Meta Platforms is expected to report its second-quarter results after market close on Wednesday, July 30, 2025. Traders are anticipating high volatility in META stock, as option pricing indicates a potential movement of more than ±5% from its current price of around US$708.

This suggests a potential rise to over US$746—surpassing its previous record close of US$738.09—or a drop to around US$670.

Historically, Meta stock tends to move about 4% the day after an earnings report, as seen after the previous quarter’s results, which exceeded expectations and underscored significant investment in artificial intelligence (AI).

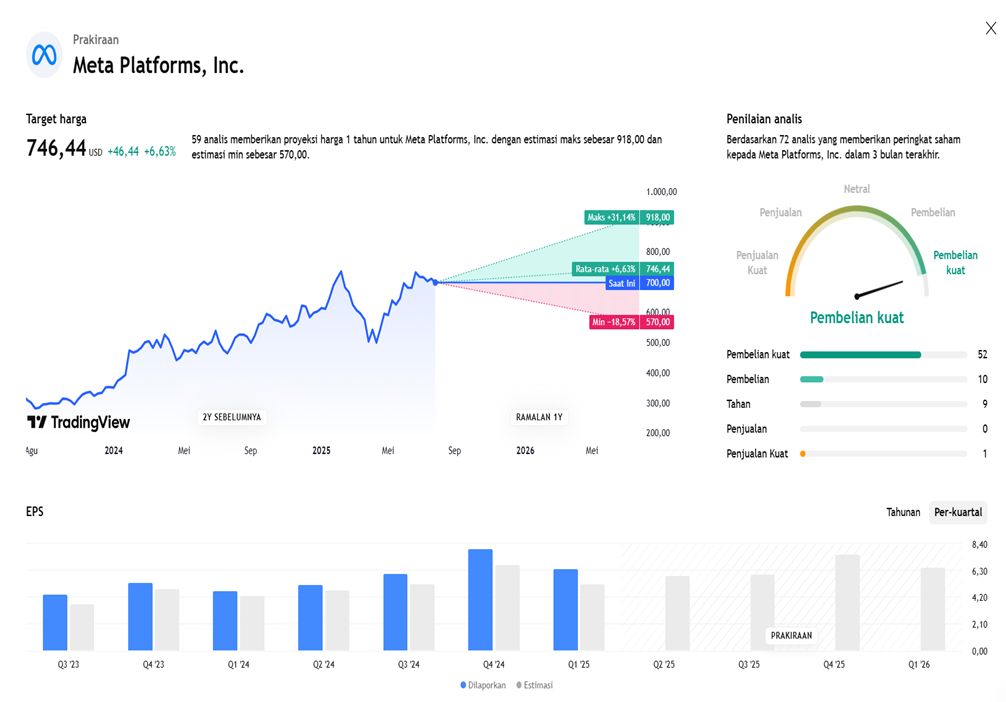

Most analysts remain optimistic about Meta, with 25 out of 27 analysts maintaining a “buy” recommendation, and an average price target of around US$754.96—an all-time high. The upcoming report is expected to show growth in revenue and profit as Meta continues to make large-scale investments in AI. A key focus for investors will be whether there is concrete evidence of returns from those AI investments.

Q3 2025 FINANCIAL PERFORMANCE PROJECTIONS

Key Highlights

Meta Platforms is scheduled to release its Q2 2025 financial report after the market closes on Wednesday, July 30, 2025 ET (likely early Thursday morning Jakarta time).

Analysts expect Q2 revenue to reach between US$44.8–44.9 billion (growth of ±14–15% YoY) with EPS around US$5.84–5.89.

Common forecasts cite revenue of approximately US$44.55 billion (+14% YoY) and EPS of US$5.84–5.86.

