Market Expectations for Exxon Mobil’s Financial Report

Exxon Mobil (XOM) is set to release its financial report before the market opens this Friday. Investors are eagerly anticipating this release, as it is deemed crucial in assessing the company’s performance amid the current economic conditions.

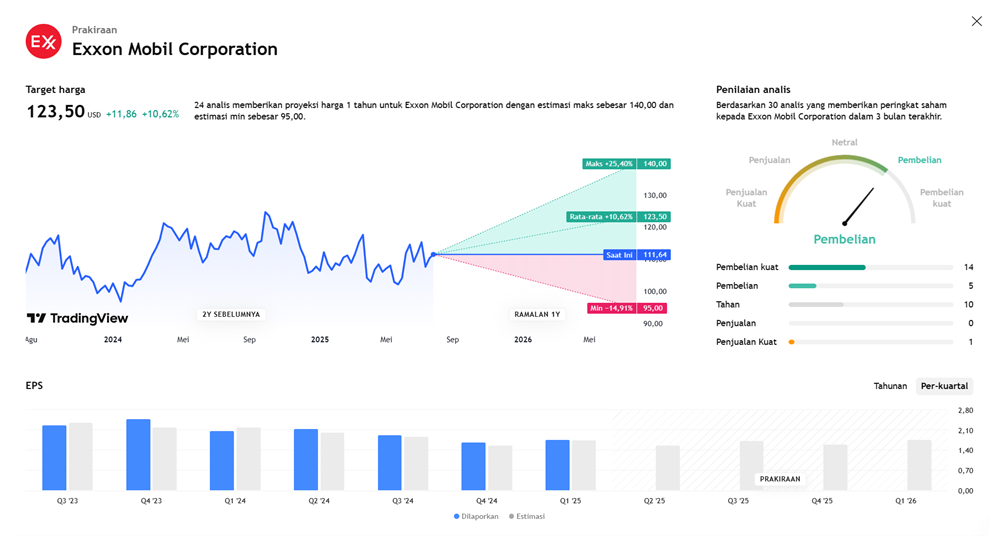

Stock Price Projection

Wall Street analysts have set a one-year target price for Exxon Mobil stock at an average of $123.82, reflecting a potential upside of approximately 10.91% from the current price of $111.64. The target range spans from $95 to $140, indicating a significant divergence in opinions regarding the stock’s prospects.

Broker Recommendations

Out of 26 brokerage firms, the average recommendation stands at 2.2, indicating an “Outperform” status. On a rating scale from 1 to 5 (1 = Strong Buy, 5 = Sell), this suggests that most analysts remain reasonably optimistic about XOM’s stock.

