Is a New Record on the Horizon?

Gold price movement (XAUUSD) last Friday once again captured global market attention. The precious metal held steady around $3,760 – $3,770 per troy ounce, despite stronger U.S. economic data that briefly weighed on expectations of a Federal Reserve rate cut. Interestingly, the new U.S. import tariff sentiment provided additional support for gold as a safe-haven asset.

Fundamental Review

- U.S. Economic Data: The release of core PCE inflation data came in line with expectations, allowing the market to continue anticipating potential monetary easing later this year.

- Import Tariffs: The new tariff policy announced by Washington heightened concerns over global trade. Such conditions often fuel higher demand for gold.

- U.S. Dollar: The U.S. Dollar Index (DXY) briefly strengthened but failed to significantly pressure gold. This shows that investors continue to favor gold as a safe alternative.

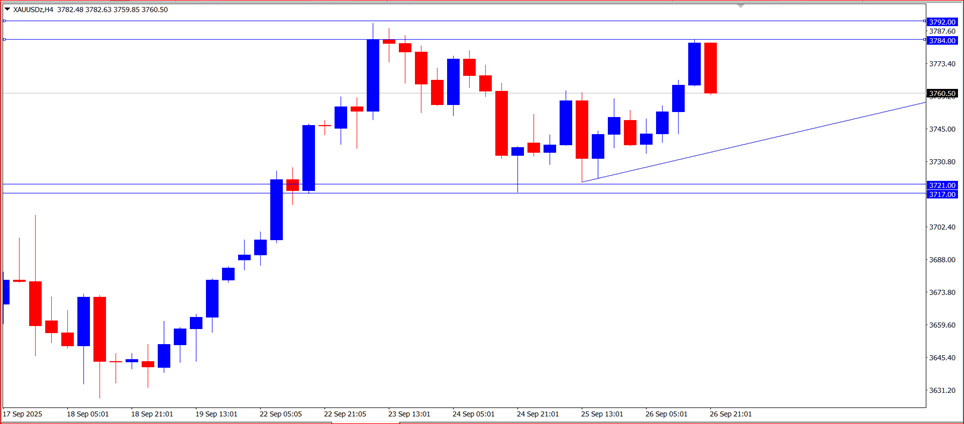

Technical Analysis Review

Technically, XAUUSD remains in a medium-term uptrend. Prices managed to stay above the $3,721/3717 support area, with the nearest resistance at $3,784/3792 and the psychological level of $3,800 as the next key target.

- Key Support: $3,717 – $3,700

- Key Resistance: $3,784 – $3,800

As long as prices hold above $3,700, the technical bias remains bullish.

Outlook

Bullish Scenario:

If global uncertainty rises and the dollar weakens further, XAUUSD has the potential to break above $3,800. The next targets could move toward $3,850 and even $3,900. This scenario offers significant profit opportunities for traders who entered early near support levels.

Bearish Scenario:

If upcoming U.S. economic data proves very strong, gold may correct below $3,720 with a potential retest toward $3,670. This risk should be carefully monitored, particularly for traders entering long positions at higher levels.

Conclusion

Gold (XAUUSD) is currently at an interesting crossroads: fundamentals support its safe-haven appeal, while technicals still leave room for further gains. With the combination of U.S. data, Fed policy direction, and tariff sentiment, investors need to carefully read the momentum.

For traders, the key levels are $3,720 as the safe support threshold and $3,800 as the psychological resistance. Anyone who can capture the momentum between these two levels has the potential to seize big opportunities—provided they apply disciplined risk management.