Tesla (NASDAQ: TSLA) shares are in the spotlight ahead of its Q2 earnings report, scheduled for release on Wednesday evening, July 23. Beyond financial performance, investors are also eagerly awaiting updates on Tesla’s latest innovations, such as the humanoid robot Optimus, advancements in robotics, and potential investments in Elon Musk’s AI company, xAI.

Despite ongoing concerns about declining sales, the loss of EV tax credits, and Elon Musk’s controversial reputation, Wedbush analyst Daniel Ives remains more optimistic compared to Q1. According to him, Musk now acts as a “wartime CEO” focusing on the expansion of Robotaxi services in Austin and other cities.

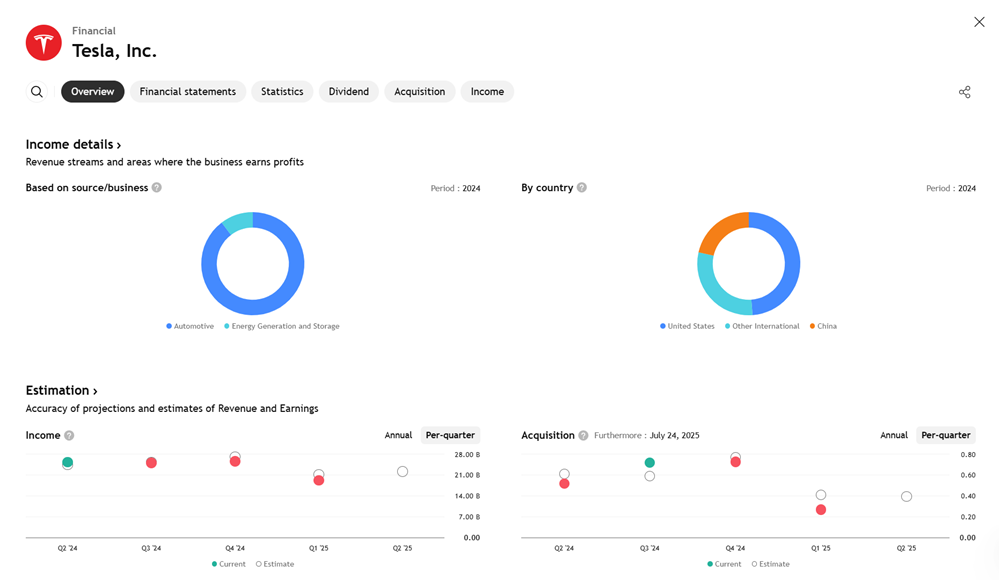

Ives views Tesla not merely as an automotive company, but as an AI-driven platform with potential to add up to $1 trillion in value. He also notes a recovery in Chinese sales — increasing for the first time in eight months in June — fueled by strong demand for the refreshed Model Y.

