Citigroup Inc (NYSE:C), one of the US-based global financial services giants, is scheduled to release its second quarter 2025 earnings report on Tuesday morning, July 15, before market open. Citi’s stock performance so far this year has shown significant gains, with a rise of 11.1% in the past month, in line with the positive sentiment surrounding the banking sector in general.

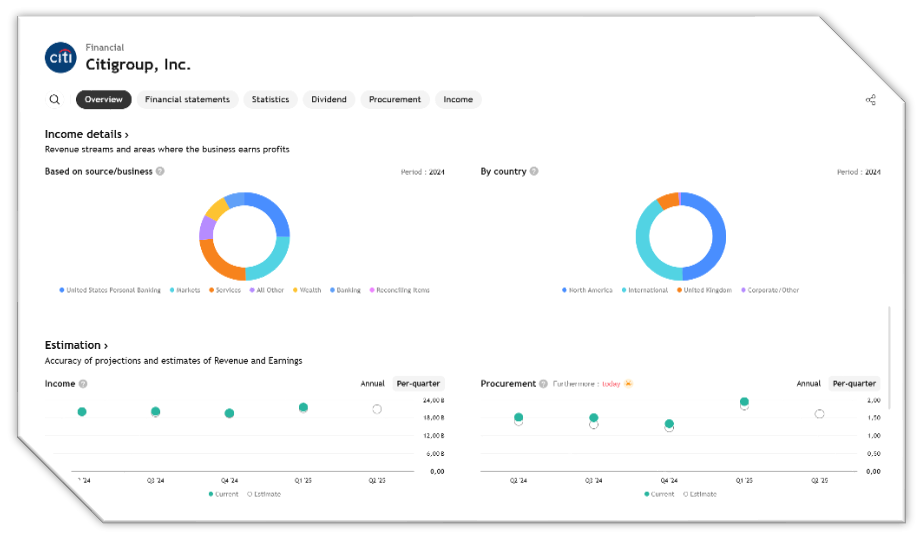

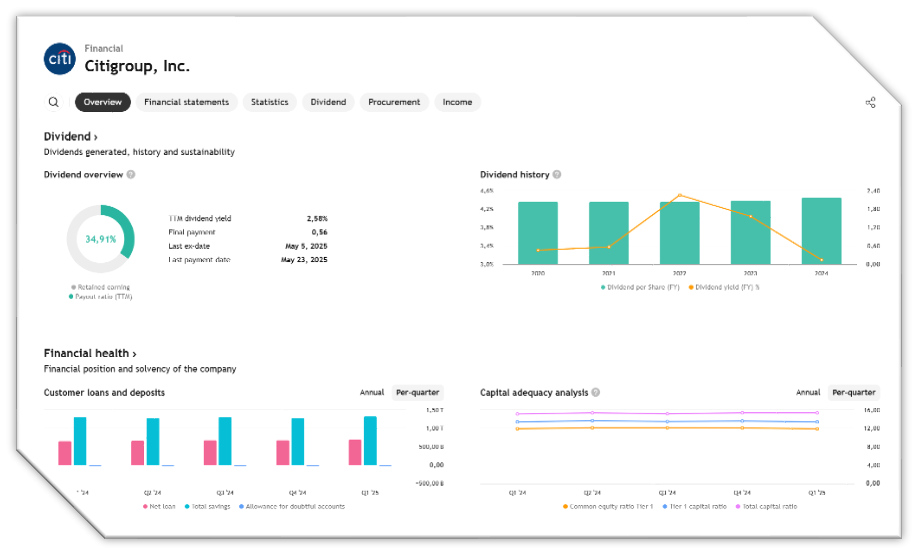

In the previous quarter, Citigroup managed to exceed market expectations. The company recorded revenues of $21.62 billion, growing 2.8% on an annualized basis and outperforming analyst estimates by 2.1%. In addition, Citigroup also recorded strong results in net interest income and tangible book value per share, both of which slightly exceeded estimates.

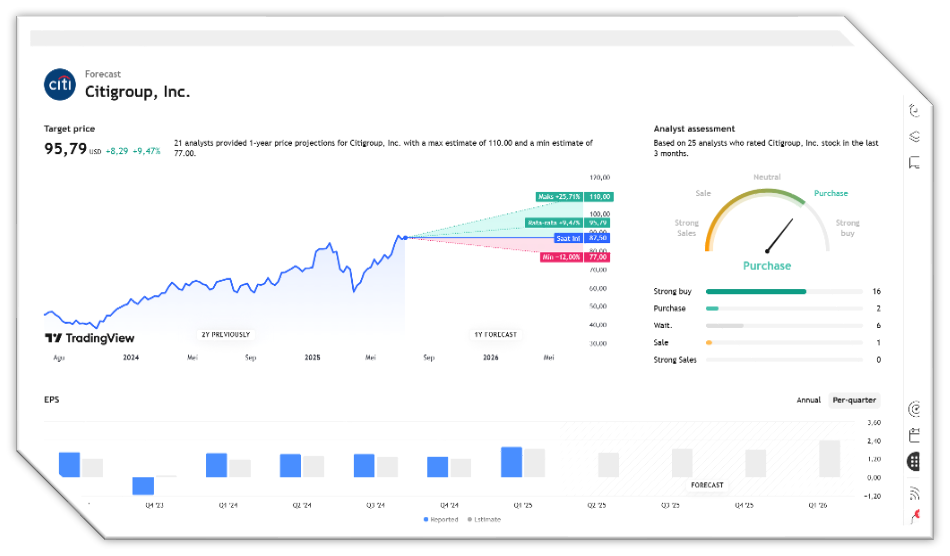

Going into the second quarter, analysts expect Citigroup’s revenue to grow 4.4% on an annualized basis to $20.93 billion. Meanwhile, adjusted earnings per share (EPS) is projected to reach $1.60. Despite the projected growth, analysts’ opinions on the company’s outlook ahead of the report are mixed. Over the past 30 days, there have been four upward and seven downward revisions to the company’s earnings estimates.

Citigroup became the first major bank to report quarterly results this earnings season, making the results an early benchmark for investors to assess the future direction of the banking sector. With a current share price of $86.70 and an average analyst price target of $94.40, investors will be watching closely to see if this report is strong enough to push Citigroup shares higher amidst looming macroeconomic uncertainties.

Citigroup Q2 2025 Preview

Release Date: Tuesday, July 15, 2025

YTD Stock Performance: +23.2%

Market Expectations:

- EPS (Earnings Per Share): $1.61 (up 5.9% YoY)

- Revenue: $20.96 billion (up 4% YoY)

Performance Supporting Factors:

- Strong performance in Q1 2025

- Efficiency initiatives and sale of non-core businesses

- Momentum continues in Investment Banking and Fixed Income and Equity Markets segments

Analyst View:

- John McDonald (Truist):

- Raise price target from $84 → $93

- Revised Buy

- Expect revenue growth from Markets segment in the mid-to-high single digits range

- Christopher McGratty (Keefe Bruyette):

- Raise price target from $92 → $105

- Revised Buy

- Optimistic on structural scale and predictability of Citi’s business model

Earning Projection Prediction

What the Analyst Stated