“The Last Chance to Buy at Low Prices May Be Approaching”

The upcoming Federal Reserve (FOMC) policy decision, set to be released in the early hours of Thursday this week, represents a critical turning point for gold prices. Amid the uncertainty surrounding interest rate direction, market participants are bracing for a surge in volatility—and this is where major opportunities arise.

Gold, as a safe-haven asset, has historically responded sharply to shifts in the direction and tone of monetary policy. With market expectations split between a rate cut and a hawkish hold, price reactions can be highly aggressive. For traders who can interpret the signals, this is more than just a typical move—it is a strategic moment with high return potential.

Why is this moment so compelling?

• The Fed’s Tone Will Set the Course

Jerome Powell’s remarks and the latest economic projections could spark immediate market reactions. Gold often becomes the primary refuge during unexpected policy shifts.

• U.S. Economic Data Still Open to Interpretation

With inflation remaining stubbornly high and the labor market showing resilience, the direction of policy remains wide open—expanding the scope for speculation.

• Global Uncertainty Driving Demand

Geopolitical tensions and global macroeconomic risks are further fueling gold demand, strengthening the potential for a price breakout.

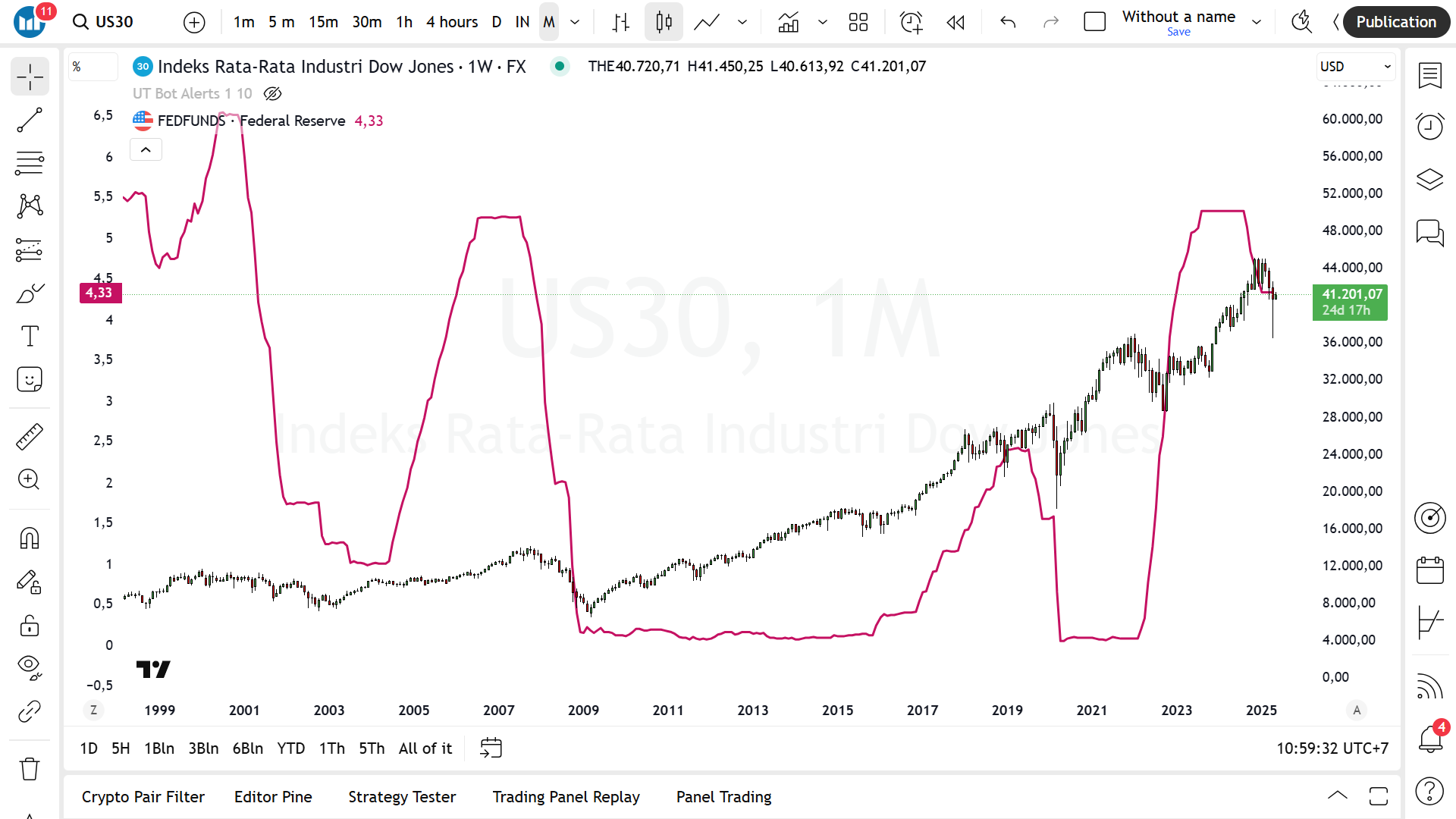

Interest Rates and Their Impact on U.S. Stock Indices: Nasdaq, Dow Jones, and S&P 500

Washington, D.C. – The benchmark interest rate set by the Federal Reserve (The Fed) is one of the most closely monitored tools in monetary policy. Changes in interest rates not only affect borrowing costs and consumer activity, but also significantly impact the stock market—especially major indices like the Nasdaq, Dow Jones Industrial Average (DJIA), and S&P 500.

1. The Role of Interest Rates in the Economy

The Fed uses interest rates to maintain inflation stability and support economic growth. When inflation is high, the Fed typically raises interest rates to dampen demand. Conversely, when the economy slows, interest rate cuts are used to stimulate consumption and investment.

2. The Impact of Rate Hikes on the Stock Market

Interest rate increases generally place downward pressure on the stock market due to several factors:

• Higher Borrowing Costs: Companies face increased financing expenses, which may reduce profit margins.

• Time Value of Money: Higher rates reduce the present value of future earnings, negatively affecting stock valuations.

• Asset Reallocation: Investors often move funds from equities into fixed-income instruments like bonds, which now offer more attractive yields.

The Nasdaq, which is heavily weighted with technology stocks, is particularly sensitive to interest rate changes, as many tech firms rely on long-term growth and external financing. As a result, the Nasdaq tends to experience stronger negative reactions to rate hikes compared to the Dow Jones or S&P 500.

