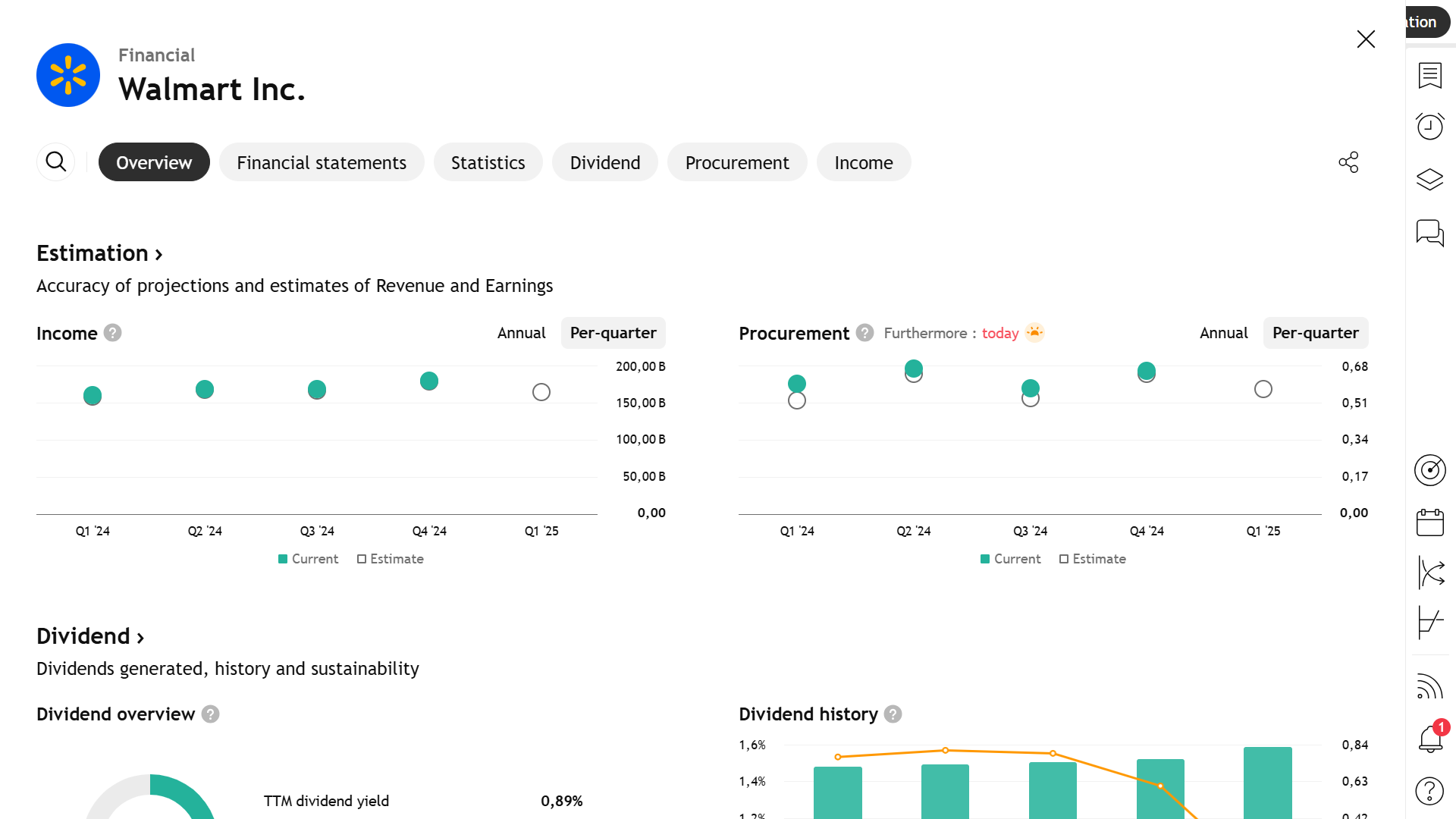

Walmart is scheduled to release its first-quarter earnings report before the market opens on Thursday. Wall Street is forecasting earnings per share (EPS) of $0.58 and total revenue of $165.88 billion. While these figures are important, long-term investors will be paying closer attention to several underlying metrics that provide a more comprehensive view of Walmart’s strategic positioning and long-term prospects.

