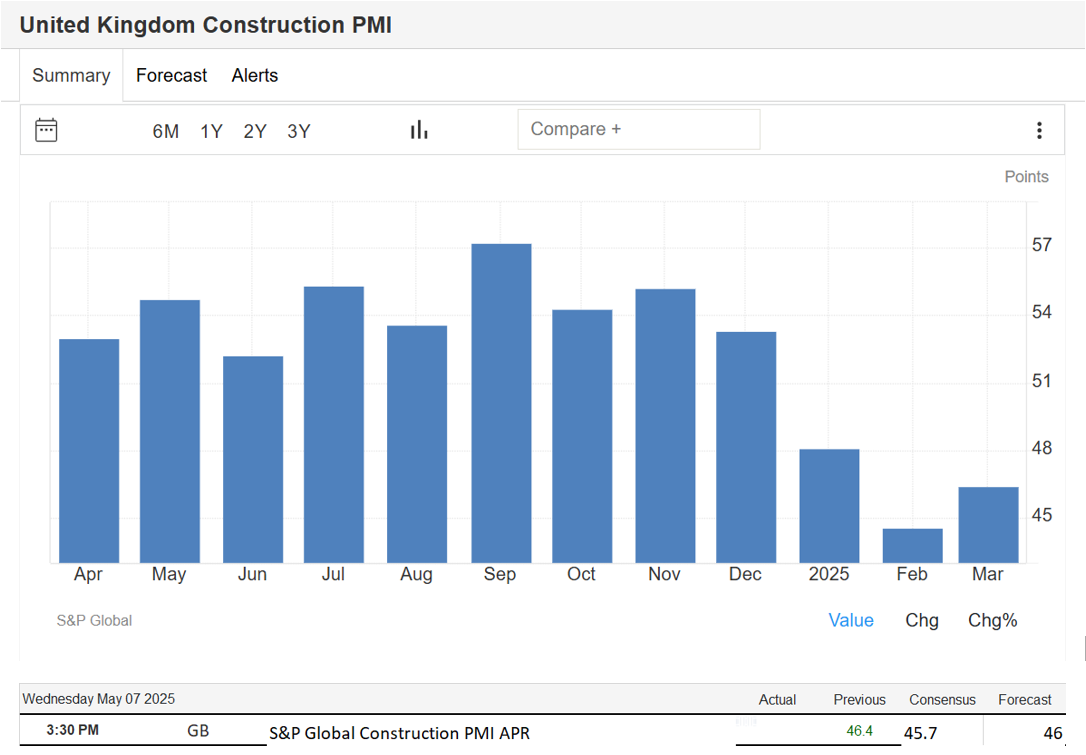

Jakarta, May 2025 – The latest data from S&P Global shows that the UK construction sector is beginning to show signs of recovery, although it remains in contraction territory. The Construction Purchasing Managers’ Index (PMI) rose to 46.4 in March, up from 44.6 in February — a slight increase that still falls below the critical 50-point expansion threshold.

What Does This Increase Mean?

While the uptick suggests some improvement, analysts warn that the UK construction sector is still grappling with significant challenges. A reading of 46.4 still reflects a contraction, indicating that sector activity has not yet seen a structural rebound.

Civil Engineering Hit the Hardest

Civil engineering recorded the weakest performance, plunging to 38.8, its lowest point since October 2020. This suggests a sharp decline in infrastructure and general construction projects. Meanwhile, the housing sector came in at 44.7, and commercial construction fell to 47.4 — both still reflecting contraction.

New Orders and Employment Continue to Weaken

Another concerning signal is the continued drop in new order inflows, pointing to weak demand. Job cuts also surged, with the steepest rate of job shedding since October 2020, indicating that companies are aggressively streamlining their workforces.

Cost Pressures and Business Confidence Decline

Input cost inflation rose to its highest level since January 2023, placing further pressure on profit margins. Additionally, business confidence fell to its lowest point since October 2023, amid mounting concerns over rising interest rates and a weakening economic outlook.

Conclusion:

While the PMI shows a glimmer of hope, the UK construction sector remains far from stable. With cost pressures, weak demand, and rising layoffs, the short-term outlook remains challenging.