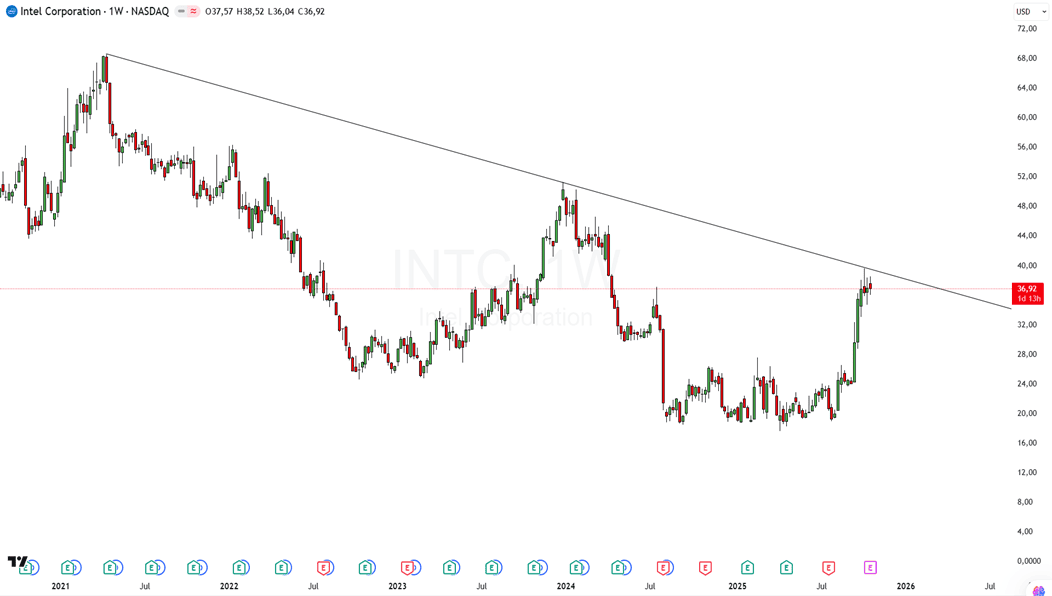

Jakarta — Shares of Intel Corp. (INTC) are expected to see sharp volatility following the company’s third-quarter earnings report, which will be released Thursday evening U.S. time. Based on options pricing, the market is pricing in a potential move of around ±10%, implying a range of roughly US$42 if results are strong, or US$32 if they disappoint.

