Netflix is ready to release its earnings report, stock has the potential to shift sharply

Netflix (NFLX) will release its second quarter 2025 earnings report on Thursday evening US time, and the market is bracing for significant share price movements. Based on the latest options prices, Netflix stock could move about 6% or $70 on Friday – up to $1,320 or down to $1,180, the lowest level since May.

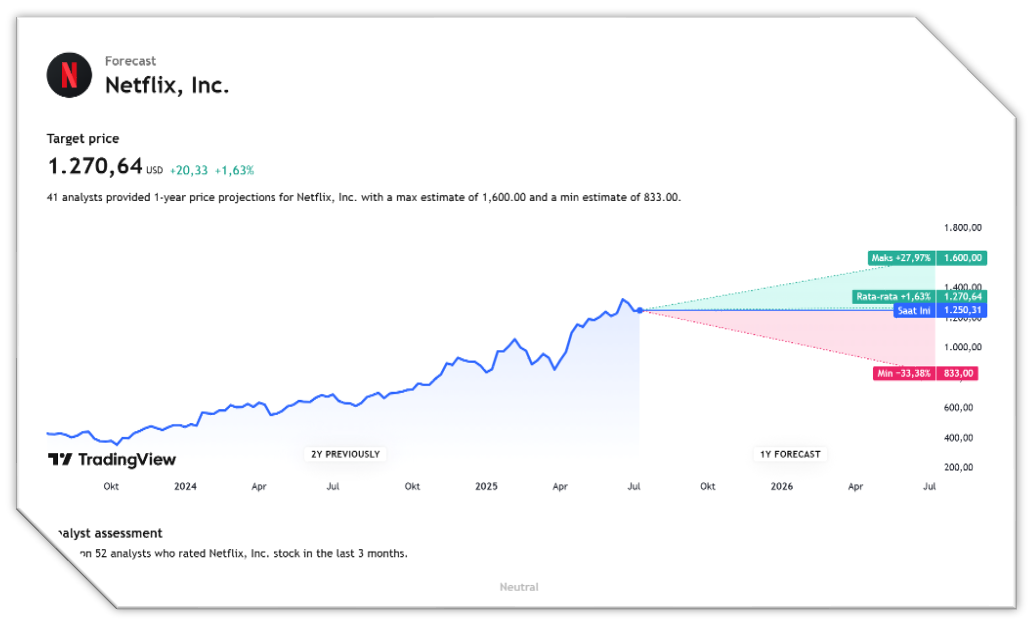

Currently, NFLX shares are at $1,250.31, after falling 1% on Wednesday. However, on a year-to-date basis, the stock has rallied more than 40%, signaling investor optimism about the company’s long-term prospects.

In the past four quarters, Netflix has averaged a 6% post-earnings move, with three gains. In its previous report in April, the stock rose 1% after revenue and profit beat expectations, supported by subscription and advertising growth.

The majority of analysts remain bullish, with 13 out of 17 analysts giving it a “Buy” rating, and the average price target coming in at $1,330 – about 6% above the current price.

Key support comes from flagship content like Squid Game 3, global ad expansion, and platform technology improvements. This combination makes Netflix one of the most powerful players in the streaming industry, despite being under intense competitive pressure from Disney, Amazon, and Apple.

Netflix Q2 2025 Performance and Outlook Summary

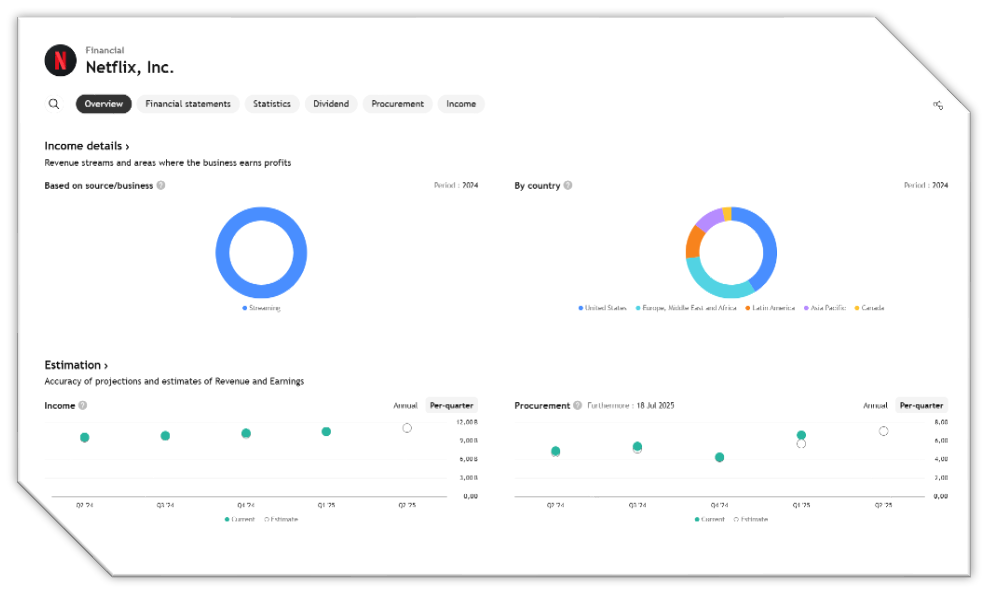

Revenue and Profit Projections:

