Streaming giant Netflix (NFLX) is scheduled to release its first-quarter earnings report after market close on Thursday, April 17. NFLX shares have performed strongly throughout 2025, avoiding the broader market correction with a gain of more than 10% since the start of the year. Despite facing fierce competition in the streaming industry, Netflix — currently holding a Zacks Rank #3 (Hold) — needs to deliver impressive results to sustain its positive momentum.

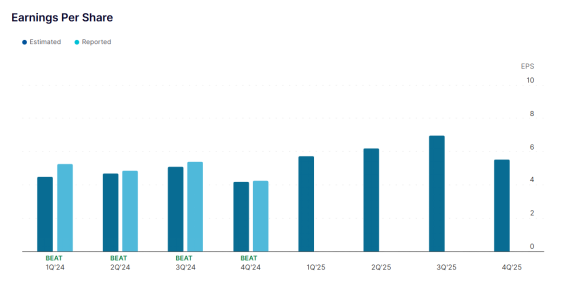

The company is expected to report earnings per share (EPS) of $5.74, marking an 8.7% increase compared to the same quarter last year. Analysts have also slightly raised their EPS estimates ahead of the release.

Netflix has beaten earnings expectations in its last four reports, with an average positive surprise of 7.2%. Expected revenue of $10.54 billion reflects an annual growth rate of 12.5%.

However, Zacks’ proprietary Earnings ESP indicator has not provided a clear signal that Netflix will beat earnings estimates this time. Investors are advised to remain cautious ahead of the upcoming announcement.

Is Netflix Stock Worth Buying Ahead of the Q1 Report?

Netflix, Inc. (NFLX) is set to announce its first-quarter earnings this Thursday, amid ongoing market volatility due to tariff pressures from President Donald Trump. Will this earnings report uplift the market, and is now the right time to buy Netflix shares?

Q1 Earnings Expectations May Boost Netflix Share Price

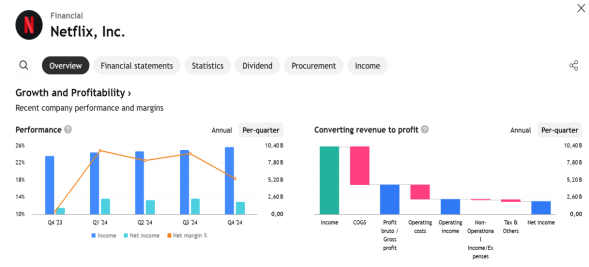

In its upcoming announcement, Netflix is expected to discuss revenue growth, operating margins, and user engagement — but will not disclose the number of new subscribers. Management forecasts revenue growth of 11.2% year-over-year — slightly below its annual projection — due to seasonal impacts on its advertising business. Nevertheless, the company is targeting full-year revenue growth between 12% and 14%, with revenue estimated between $43.5 billion and $44.5 billion, a $500 million increase from previous guidance.

For the full year, Netflix is targeting an operating margin of 29%, up from the prior forecast of 28%. In Q1, the company projects an operating margin of 28.2%, net income of $2.44 billion, and EPS of $5.58. Given its average earnings surprise of 7.2% over the last four quarters, Netflix is likely to meet this profit target — potentially lifting its stock price.

Netflix Aims for $1 Trillion Market Cap

According to The Wall Street Journal, Netflix is aiming to join the $1 trillion market cap club by 2030 — alongside companies like Apple, Microsoft, NVIDIA, and Alphabet. The company plans to double its revenue from $39 billion last year and generate nearly $9 billion from global advertising by 2030. Operating income is projected to triple to $30 billion, and its subscriber base is expected to reach 410 million during the period.

To achieve this goal, Netflix plans to expand into markets such as India and Brazil, with new strategies like low-cost ad-supported subscriptions and live streaming content.

WHAT THE ANALYST STATED