Investors are facing a challenging start to the week following Moody’s Ratings downgrade of the United States government’s credit rating. On Friday evening, Moody’s lowered the U.S. rating from Aaa to Aa1, citing a ballooning budget deficit and the lack of concrete measures to reduce it.

This decision has heightened concerns on Wall Street regarding the stability of the U.S. bond market, particularly as the government and Congress continue to consider additional tax cuts that lack sufficient funding. Amid economic uncertainty and President Donald Trump’s shifting trade policies, markets responded negatively.

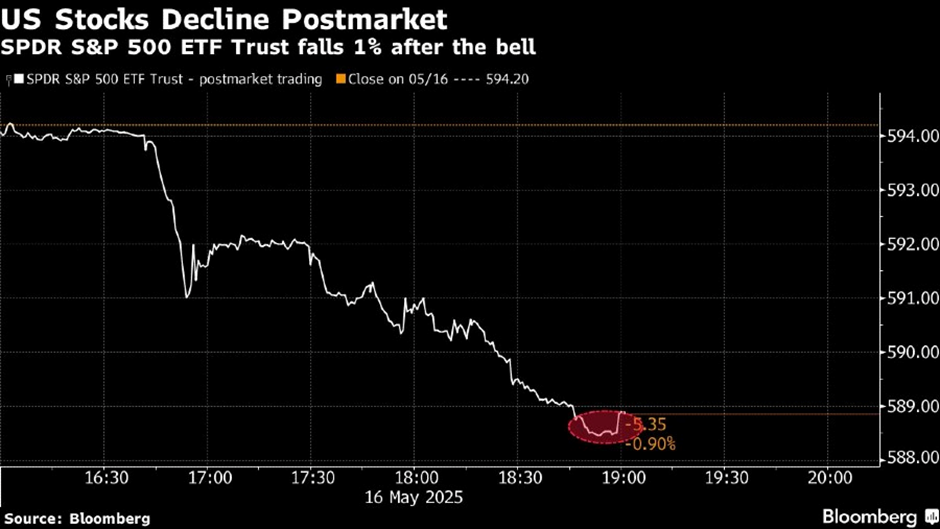

As an early signal of the downgrade’s impact, the yield on 10-year Treasury bonds rose to 4.49%, and ETFs tracking the S&P 500 index fell by 0.6% after market close. Max Gokhman of Franklin Templeton noted that the downgrade adds pressure on the U.S. dollar and could push investors to move away from Treasuries and toward other safe-haven assets, potentially further unsettling the markets.

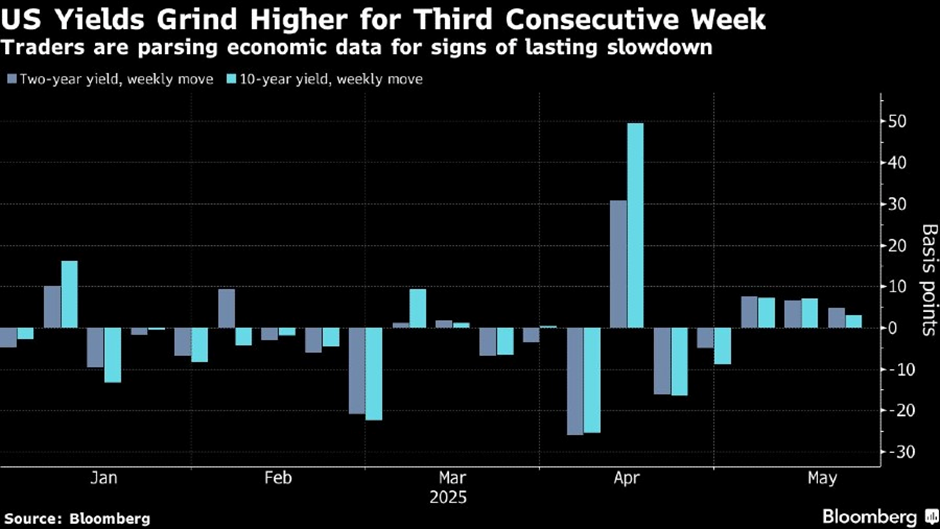

Michael Schumacher and Angelo Manolatos of Wells Fargo forecast that yields on 10- and 30-year U.S. Treasury bonds could rise by 5–10 basis points as a result of Moody’s downgrade. If the 30-year yield increases by 10 basis points, it would surpass 5%—the highest level since November 2023 and nearing its peak since 2007. Typically, rising yields strengthen the dollar, but current concerns over U.S. debt are instead weakening confidence in the currency.

The U.S. Dollar Index is hovering near its lowest level since April, while option market sentiment toward the dollar is at its most negative in five years. The dollar traded mixed against major G10 currencies, weakening against the euro and yen following the downgrade. European Central Bank President Christine Lagarde stated that the dollar’s decline reflects uncertainty and a loss of confidence in U.S. policy among market participants. Meanwhile, higher Treasury yields are increasing the government’s interest payment burden and could drive up borrowing costs, posing risks to the broader economy.

U.S. Treasury Secretary Scott Bessent dismissed concerns about debt and inflation, calling Moody’s a “lagging indicator.” He reaffirmed the Trump administration’s commitment to reducing government spending and promoting economic growth. To calm markets, President Trump announced plans to hold talks with Russian President Vladimir Putin to discuss resolving the conflict in Ukraine.

Moody’s downgraded the U.S. credit rating due to a federal budget deficit approaching $2 trillion per year—over 6% of GDP. Government debt is projected to surpass World War II-era records, reaching 107% of GDP by 2029. The deficit is expected to widen to nearly 9% of GDP by 2035, driven by rising interest payments, entitlement spending, and weak revenues.

Nevertheless, Congress is expected to continue pushing forward large-scale tax and spending bills that could add trillions more in debt. Analysts at Barclays believe the downgrade is unlikely to significantly impact Congressional policy or bond markets, similar to the limited market reaction following the U.S. credit rating downgrade in 2011.