PERDAGANGAN

PARTNER

PERUSAHAAN

ANALISA HARIAN

PIVOT

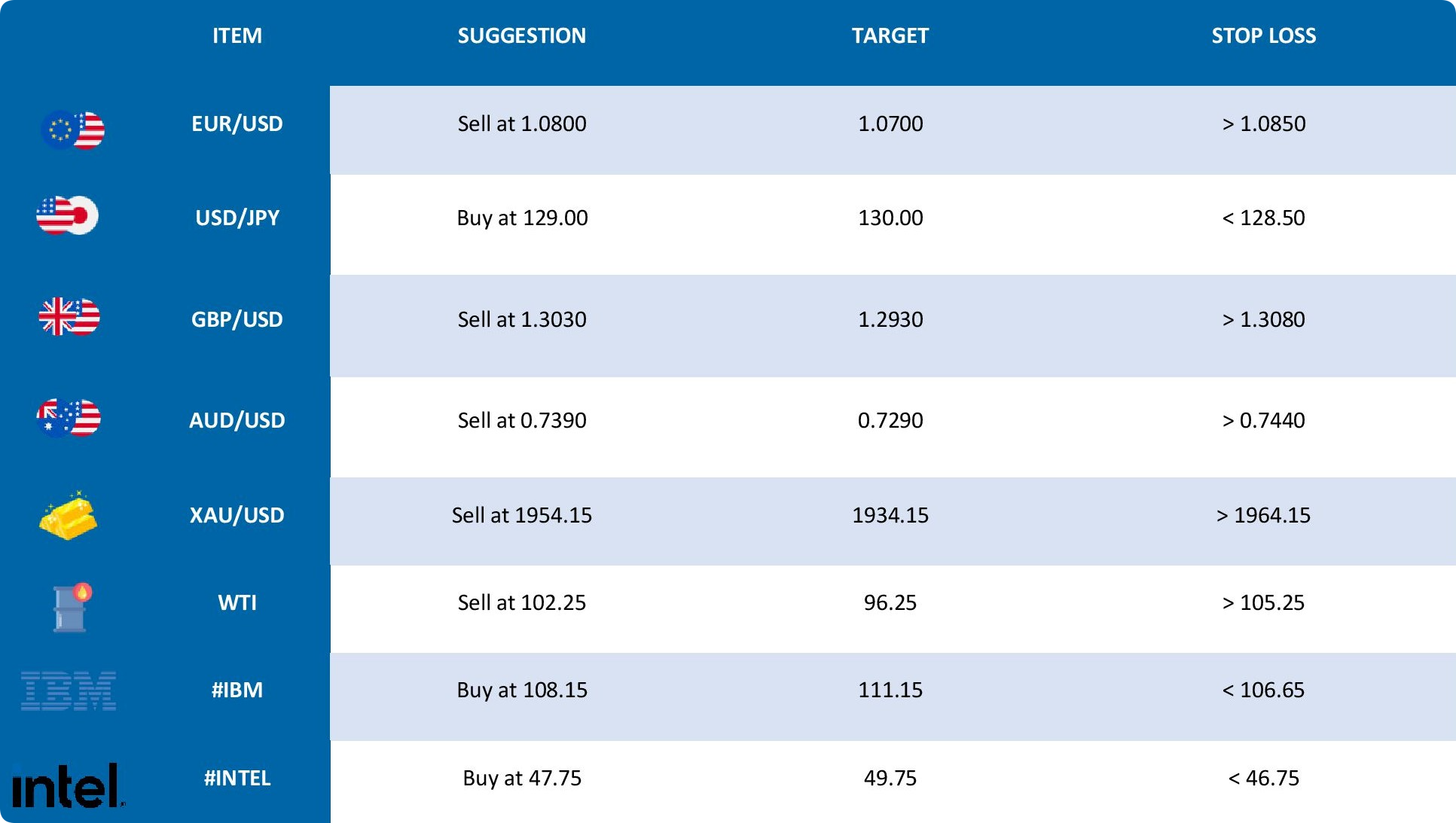

Prediksi Strategi untuk Perdagangan Jangka Pendek

EUR/USD

EUR/USD mencapai puncaknya di 1.0814 pada hari Selasa dan kemudian mundur menemukan support di 1.0780. Pemulihan euro dari dekat level terendah dalam dua tahun tetap terbatas di belakang dolar AS yang lebih kuat karena imbal hasil Treasury terus bergerak lebih tinggi. Perbedaan antara Federal Reserve dan Bank Sentral Eropa (ECB) terus membebani pasangan ini.

Imbal hasil 10-tahun AS naik menjadi 2.92% dan 30-tahun menjadi 3.01%, tertinggi sejak April 2019. Aksi jual Treasuries terus berlanjut menyusul komentar dari Bullard The Fed pada hari Senin yang menunjukkan bahwa kenaikan suku bunga 75 bp dapat dipertimbangkan jika diperlukan untuk menekan inflasi.

USD/JPY

USD/JPY meluas ke tertinggi 20-tahun dan mengincar untuk mencapai angka 130.00, selama sesi Amerika Utara, di tengah sesi beragam dengan ekuitas global berfluktuasi, imbal hasil obligasi naik, dan komoditas turun. Pada saat penulisan, USD/JPY diperdagangkan pada 128.71.

Pembicaraan damai antara kedua belah pihak ditahan karena Menteri Luar Negeri Rusia Lavrov mengatakan bahwa tahap lain dari operasi itu akan dimulai. Sementara itu, pembicaraan The Fed mempertahankan dolar AS tetap apung. Pada hari Senin, Presiden The Fed St Louis Bullard mencatat bahwa inflasi "terlalu tinggi untuk kenyamanan" dan menambahkan bahwa pejabat The Fed ingin segera mencapai tingkat netral.