1. Growth in Advertising (Retail Media)

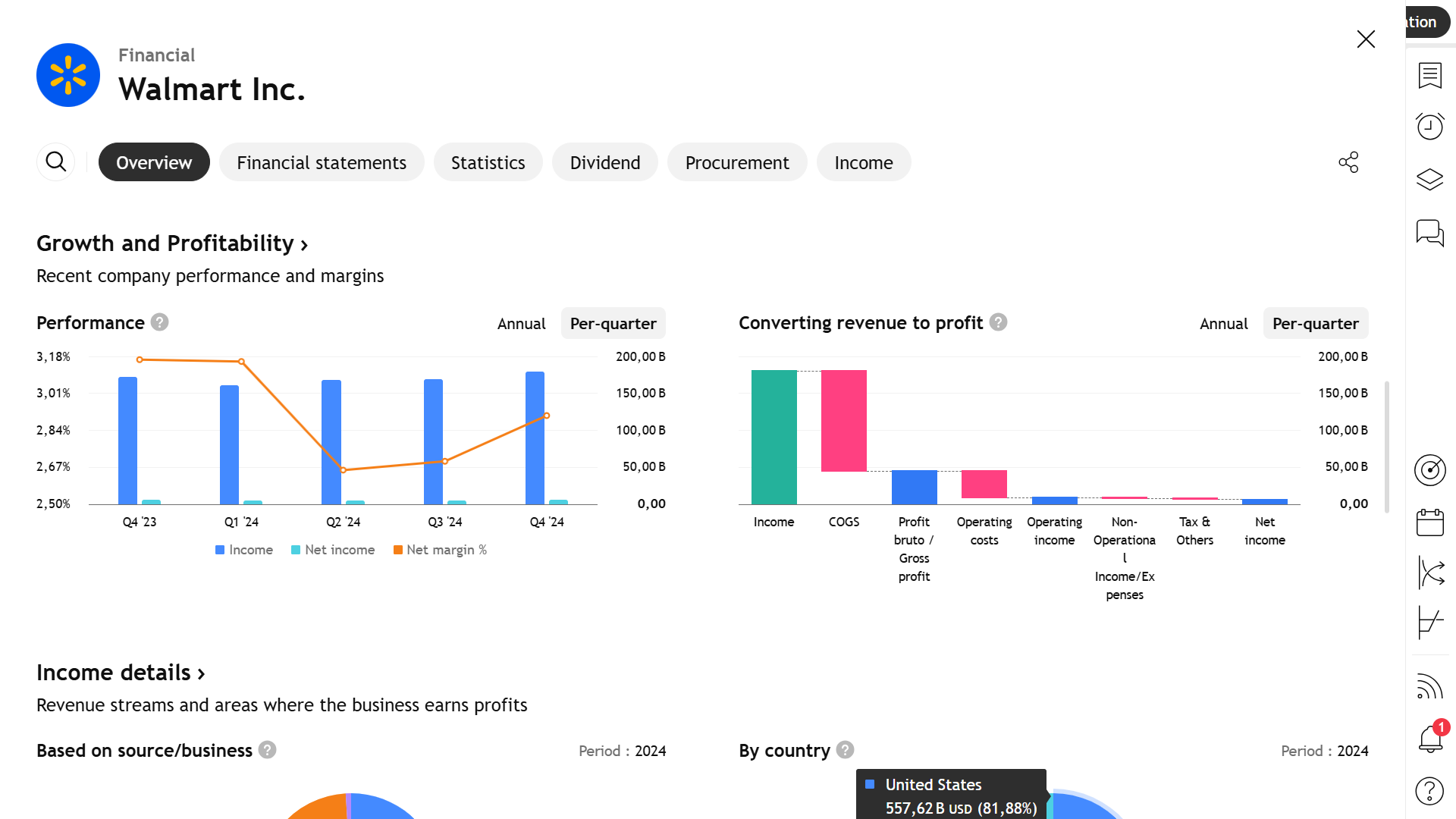

Walmart’s retail media business continues to deliver impressive growth, with annual revenue increases of approximately 28%. Although it represents a small fraction of total sales, the high profit margins associated with this segment make it an increasingly valuable contributor to overall earnings.

2. Product and Operational Costs

The impact of import tariffs is beginning to materialize in Walmart’s cost structure. The company is actively working to manage these challenges. Investors will closely monitor whether Walmart can maintain its gross margin near 24% and whether its investments in supply chain automation are beginning to drive operational efficiencies.

3. E-Commerce Performance

Walmart’s online operations generate more than $100 billion in annual revenue, accounting for approximately 15% of total sales. However, growth has started to moderate, with global e-commerce revenue rising by 16% and U.S. growth at 20%. Given e-commerce’s role as a core driver of the company’s future expansion, this slowdown will be a point of focus.

Supporting Strengths

Walmart benefits from its position as the largest grocery retailer in the United States, offering stable demand for everyday goods. Its competitive pricing strategy attracts a broad customer base, including middle- and upper-income segments. In addition, the company continues to grow its non-retail business lines, including advertising, logistics, and Walmart+ membership services.