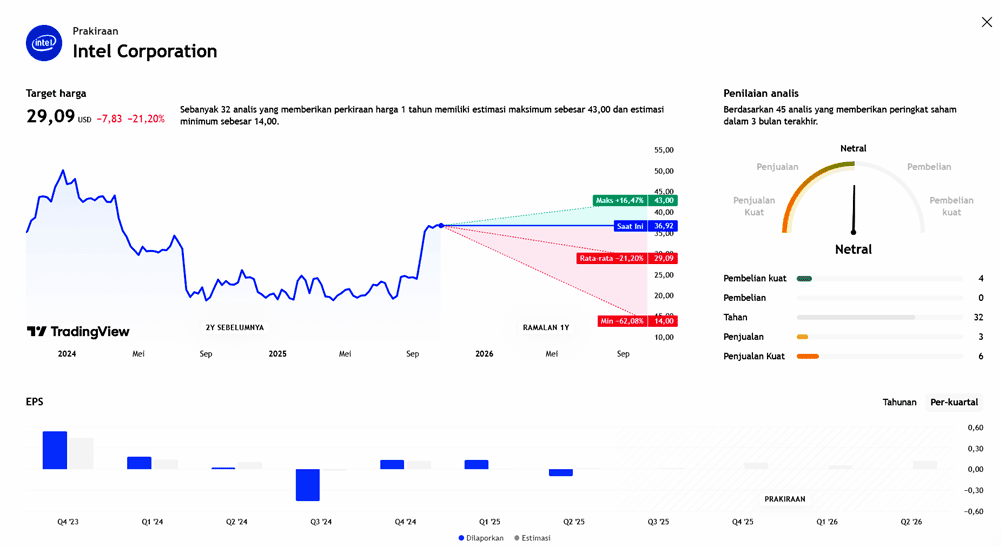

This comes after Intel’s previous quarterly results triggered an 8% drop in its share price due to unexpected losses and weak guidance. While Intel’s stock has rallied nearly 90% year-to-date, some analysts remain cautious, with an average price target of US$30.60, roughly 20% below current market levels.

Investor optimism has been buoyed by U.S. government investment, which took nearly a 10% stake in Intel, along with new partnerships with Nvidia and SoftBank — developments seen as a potential boost to Intel’s foundry business revival.

Traders will focus on Intel’s forward guidance and commentary regarding its chip manufacturing outlook during the upcoming earnings call. A strong report could extend the recent rally, while disappointing results could trigger a sharp correction.

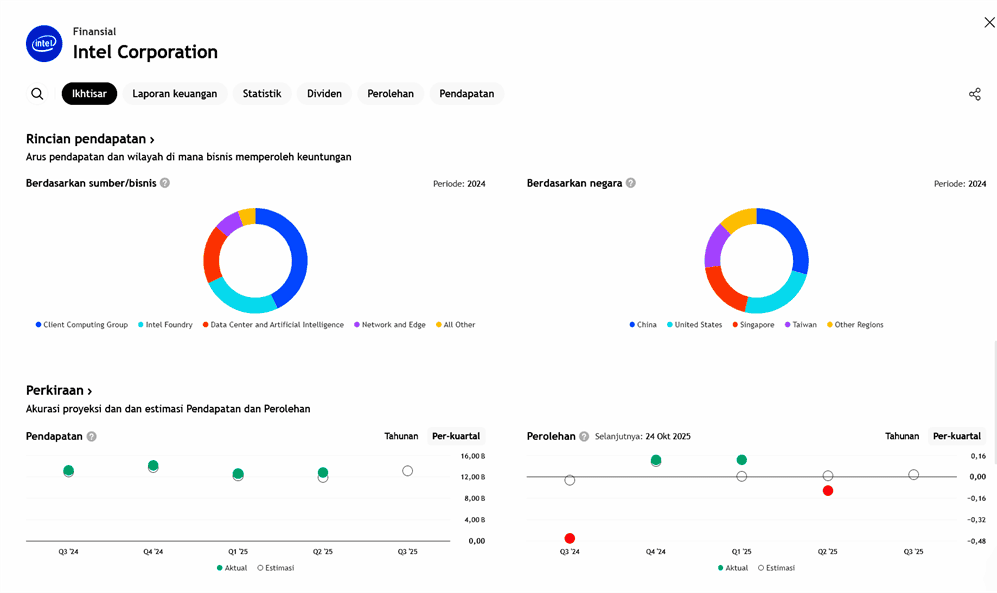

1. Earnings Expectations

- Intel is expected to report third-quarter revenue of around US$13.2 billion.

- Adjusted earnings per share (EPS) are forecast at just US$0.02.

- According to Reuters, Intel may post a ~1% year-over-year decline in revenue to US$13.14 billion.

- Segment breakdown: The Client Computing (PC) division is expected to grow ~11% to US$8.12 billion, supported by the Windows upgrade cycle and new Intel processors.

- The Foundry Services unit (third-party chip manufacturing) is projected to deliver relatively flat revenue of ~US$4.37 billion.

