Alphabet Set to Release Q1 Earnings Amid Trade Tensions and AI Disruption

Alphabet, Google’s parent company, is set to announce its first-quarter fiscal earnings after market close on Thursday. This will be the first earnings report since President Trump implemented a series of tariffs on global trading partners.

While analysts don’t expect the tariffs to impact revenue or earnings per share (EPS) for Q1, investors will be watching closely for forward guidance on the potential effects in the second half of the year.

“We’re seeing a slowdown in e-commerce transaction velocity recently, and given current macro conditions, we expect digital ad spending to weaken in Q2,” Barclays analyst Ross Sandler wrote in a note to investors dated April 8.

Alphabet shares have dropped more than 19% year-to-date and about 3% over the past 12 months.

Tariffs Aren’t the Only Concern

Wells Fargo Securities equity analyst Ken Gawrelski noted that for the first time, ad agencies are reassessing their search advertising strategies as users increasingly turn to generative AI agents and social media platforms to find information online.

Q1 Financial Estimates

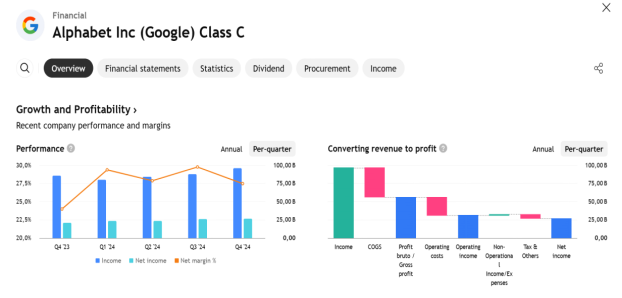

According to Bloomberg consensus estimates, Google is projected to post EPS of $2.01 on revenue of $89.1 billion. Revenue excluding traffic acquisition costs (TAC) — what Google pays partners for search integration — is estimated at $75.4 billion. Last year in the same quarter, Google reported EPS of $1.89 on $80.5 billion in revenue.

Ad revenue is projected to hit $66.4 billion, with YouTube contributing $8.9 billion. In Q1 2024, Google’s ad revenue stood at $61.1 billion.

Spotlight on Google Cloud Platform (GCP)

Investors are also closely watching growth in Google Cloud Platform (GCP) revenue. Like Amazon and Microsoft, Google is investing billions into AI-powered data centers. In 2025 alone, the company is expected to spend $75 billion on AI infrastructure and data center capacity.

In Q4’s earnings call, Alphabet and Google CFO Anat Ashkenazi stated that the company’s AI services are currently limited by capacity constraints. Until enough servers are deployed to meet demand, Google risks losing revenue from potential clients.

Mizuho analyst James Lee noted that Elon Musk’s cost-cutting measures at the U.S. Department of Government Efficiency (DOGE) could impact GCP sales. According to Lee, one GCP channel partner reported that 25% of their clients affected by DOGE and tariffs have reduced spending compared to their 2025 budgets.

GCP revenue is projected at $12.3 billion this quarter, up from $9.5 billion in Q1 2024.

Legal Trouble: Antitrust Lawsuits

Google is also grappling with two major antitrust case losses. Last week, a U.S. federal judge ruled that Google holds an illegal monopoly in the online advertising market, which could force the company to sell or restructure parts of its ad business.

This loss follows another ruling less than a year ago that found Google’s search and advertising business in violation of antitrust laws.

Search ad revenue is expected to grow 9% to $50.49 billion, down from 12% growth in the prior quarter. Investors are watching the rollout of “AI Overviews” — search results powered by Gemini AI, introduced last year. Competition from ChatGPT and other AI models is pushing Google to accelerate its innovation.

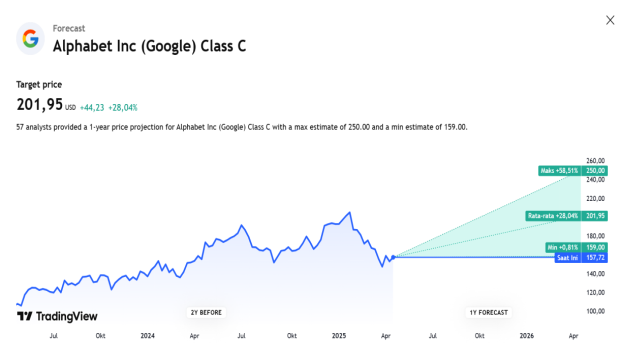

Analysts foresee potential headwinds due to weakening business sentiment. Total revenue is projected to rise 11% to $89.2 billion, with EPS increasing 6% to $2.01. Cloud revenue is expected to grow 28%, slightly down from the previous quarter.

YouTube ad revenue is projected at $8.96 billion, nearly 11% growth. Investors also anticipate a potential new stock buyback program, following Alphabet’s first dividend payout last year.

Currently, Google stock holds a weak Relative Strength Rating of 31 out of 99 and an Accumulation/Distribution rating of D — a sign of institutional selling pressure.

Earning Projection Prediction

WHAT THE ANALYST STATED