Key Points

- Microsoft is scheduled to report fiscal third-quarter earnings after market close on Wednesday.

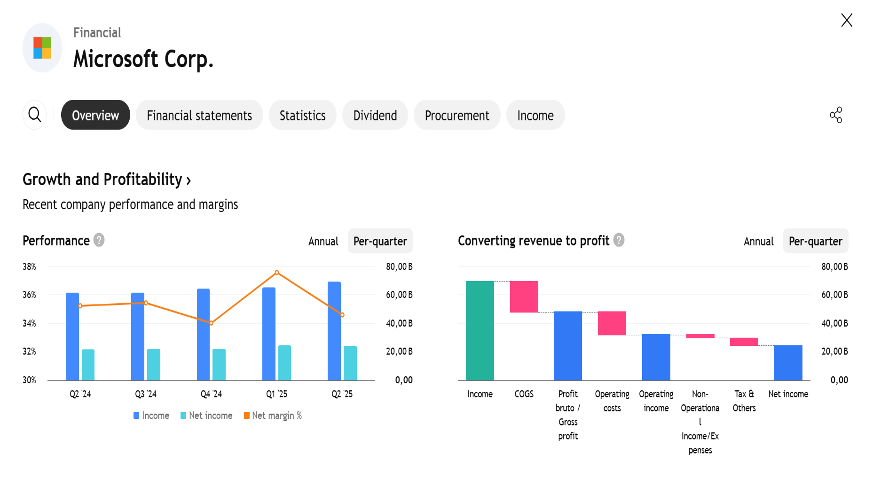

- Revenue and profit are expected to increase on an annualized basis, thanks in part to Microsoft’s Intelligent Cloud segment.

- All of the 20 analysts monitoring Microsoft via Visible Alpha have given the stock a “buy” or equivalent rating.

Microsoft (MSFT) is scheduled to report its fiscal third-quarter results after the market closes on Wednesday, with analysts largely bullish on the tech giant’s stock.

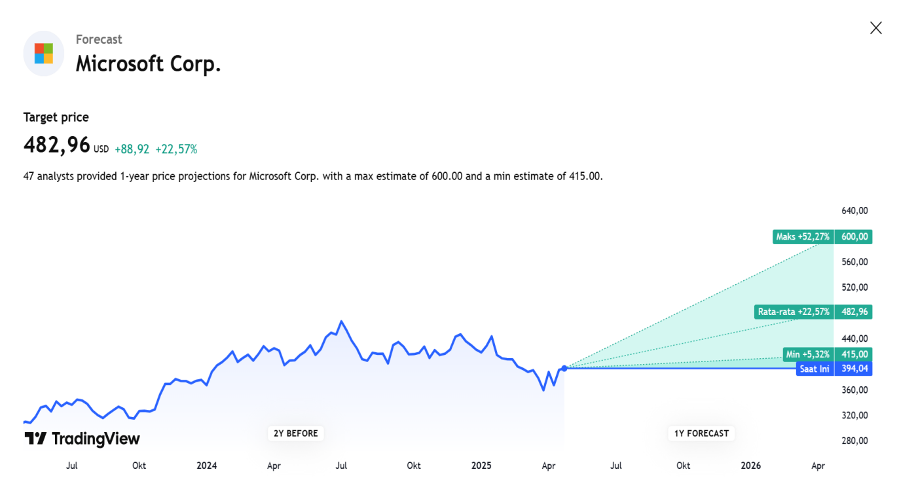

All 20 analysts monitored by Visible Alpha have given a “buy” or equivalent rating to Microsoft stock, which has seen a decline of nearly 7% through 2025. Their average price target is slightly above $492, which suggests a potential upside of 25% from Tuesday’s closing price of around $394.

Analysts from Wedbush recently lowered their price target to $475 from $550 due to concerns over tariffs imposed by President Trump, but said they remain optimistic about Microsoft in the long term, highlighting the potential of artificial intelligence (AI). “We increasingly believe that the monetization opportunity from deploying AI in the cloud is a transformational opportunity across industries, with Redmond remaining a leader,” they said.

Analysts from Goldman Sachs, who also maintained a “buy” rating for Microsoft but lowered their target price to $450 from $500, said that current economic conditions have created “a wide range of possible outcomes,” but they believe Microsoft is well positioned to capitalize on AI opportunities.

Analysts from Morningstar said Microsoft may also be in a stronger position than many other tech companies, as it has “minimal risk exposure to retail, advertising spending, cyclical hardware, or physical supply chains.”

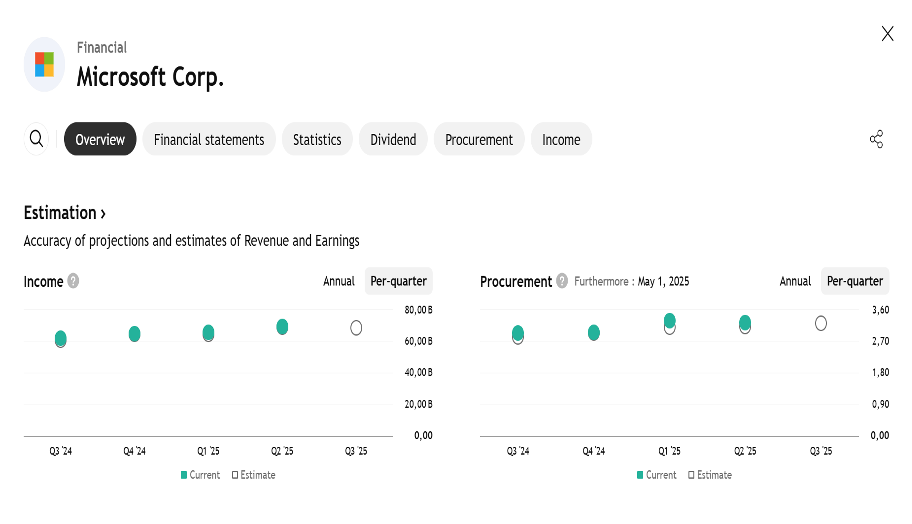

On average, analysts surveyed by Visible Alpha expect Microsoft to report third-quarter revenue of $68.44 billion, an increase of more than 10% from a year earlier, and net income of $23.94 billion, or $3.21 per share, compared to $21.94 billion, or $2.94 per share, a year earlier. Revenue from Microsoft’s Intelligent Cloud segment, which includes the Azure cloud computing platform, is expected to jump 18% to $26.13 billion.

EARNING PROJECTION PREDICTIONS

WHAT THE ANALYST STATED