2. Positive Drivers

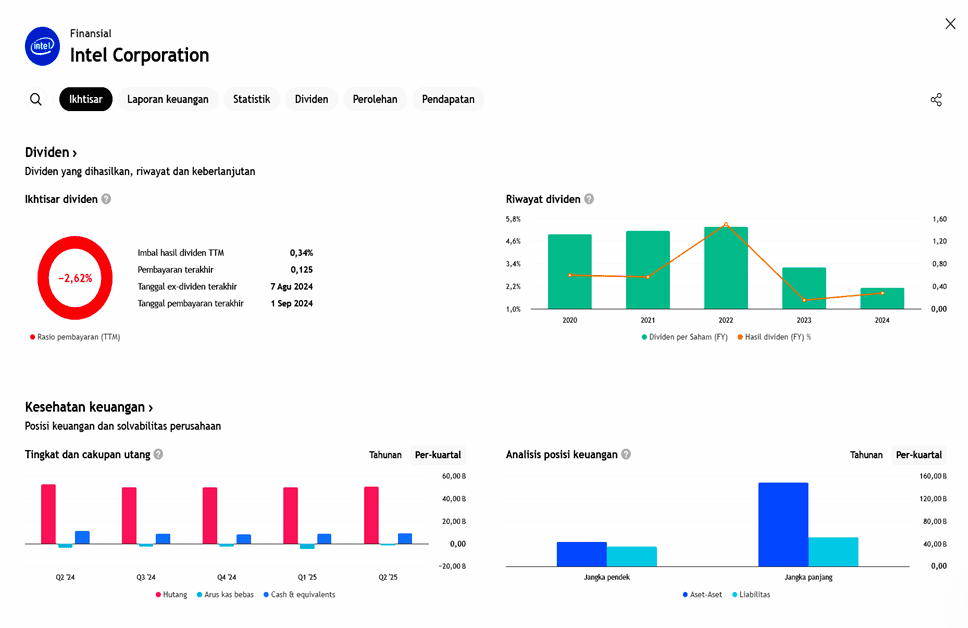

- Intel recently secured significant investments: approximately US$5 billion from NVIDIA, US$2 billion from SoftBank Group, and a ~10% equity stake from the U.S. government — providing renewed confidence in Intel’s foundry capabilities.

- PC demand is showing signs of recovery, with Gartner reporting global PC shipments up about 8% during the quarter.

- The launch of Intel’s new 18A node processors serves as a potential catalyst for both the PC and foundry segments.

3. Key Challenges and Risks

- Despite encouraging signals, Intel continues to face major competitive pressure in both PC and server CPU markets from Advanced Micro Devices (AMD) and the growing adoption of ARM-based architectures, which could threaten Intel’s x86 business model.

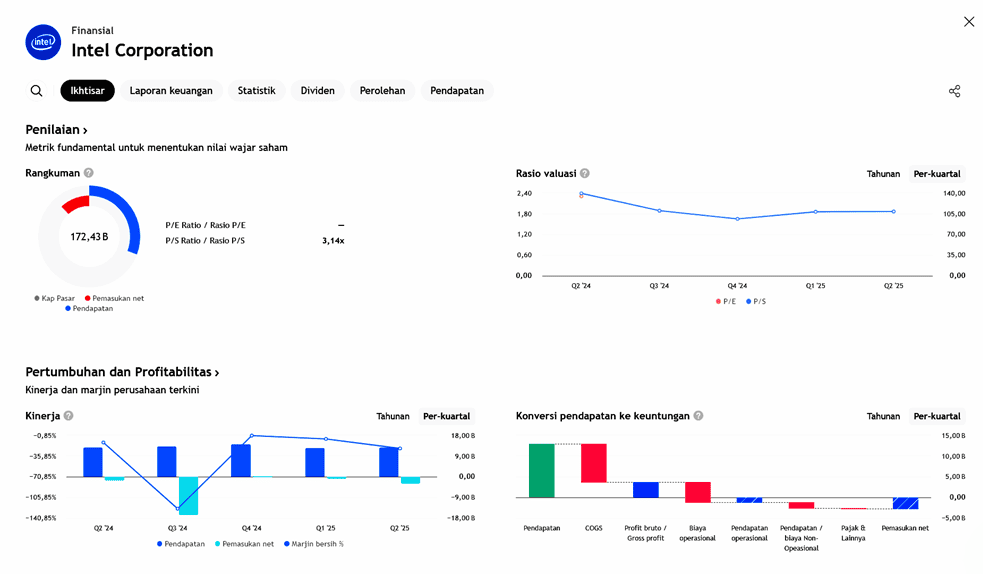

- Many analysts question whether the ~80% stock rally this year is sustainable, as expectations may already be priced in.