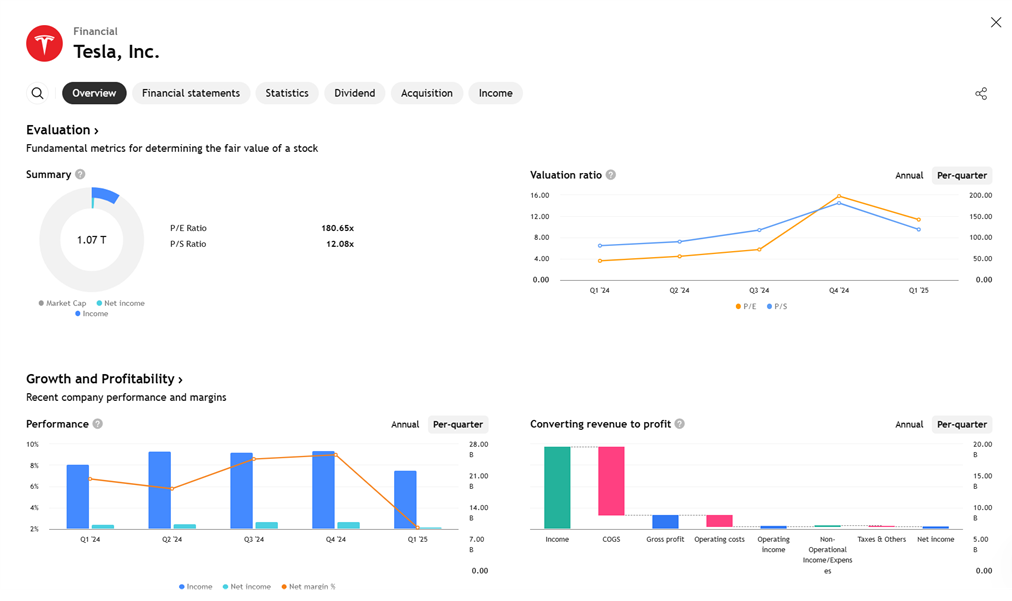

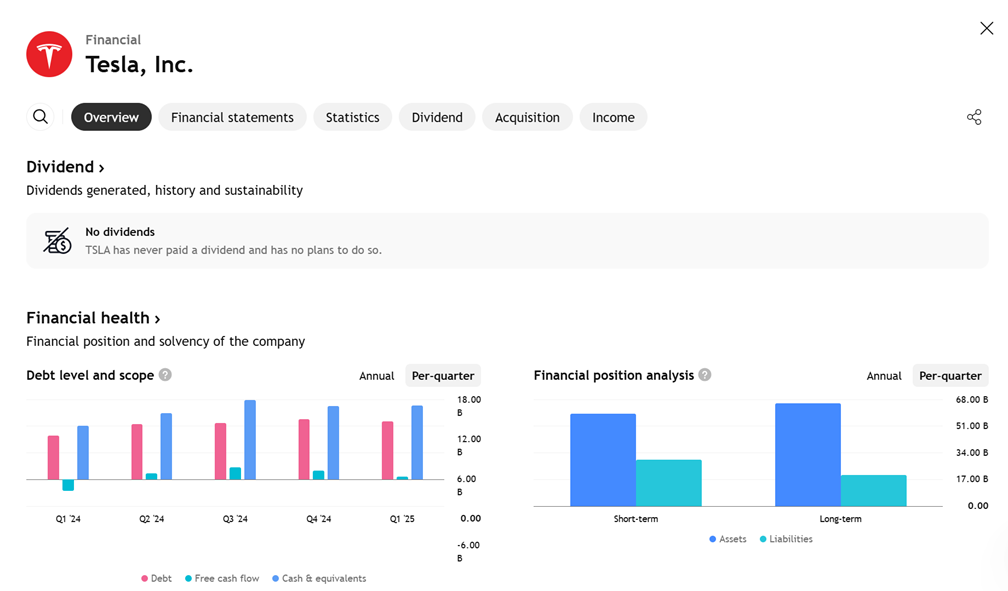

In terms of numbers, market consensus projects revenue of $22 billion, with $16 billion expected from automotive. Gross margins are forecast at around 13–14%, and earnings per share (EPS) are estimated at $0.39. However, the loss of EV tax credits is expected to weigh on Tesla’s future free cash flow.