GBP/USD

GBP/USD turun lebih rendah dan berbalik datar pada hari ini di dekat 1.3000 setelah naik menuju pertengahan 1.3000 di pagi hari Eropa. Greenback mempertahankan kekuatannya pada kenaikan imbal hasil obligasi-T AS dan tidak memungkinkan pasangan untuk mendapatkan daya tarik pada hari Selasa. GBP/USD menghadapi resistensi utama di 1.3050 dan bisa membukukan kenaikan pemulihan tambahan jika penjual gagal mempertahankan level itu. Dengan tidak adanya rilis data berdampak tinggi dari Inggris, penilaian pasar dolar terus mendorong tindakan GBP/USD pada hari Selasa. Indeks Dolar AS (DXY) tampaknya telah stabil di dekat 100.80, di mana ditutup pada hari Senin, setelah naik di atas 101.00 selama sesi Asia.

AUD/USD

Setelah gagal dalam upaya sebelumnya untuk mendorong kembali ke utara 0.7400 selama awal perdagangan Eropa, AUD/USD kembali diperdagangkan di 0.7360, membuatnya sekarang hanya sekitar 0.2% lebih tinggi hari ini. Itu berarti pasangan ini telah mengikis sebagian besar kenaikan risalah RBA pasca-hawkish. Pedagang mengutip ketahanan dalam dolar AS setelah kenaikan lebih lanjut dalam imbal hasil AS menyusul komentar hawkish dari The Fed arch-hawk James Bullard pada hari Senin, yang mengisyaratkan dia terbuka untuk kenaikan suku bunga 75 bps pada pertemuan mendatang, yang membebani AUD/USD. itu mencoba untuk rally kembali di atas 0.7400. Ke depan, acara utama minggu ini untuk pasangan ini adalah pidato Kamis di pertemuan IMF/Bank Dunia minggu ini oleh Ketua The Fed Jerome Powell.

XAU/USD

Emas melemah pada hari Selasa setelah menyentuh resistance di level $2.000 per ons di sesi sebelumnya, karena dolar naik ke level tertinggi dua tahun dan melemahkan daya tarik emas batangan. Spot gold turun 1.52% pada $1.948.46 per ounce, sementara emas berjangka AS turun 1.8% menjadi $1.950.7. Dolar menguat ke level tertinggi sejak April 2020 karena investor bersiap untuk beberapa kenaikan suku bunga setengah persentase poin dari Federal Reserve karena berusaha mengendalikan inflasi yang melonjak.

WTI

Harga minyak jatuh 5% dalam perdagangan yang bergejolak pada hari Selasa di tengah kekhawatiran permintaan setelah IMF mengurangi perkiraan pertumbuhan ekonomi dan memperingatkan inflasi yang lebih tinggi. Harga turun meskipun produksi lebih rendah dari OPEC+, yang memproduksi 1.45 juta bph di bawah targetnya pada Maret, karena produksi Rusia mulai menurun menyusul sanksi yang diberlakukan oleh Barat, menurut laporan dari aliansi produsen yang dilihat oleh Reuters. Rusia memproduksi sekitar 300.000 barel per hari di bawah targetnya pada bulan Maret sebesar 10.018 juta barel per hari, berdasarkan sumber sekunder, laporan tersebut menunjukkan. Minyak mentah Brent turun 5.22% menjadi $107.25, sementara minyak mentah West Texas Intermediate AS menetap 5.2% lebih rendah pada $102.56 per barel.

#IBM

IBM melaporkan pendapatan kuartal pertama Selasa malam yang mengalahkan perkiraan di garis atas dan bawah karena raksasa teknologi terus membuat kemajuan dalam restrukturisasi besar-besaran. Saham IBM naik karena berita tersebut. Perusahaan melaporkan pendapatan yang disesuaikan sebesar $1.40 per saham dengan pendapatan $14.2 miliar. Analis memperkirakan IBM akan melaporkan pendapatan $1.38 per saham atas pendapatan $13.85 miliar. Saham IBM lebih tinggi 2.98 (+2.36%) ditutup pada 129.15 pada hari Selasa. IBM terus menjalani restrukturisasi yang signifikan selama bertahun-tahun. Pemimpin di ruang cloud publik termasuk (AMZN) dan (MSFT). Pendapatan cloud hybrid mencapai $5 miliar pada kuartal pertama, naik 14%. Grup perangkat lunak IBM menunjukkan pendapatan sebesar $5.8 miliar, naik 12%.

#INTEL

Dalam surat investor Q1 2022, ClearBridge Investments Dividend Strategy menyebutkan Intel Corporation (NASDAQ:INTEL) dan menjelaskan wawasannya untuk perusahaan. Didirikan pada tahun 1968, Intel Corporation (NASDAQ:INTEL) adalah perusahaan multinasional dan perusahaan teknologi yang berbasis di Santa Clara, California dengan kapitalisasi pasar $186.7 miliar. Intel Corporation (NASDAQ:INTC) memberikan pengembalian -11.32% sejak awal tahun, sementara pengembalian 12 bulannya turun -29.76%. Saham ditutup pada $45.67 per saham pada 14 April 2022. Saham INTC naik 1.29 (+2.77%) kemarin. Harga saham dari produsen chip semikonduktor terbesar di dunia berdasarkan pendapatan, ditutup pada 47.93 pada hari Selasa.

PERDAGANGAN

PARTNER

PERUSAHAAN

MEMBANTU

Disclaimer: Trading derivatif mengandung risiko kerugian tinggi dan belum tentu cocok untuk semua investor. TIDAK ADA JAMINAN KEUNTUNGAN dari investasi Anda.

ID

ID

-

English

-

Bahasa Indonesia