- Share dilution remains a concern: large-scale investments and new share issuances (including the government stake) could reduce future EPS.

- The foundry unit must still prove its ability to attract large, external third-party clients to achieve meaningful scale — failure to do so could result in stagnant revenue growth.

4. Implications for Investors

- Given the current setup — elevated expectations but unproven turnaround performance — Intel’s stock presents a sharp risk-reward profile: high upside potential if results surprise to the upside, but equally high downside risk if they disappoint.

- Risk-tolerant investors who believe in Intel’s transformation story — particularly in foundry operations and next-generation processors — may view this as an opportunity.

- Meanwhile, conservative investors focused on stability and earnings visibility may prefer to stay cautious.

- Key focus areas during the earnings release will include:

- Whether Intel’s large-scale investments are beginning to yield measurable results;

- Signs of margin recovery;

- Updates on the PC, server, and foundry business dynamics.

- External factors such as the global PC replacement cycle, competitive landscape, and macroeconomic conditions will also play a crucial role. For example, while PC demand may rise due to Windows refreshes, there’s a risk that this demand is “front-loaded,” potentially leading to weaker sales in subsequent quarters.

Earning Projection Prediction

WHAT THE ANALYST SAYS

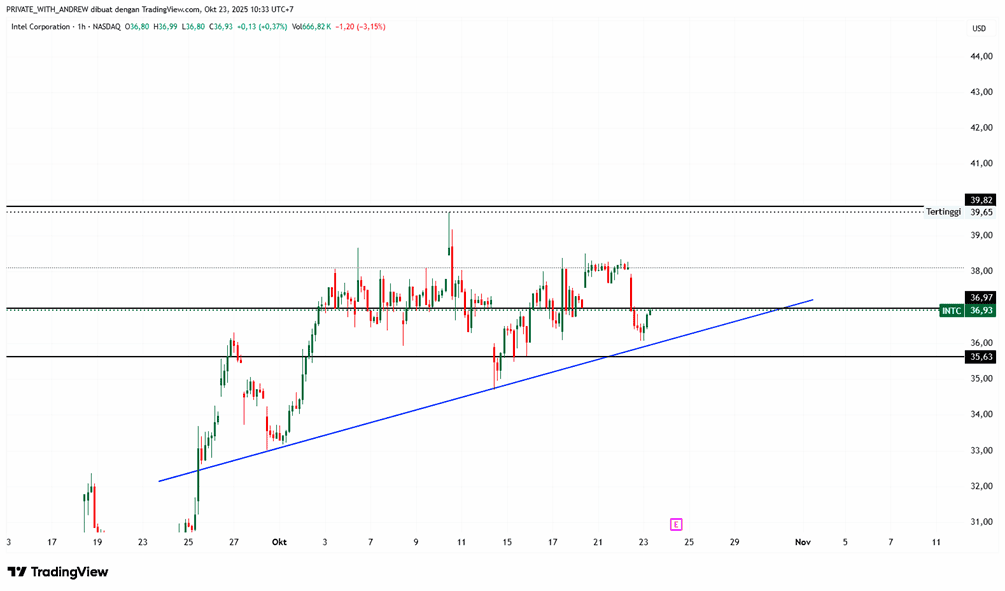

Short – Medium Term Projection

STRATEGY

| Sell INTEL | |

| Entry | 36.92 |

| Take Profit | 39.89 |

| Stoploss | 35.63 |

Disclaimer On