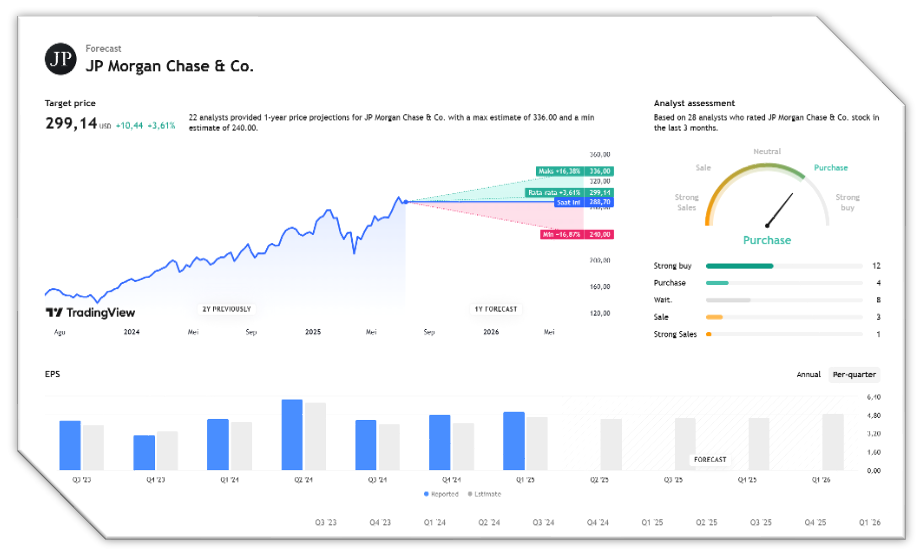

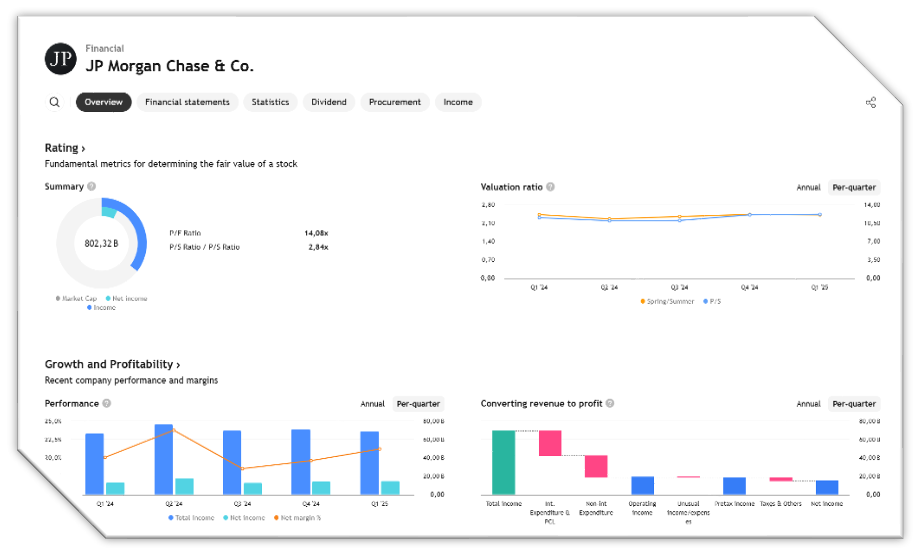

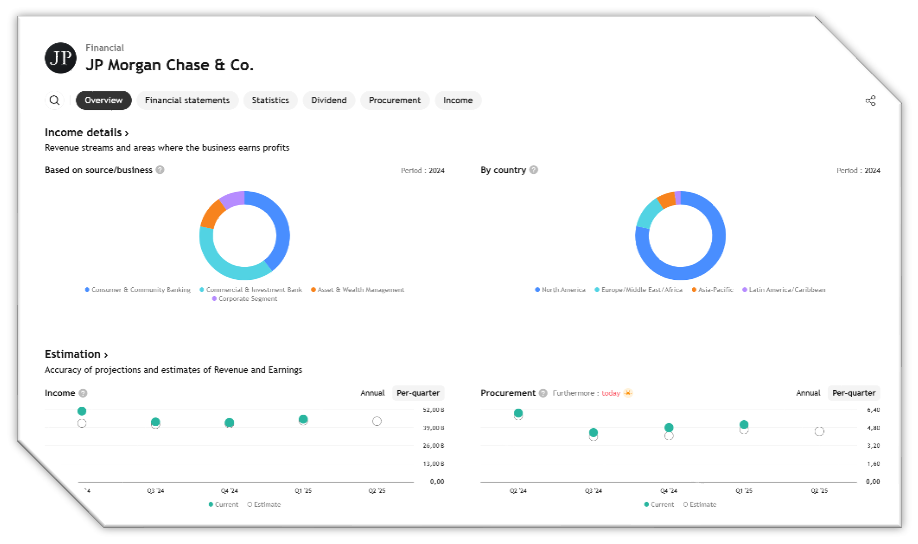

JPMorgan Chase is scheduled to release its second quarter 2025 earnings report on Tuesday morning US time, and market participants are eagerly awaiting the results. The company’s performance in the previous quarter was quite impressive-JPM managed to post revenue of $46.01 billion, up 9.7% year-on-year, while beating analysts’ expectations by 5.6%. Earnings per share (EPS) also came in ahead of market estimates, while tangible book value per share was in line with expectations. This solid performance was underpinned by strong net interest income and steady growth in consumer banking and trading activities.

For the quarter, analysts expect JPMorgan to post revenue of around $45.6 billion with earnings per share (EPS) projected at $4.15. Some of the key factors that investors will be watching include the development of net interest income (NII), which is likely to remain high as the Fed maintains its high interest rate policy. In addition, loan growth from both the credit card and commercial loan segments will also be scrutinized, along with the extent to which the company needs to increase loan loss reserves in anticipation of default risk.

Although the outlook is still positive, there are some challenges that need to be watched out for. Sluggish consumer credit growth, depressed interest margins due to competition, as well as pressure from tighter regulations could be a drag on performance. Investment banking activities have also yet to show a significant recovery, especially amid the lack of mergers and acquisitions.

Nevertheless, overall JPMorgan is still seen as a large bank with a very strong foundation. With solid capital and liquidity, plus extensive market leadership in the retail and institutional banking sectors, JPM remains well positioned to maintain solid performance amidst challenging global economic dynamics.

JPMorgan Chase Ready to Release Second Quarter 2025 Financial Statements

Reporting Time:

- Tuesday, 15 July 2025 (before market open)

- Investor session: 08.30 a.m. ET

Wall Street expectations (sources: LSEG & StreetAccount):

- Earnings per Share (EPS): $4.48

- Revenue: $44.16 miliar

- Net Interest Income: $23.6 miliar

- Trading Revenue:

- Fixed Income: $5.2 miliar

- Equities: $3.2 miliar

Performance factors:

- Trading revenue is expected to remain high due to market volatility triggered by President Trump’s tariff policy.

- Investment banking revenue could recover by the end of the quarter as markets rebound since May.

- The wealth management division benefited from the high value of client assets.

- Credit risk is not yet a major issue as US employment remains strong.

- Banking stocks surged, with the S&P 500 Banks Index rising 14.4% in the quarter – outperforming the rest of the financial sector.

Conclusion:

JPMorgan is expected to post a solid performance in Q2 thanks to a combination of dynamic markets, high assets in wealth management, and the prospect of deregulation of the banking industry.

Earning Projection Prediction

What the Analyst Stated