Key Focus: AI Investment & Capital Expenditure

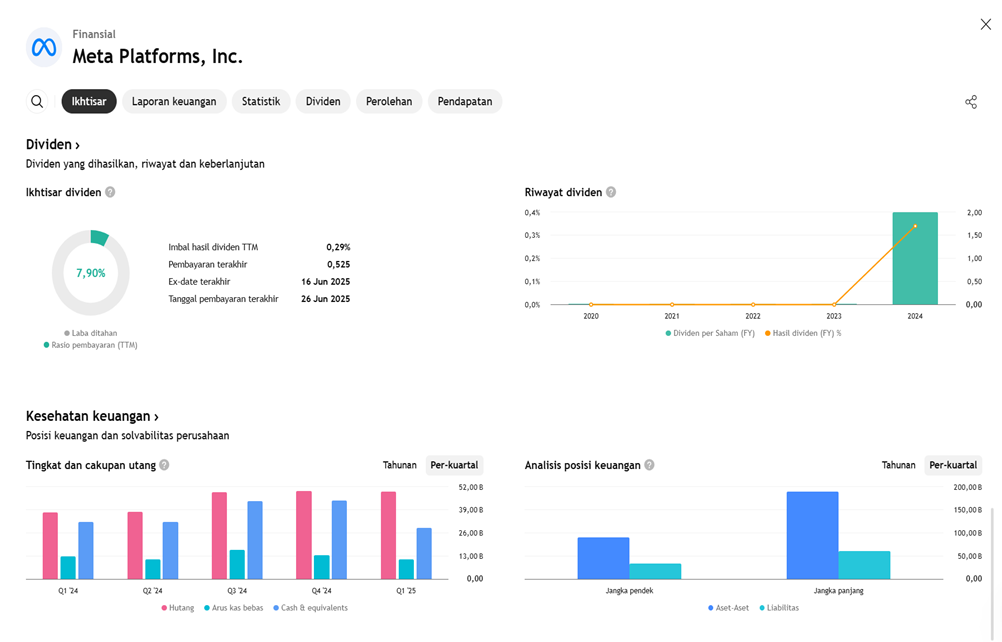

Meta is aggressively expanding its AI investments, with projected CapEx for 2025 between US$64–72 billion, potentially rising to over US$76 billion by 2026.

Major initiatives include a US$14.3 billion investment for a 49% stake in Scale AI and the formation of a new “Superintelligence Lab,” hiring top AI talent with extremely high compensation offers (up to or exceeding US$100 million).

Q2 2025 Performance: Trends & Challenges

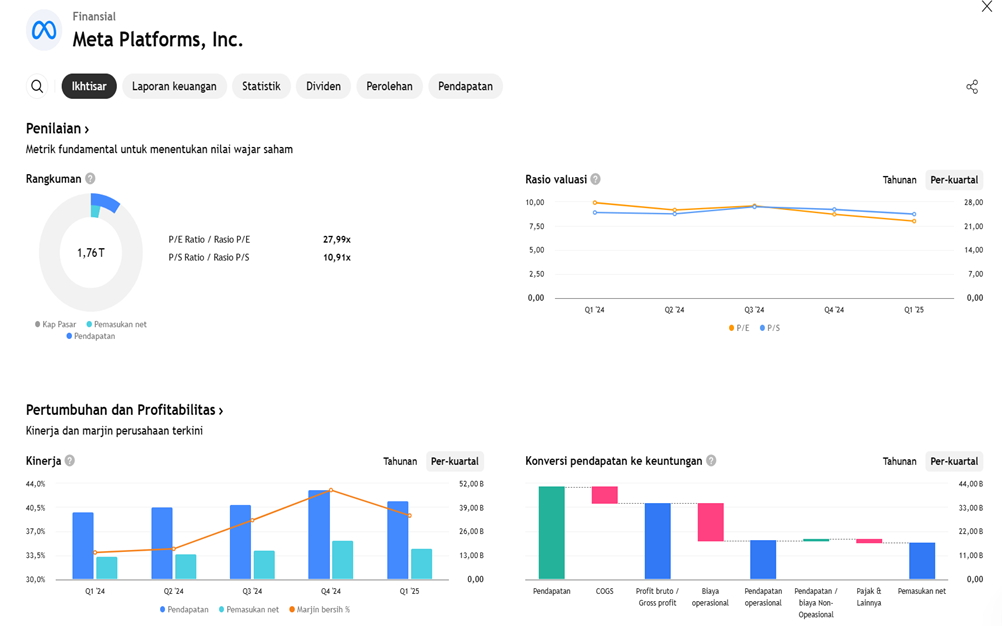

Analysts expect YoY revenue growth of around 14–15%, with net income around US$15.0 billion (EPS US$5.88–5.89), although this marks the slowest earnings growth in the past two years.

