Release Date: Tuesday, July 15, 2025

Wells Fargo (NYSE: WFC) is set to release its second-quarter earnings report on July 15, marking a significant moment as this will be the first report since the Federal Reserve lifted the long-standing asset cap of $1.95 trillion on the bank. While this removal represents a positive development for Wells Fargo’s long-term prospects, its immediate impact on this quarter’s performance is expected to be limited. Expansion in lending, third-party fund accumulation, and other asset management activities generally take time to scale meaningfully.

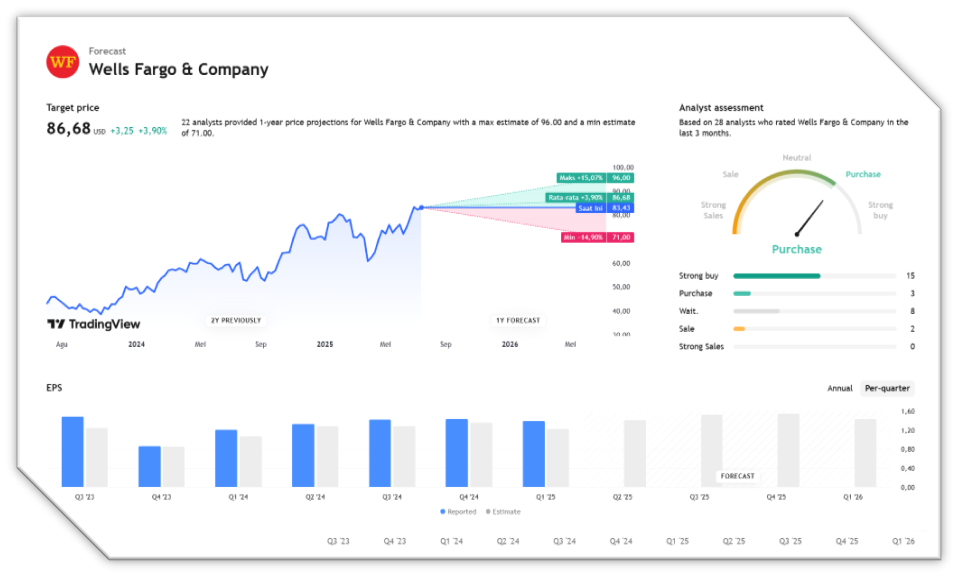

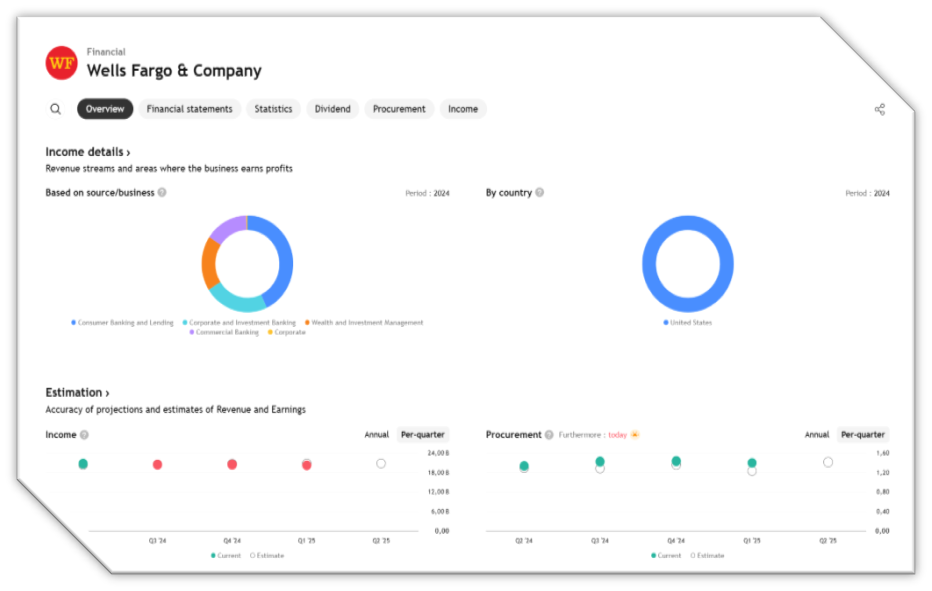

For the quarter, earnings per share (EPS) are projected to be around $1.40, slightly higher than the $1.33 recorded during the same period last year. Meanwhile, revenue is expected to remain flat at approximately $20.76 billion, pressured by slower loan growth and subdued investment and corporate banking activity amid continued economic uncertainty due to trade policy tensions.