Risks and Uncertainties

The full impact of recently imposed and adjusted import tariffs remains uncertain. Approximately one-third of Walmart’s merchandise is sourced internationally, primarily from China and Mexico. Although the Trump administration has temporarily lowered some tariffs for a 90-day window, the long-term implications for Walmart’s cost structure are yet to be determined.

Analyst Viewpoint

Analysts remain positive on Walmart’s outlook, citing its large scale and operational discipline as key advantages. Preserving market share amid cautious consumer spending behavior will be critical in the coming quarters.

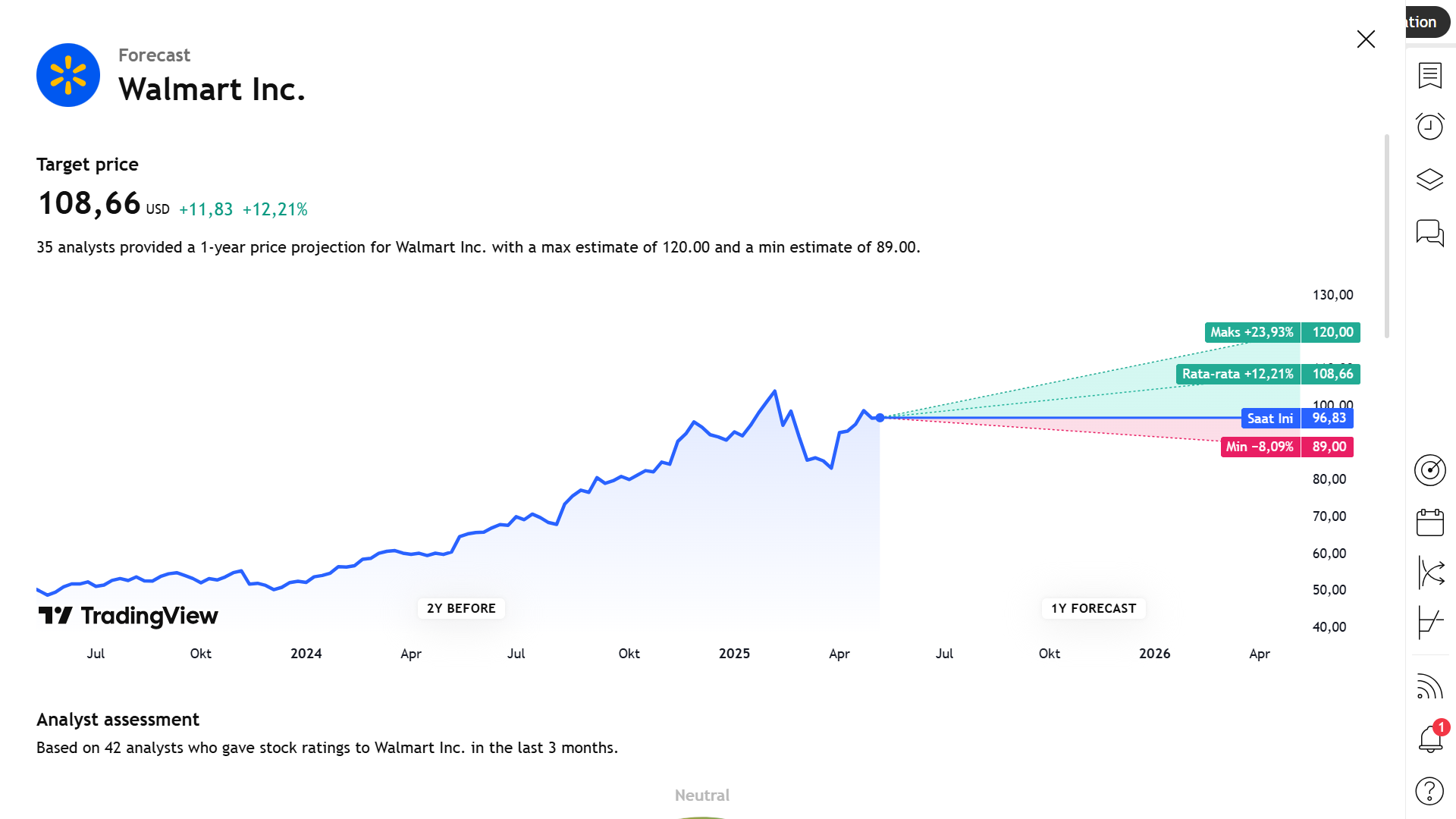

Stock Performance

Walmart’s stock has risen approximately 7% year-to-date, outperforming the largely flat S&P 500. The company’s current market capitalization stands at approximately $775 billion.

Earning Projection Prediction

WHAT THE ANALYST STATED