- Netflix projects second-quarter 2025 revenue to rise 15.4% YoY to $11.035 billion (or +17% without exchange rate effects).

- The consensus estimate is slightly higher at $11.05 billion, indicating 15.63% YoY growth.

- Earnings per share is projected at $7.03, while the Zacks consensus stands at $7.06, slightly higher (+0.1% in the last 30 days).

Positive Surprise Potential:

- Netflix has a positive Earnings ESP of +1.68% and a Zacks Rank #2 (Buy), increasing the likelihood of exceeding market expectations.

- NFLX has a history of 4 consecutive quarters of beating earnings estimates, with an average surprise of 6.94%.

Performance Drivers:

- trong Q1 performance with revenue growing 13% and operating profit up 27%.

- Q2 featured content such as:

- Squid Game Season 3 (June 27 release)

- Top movies such as Havoc (Tom Hardy), Straw (Taraji P. Henson), Nonnas (Vince Vaughn), and The Four Seasons (Tina Fey & Steve Carell)

- Technological innovation: AI-based search feature, new recommendation system, and new homepage design increased user engagement and retention.

- Ad business expansion through Netflix Ads Suite has covered all 12 ad-supported countries, driving a projected doubling of ad revenue by 2025.

- Long-term investments such as the development of a $1 billion production center in Fort Monmouth.

Regional Growth:

- Asia-Pacific: $1.31 billion (+25.1% YoY)

- Latin America: $1.36 billion (+13%)

- EMEA: $3.46 billion (+15.3%)

- UCAN: $4.91 billion (+14.4%)

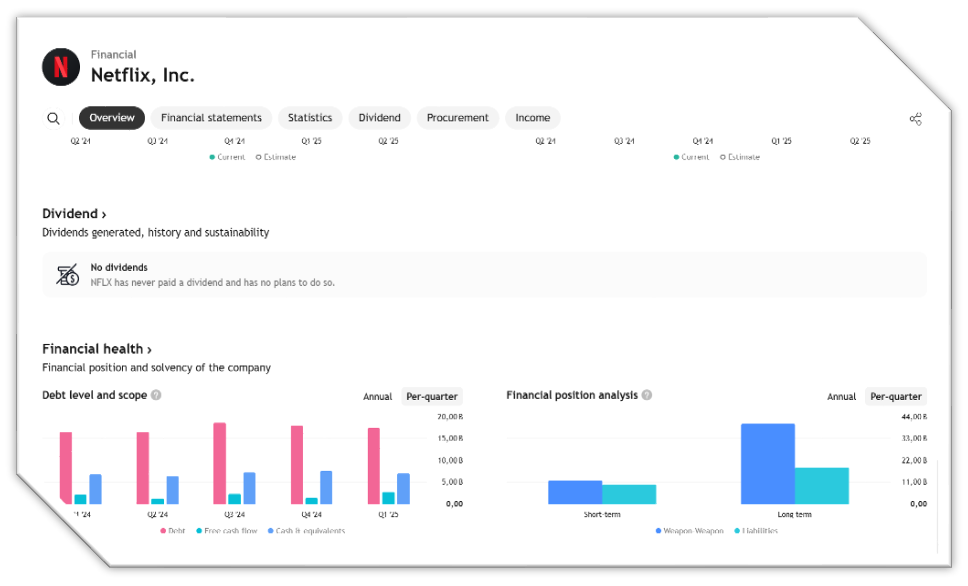

Stock Valuation & Performance:

- NFLX stock is up 41.1% YTD, outperforming Amazon (+10.2%), Disney (+7.7%), and Apple (-15.8%).

- The current valuation at 44.38x forward earnings, higher than the five-year (33.79x) and industry (31.1x) averages, suggests a relatively premium stock price.

Conclusion:

Netflix is strongly positioned to deliver solid performance in Q2 2025. With a combination of premium content, technological innovation, advertising growth, and global ramp-up, the company is showing solid growth momentum. Despite the high valuation, the medium-to-long term outlook remains attractive for investors seeking growth in the streaming sector.

Earning Projection Prediction

WHAT THE ANALYST STATED