FINANCIAL PERFORMANCE PROJECTIONS

Exxon Mobil Q2 2025 Earnings Expectations

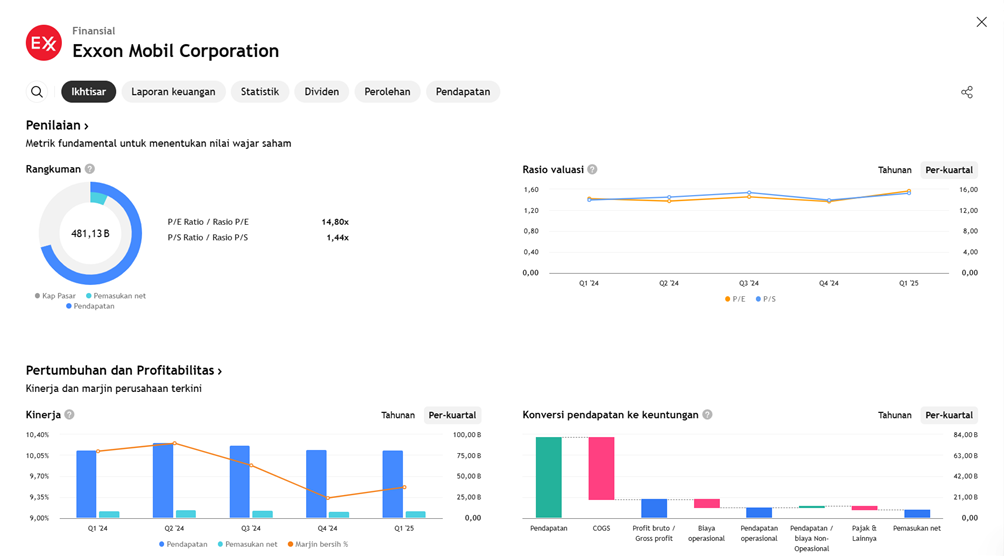

Revenue & Net Income:

- EPS is projected at $1.49, reflecting a 30.4% year-over-year (YoY) decline.

- Revenue is expected to reach $82.82 billion, down 11% YoY.

EPS Estimate Revisions:

Over the past 30 days, the EPS estimate has been revised up by 10.7%, indicating growing analyst optimism regarding this quarter’s performance.

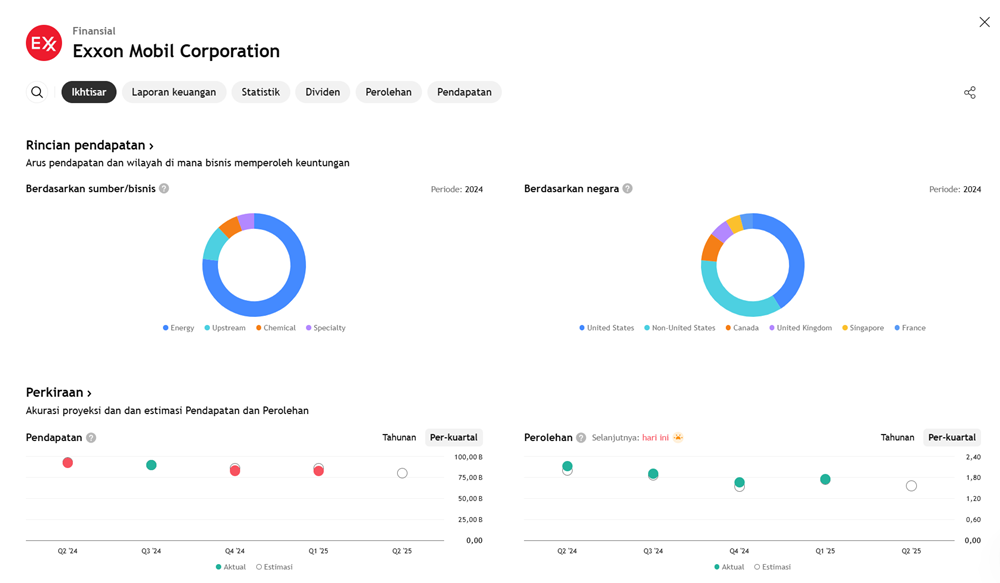

Revenue Projections by Segment

| Segment | Estimated Revenue | YoY Change |

|---|---|---|

| Revenues – Other Income | $618.89 million | -53.50% |

| Sales & Other Operating Revenue | $80.11 billion | -11% |

| Income from Equity Affiliates | $1.56 billion | -10.40% |

| Energy Products (Total) | $61.18 billion | -11.90% |

| Energy Products – U.S. | $24.24 billion | -8.20% |

| Energy Products – Non-U.S. | $36.94 billion | -14.10% |

| Chemical Products – U.S. | $1.97 billion | -11.20% |

Despite expectations of year-over-year declines in profit and revenue, recent increases in oil production and upward EPS revisions reflect some hope for short-term stability. However, price pressures and downturns in the gas and chemical product segments remain areas of concern for investors. Market reactions are likely to hinge on how closely the actual results align with or exceed these revised expectations.

EARNING PROJECTION PREDICTION

WHAT THE ANALYST STATED