3. The Impact of Rate Cuts

In contrast, interest rate cuts often lead to rallies in the stock market because:

• Increased Liquidity: Lower borrowing costs encourage both consumer spending and business expansion.

• Improved Valuations: Future earnings projections become more valuable when discounted at lower interest rates.

• Greater Risk Appetite: Investors are more inclined to pursue higher yields through riskier assets like stocks.

Technology and growth sectors are typically the biggest beneficiaries, giving the Nasdaq a strong boost. Nevertheless, the Dow Jones—which represents large industrial firms—and the broader S&P 500 also benefit overall.

4. Policy Uncertainty and Volatility

When the Fed announces unpopular policies or delivers ambiguous signals about the future path of interest rates, the market may react negatively due to rising uncertainty. Investor sentiment becomes fragile, and volatility across major indices increases.

4.1 Rate Hikes: 2004–2006

During this period, the Fed gradually raised rates from 1% to 5.25%.

• The Nasdaq dropped by an average of 3–5% with each rate hike announcement.

• The Dow Jones and S&P 500 remained more stable but still experienced short-term pressure.

Investors began reallocating capital from high-risk stocks to safer, fixed-income assets.

4.2 The 2008 Financial Crisis: Drastic Rate Cuts

During the global financial crisis, the Fed aggressively cut interest rates.

• The market did not respond positively at first, as systemic stress was too severe.

• However, after clear policy direction and quantitative easing (QE) programs were introduced, the S&P 500 and Nasdaq began strong rebounds in 2009.

4.3 COVID-19 Pandemic (2020)

The Fed slashed interest rates to near 0% and launched massive asset purchase programs.

• The Nasdaq surged as the technology sector benefited from accelerating digital trends.

• The S&P 500 and Dow Jones recovered more slowly, but showed positive momentum within a few months.

4.4 Aggressive Rate Hikes in 2022

To combat inflation, the Fed raised rates from 0.25% to over 4% in a short period.

• The market saw sharp corrections, especially in the tech sector (the Nasdaq dropped over 30% in one year).

• Volatility rose significantly, and investors began weighing the risk of recession.

5. Conclusion

The stock market’s response to interest rate changes depends largely on market expectations, macroeconomic conditions, and the global context. In general:

• Rate hikes tend to pressure stock indices, particularly growth sectors like technology.

• Rate cuts can trigger market rallies, but only if accompanied by confidence in economic stability.

Investors and analysts must assess the broader policy context—not just the interest rate figures themselves—to make well-informed decisions.