Goldman Sachs is scheduled to release its second quarter (Q2) 2025 earnings report on Wednesday, July 16, 2025, with high market expectations following its strong performance in the previous quarter. The investment banking giant has been in the spotlight, as its performance has consistently outperformed analysts’ expectations, especially in its Global Banking and Wealth Management divisions. However, the uncertain global economic backdrop poses a challenge.

In the first quarter of this year, Goldman Sachs recorded earnings per share (EPS) of $14.12, far exceeding the consensus estimate of $12.57. Revenue was also recorded at $15.06 billion, slightly above analyst expectations. One of the drivers of the performance was the Global Banking & Markets division which generated more than $10.7 billion in revenue, with a return on equity (ROE) exceeding 20%.

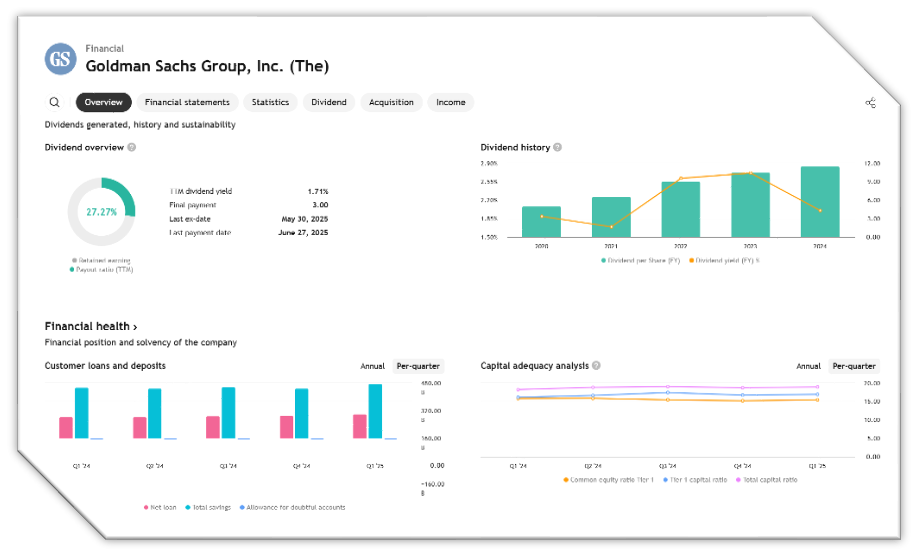

Strong performance was also seen in the Wealth and Asset Management division, which recorded revenue growth of 11% on an annualized basis, reaching approximately $2.2 billion. At the same time, the company’s total assets under management (AUM) reached an all-time high of approximately $3.2 trillion, supported by 29 consecutive quarters of fee-based inflows. This fact demonstrates the growing investor confidence in Goldman’s wealth management services.

Goldman Sachs also showed confidence in its position by allocating $40 billion to its buyback program, which reinforced the strength of its balance sheet and its strategy of returning value to shareholders.

However, this does not mean Goldman is free from challenges. Its mergers and acquisitions (M&A) and advisory services have been under pressure in recent quarters due to geopolitical uncertainty and volatile tariff policies. CEO David Solomon even said that he advised clients to “go slow” and wait for more clarity from the US government’s policy direction and global market conditions.

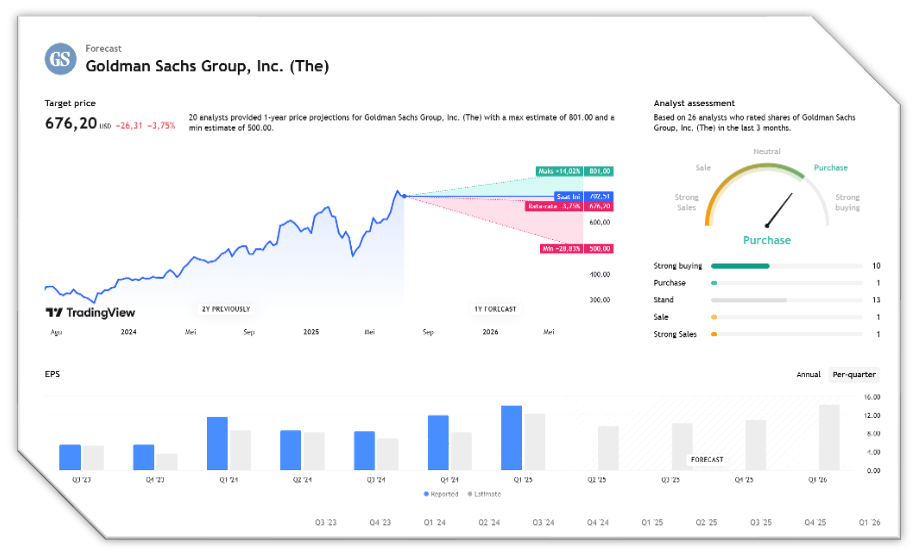

Ahead of the Q2 report, analysts expect Goldman’s revenue to reach about $13.5 billion, up about 6% compared to the same period last year. Meanwhile, EPS is projected to be in the range of $9.59 to $9.68, higher than its Q2 2024 guidance of around $8.62.

Analyst sentiment on Goldman Sachs’ stock remains positive, with a consensus rating of “Moderate Buy”. This is driven by expectations of profit growth of 4.3% and revenue growth of 3.5% for the current fiscal year. However, risks remain, including a potential increase in loan provisions and continued pressure on the investment banking division.

Looking ahead, investor focus will be on how much growth can be sustained in uncertain macroeconomic conditions, as well as how Goldman manages asset growth momentum and non-interest income from its wealth and alternatives divisions. This Q2 report will be an important test in assessing whether Goldman Sachs’ business diversification strategy is able to cushion external pressures and keep performance stable through the rest of 2025.

Q1 2025 Performance as a Basis for Comparison

- Q1 2025 EPS: $14.12, exceeding estimates (~$12.57) by ~$1.55

- Revenue: $15.06 billion, slightly above estimate of $14.99 billion

- ROE & ROTE: Approximately 16.9% and ~18%

- Global Banking & Markets Sector: Revenue ~$10.7 billion, ROE >20%

- Wealth Management Division: Revenue growth +11% YoY, up to ~$2.2 billion

- Assets under management: highest level in history (~$3.2 trillion), with 29 quarters of net fee-based flows

- Buyback program: Goldman Sachs allocates $40 billion for share buybacks, showing confidence in financial position

- Macro Risks & Conditions:

- US tariff policy uncertainty increased volatility, benefiting trading but hampering investment banking activity (advisory revenue fell ~22% YoY)

- CEO David Solomon advised clients to “go slow”, awaiting market and policy clarity

Q2 Outlook & Market Sentiment

- Ainvestweb analysis cites upside potential thanks to strong asset growth, wealth & alternatives division, alternative fundraising, and organizational efficiency technology

- Analyst sentiment: “Moderate Buy” rating due to earnings (~4.3%) and revenue (~3.5%) growth expectations

- Risks remain: global uncertainty, increased credit provisions, and pressure on advisory division are key challenges.

EARNING PROJECTION PREDICTION

WHAT THE ANALYST STATED