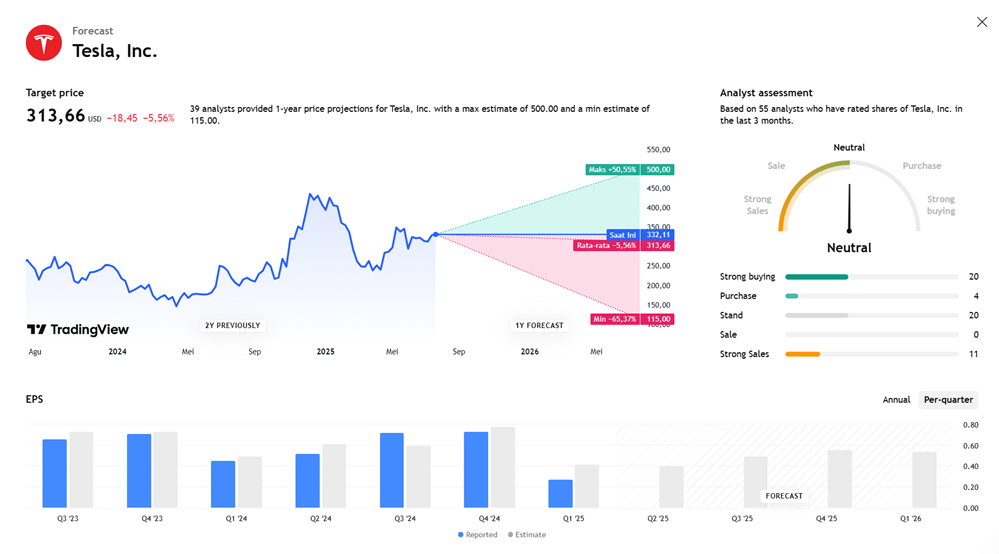

Ives maintains an “Outperform” rating, with a Street-high price target of $500 — implying nearly 50% upside. Still, the overall analyst consensus remains neutral, with a “Hold” rating, an average price target of $299.52, and a projected 10% downside in the next 12 months.

Shift in Focus from Numbers to AI and Robotaxi Ambitions

- Q2 Financial Expectations:

- Tesla is set to report Q2 earnings on Wednesday, July 23, after market close.

- Analysts expect a 25% decline in EPS to $0.39 and a 13% drop in revenue to $22.19 billion.

- The decrease stems from a global vehicle sales decline of more than 13% in Q2.

- Some forecasts (e.g., Sharp consensus) project revenue below $22 billion.

- Price Target Revisions and Headwinds:

- Bank of America raised its TSLA target from $305 to $341, while still cautioning about delivery declines and tariff pressure.

- Piper Sandler warns that tax credit cuts by the Trump administration will significantly impact Tesla’s free cash flow, which had previously been supported by $3.5 billion in regulatory credits.

- Tesla is expected to receive $3 billion in credits in 2025, declining to $2.3 billion in 2026.

- Investor Focus: AI, Robotaxi, and Affordable EVs

- Regardless of earnings, investor attention will likely focus on:

- Launch of limited Robotaxi services in Austin, Texas.

- Tesla’s long-awaited affordable EV project.

- Potential investment in Elon Musk’s AI company, xAI.

- Regardless of earnings, investor attention will likely focus on:

- Analyst Commentary and Outlook:

- Wedbush’s Dan Ives describes this setup as “dramatically different” from Q1, with key focus areas including:

- Global sales rebound, especially in China driven by the refreshed Model Y.

- Medium-term risks from reduced tax incentives.

- Cantor Fitzgerald expects downward revisions in Tesla’s automotive and energy business outlook due to tariff impacts.

- Wedbush’s Dan Ives describes this setup as “dramatically different” from Q1, with key focus areas including:

- Stock Performance:

- TSLA rose 1.7% to $333.90 on Tuesday and briefly hit $338 on Monday.

- Shares gained 5.15% last week, breaking above the 50-day moving average.

- Since the Robotaxi launch on June 22, the stock is down 3% and remains 32% below its all-time high of $488.54.

- Average price target: $313.66; Consensus rating: Hold.

Conclusion:

Tesla’s Q2 report is likely to reflect pressures from declining sales and diminishing incentives, but investors are increasingly focused on long-term prospects in AI, Robotaxi development, and affordable EV models. Elon Musk is expected to play a key role in sustaining optimism during the upcoming earnings call.

Earning Projection Prediction

WHAT THE ANALYST STATED