in Q2.

Earning Projection Prediction

WHAT THE ANALYSTS SAY

Short – Medium Term Projection

| BUY McD | |

| Entry | 310 |

| Take Profit | 359 |

| Stoploss | 276 |

Disclaimer On