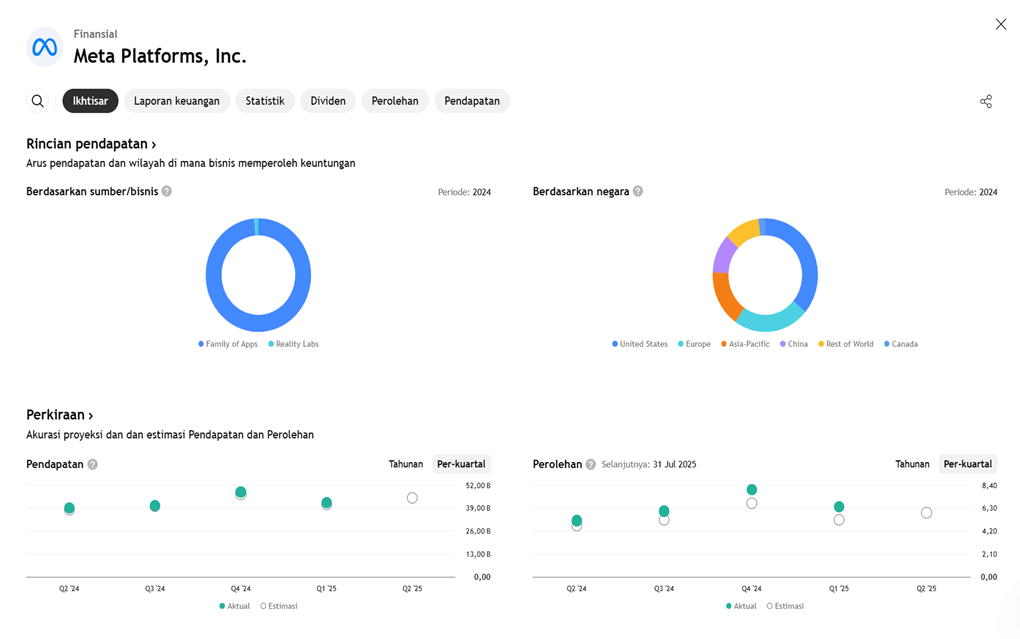

AI is beginning to impact growth: tools like Advantage+ Shopping increased Reels conversion by 5%, engagement rose 7% on Facebook, and up to 35% on Threads. Reels engagement also rose 24% due to AI-driven personalization.

Reality Labs (metaverse/VR/AR division) continues to be a drag, with expected losses of US$5–5.4 billion this quarter, up from ~US$4.5 billion previously.

Analyst Sentiment & Risks

Analyst sentiment remains largely positive: 25 of 27 analysts rate the stock as “Buy” or “Strong Buy,” with average price targets between US$755–783, and some estimates reaching US$800.

While Meta shares have risen over 20–30% in 2025, ±5% volatility post-earnings is considered normal.

However, several concerns have emerged:

- Will such large AI investments yield clear short-term ROI?

- WhatsApp monetization remains low (only US$1–2 billion from 3 billion users), though its messaging business potential—especially with AI—could reach US$30–40 billion.

- Regulatory pressures and competition from players like TikTok, along with trade tariff impacts in Asia-Pacific.

What Investors Are Watching in the Q2 Report

- Concrete data on AI’s contribution to revenue (e.g., improvements in ad monetization and operational efficiency).

- Clarification on advertising business margins and whether CapEx burdens are sustainable.

- Plans for cost restructuring in Reality Labs if losses remain high.

- Updates on WhatsApp monetization and progress on the Superintelligence unit.

- The company’s outlook for Q3 and upcoming CapEx installments.

EARNING PROJECTION PREDICTION

WHAT THE ANALYST STATED