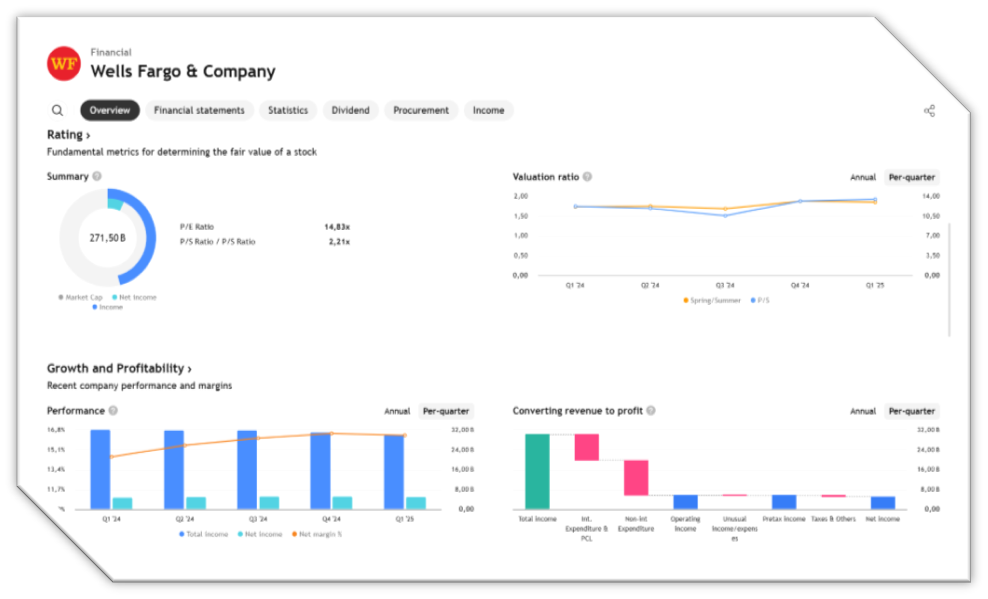

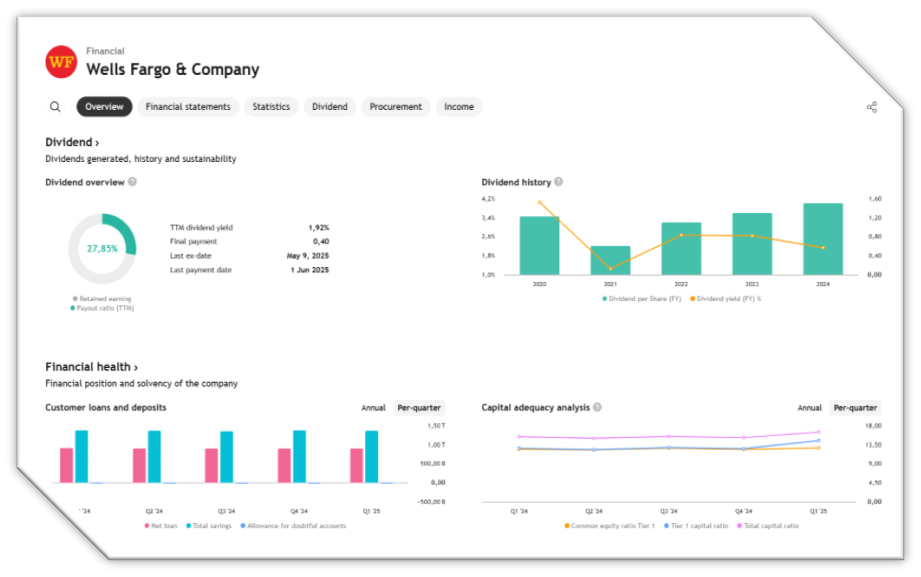

Fundamentally, Wells Fargo has a market capitalization of $271 billion, trailing 12-month revenue of $82 billion, and net income of roughly $20 billion. For investors seeking growth opportunities with less volatility than individual stocks, Trefis’ “High Quality” portfolio has been noted as an appealing alternative, having outperformed the S&P 500 with a cumulative return of over 91% since launch.

Q2 2025 Outlook: Cautious Optimism

Analyst consensus forecasts:

- Q2 EPS: $1.41 → up 6% year-over-year

- Revenue: $20.73 billion → slight increase of 0.2% YoY

Over the past 30 days, EPS estimates have been revised upward by 0.53%, reflecting growing analyst confidence in the company’s short-term outlook. This optimism may be driven by expectations of improvement in specific business segments and the impact of the company’s latest strategic initiatives.

Positive Catalyst: Fed Lifts Asset Cap

A major recent development is the Federal Reserve’s removal of Wells Fargo’s $1.95 trillion asset cap in June 2025. This cap, in place since 2018 following the fake accounts scandal, has significantly hindered Wells Fargo’s expansion.

Implications of the asset cap removal include:

- Room for asset and lending growth

- Enhanced strategic flexibility

- Potential for increased future earnings and revenue

Lingering Challenges

Despite the promising medium-term outlook, certain risks and challenges remain:

- The average analyst price target is $82.72, slightly below the current market price of $83.43, indicating that the stock may already reflect much of the good news — or is trading at a “priced-to-perfection” valuation.

- Competition in the financial services sector is intensifying, both from traditional banks and fintech players. This requires Wells Fargo to continuously innovate in digital services and technology to maintain competitiveness.

Investor Focus for Q2 Report

Investors will be closely watching key metrics in the upcoming Q2 report:

- Net Interest Margin (NIM) – a key indicator of loan profitability

- Loan growth and asset expansion

- Cost management / operational efficiency

- Updates on long-term strategy and digital expansion

- Management’s outlook following the asset cap removal

Wells Fargo is scheduled to hold its earnings call on July 15 at 10:00 AM ET, during which management is expected to provide more detailed explanations of performance and future plans.

EARNING PROJECTION PREDICTION

WHAT THE ANALYST STATED