PERDAGANGAN

PARTNER

PERUSAHAAN

ANALISA MINGGUAN

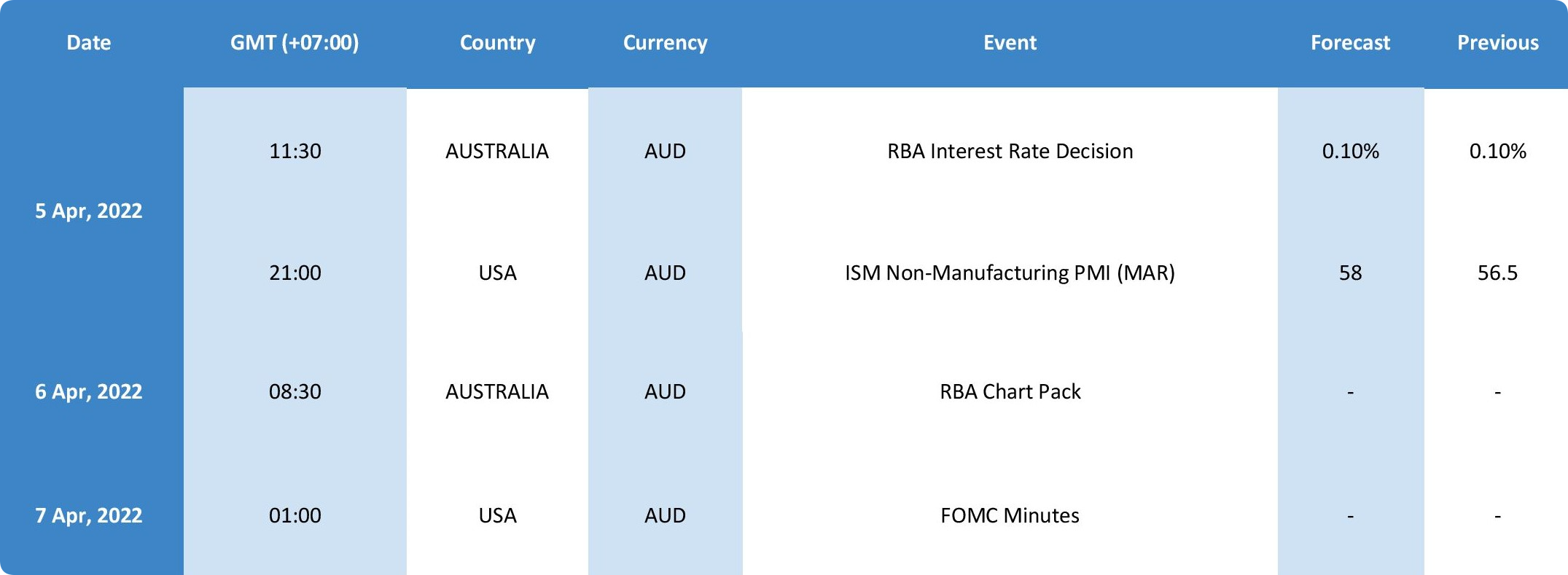

ECONOMIC CALENDAR (4-8 APRIL 2022)

PIVOT

EUR/USD

Mata uang bersama telah terpukul keras setelah Eurostat melaporkan Tingkat Pengangguran di 6.8%, yang tetap di tengah konsensus pasar di 6.7% dan angka sebelumnya 6.9%. Sementara itu, taruhan pada kenaikan suku bunga oleh Bank Sentral Eropa (ECB) meningkat lebih tinggi. Melonjaknya inflasi di Zona Euro memaksa para pembuat kebijakan ECB untuk menaikkan suku bunga untuk pertama kalinya setelah pandemi Covid-19. Inflasi tahunan Jerman telah naik menjadi 7.3%, angka tertinggi dalam lebih dari empat dekade. Sedangkan Indeks Harga Konsumen (IHK) di Prancis telah mencapai 5.1% dan angka inflasi di Italia telah mencapai 6.7%.

Di sisi dolar, indeks dolar AS (DXY) telah mengklaim kembali 98.00 dengan nyaman meskipun ada sedikit penurunan dalam inflasi Pengeluaran Konsumsi Pribadi Inti (PCE). Inflasi PCE Inti tahunan mencapai 5.4%, sedikit lebih rendah dari perkiraan 5.5% tetapi lebih tinggi dari angka sebelumnya sebesar 5.2%. Peningkatan daya tarik safe-haven setelah optimisme dalam pembicaraan damai Rusia-Ukraina memudar telah menopang greenback terhadap mata uang bersama.

USD/JPY

Spekulasi bahwa pihak berwenang akan campur tangan dan menanggapi penurunan tajam baru-baru ini dalam yen Jepang, bersama dengan memudarnya harapan untuk diplomasi di Ukraina, bertindak sebagai angin sakal untuk pasangan USD/JPY. Pedagang bearish lebih lanjut mengambil isyarat dari penurunan berkelanjutan dalam imbal hasil obligasi Treasury AS, meskipun permintaan dolar AS yang bangkit kembali membantu membatasi penurunan harga spot, setidaknya untuk saat ini.

Menyusul penurunan baru-baru ini ke level terendah hampir dua minggu, USD membuat comeback yang solid di tengah penerimaan bahwa Fed akan menaikkan suku bunga sebesar 50 bps pada dua pertemuan berikutnya untuk memerangi inflasi yang tinggi. Taruhan pasar ditegaskan kembali oleh rilis Indeks Harga PCE Inti AS pada hari Kamis, yang dipercepat ke tingkat 5.4% YoY di Februari dari 5.2% yang dilaporkan di bulan sebelumnya.

GBP/USD

GBP/USD telah berjuang untuk membuat langkah yang menentukan di kedua arah pada hari Kamis dan mulai melemah di awal sesi Eropa pada hari Jumat. Pasangan ini mendekati support 1.3100 dan tekanan bearish bisa meningkat jika level tersebut gagal. Meningkatnya ketegangan geopolitik pada keputusan Rusia untuk memaksa pembeli membayar gas Rusia dalam rubel memaksa investor untuk mencari perlindungan Kamis malam. Selain itu, pasukan Rusia dilaporkan melakukan relokasi dan reorganisasi daripada mundur, menghidupkan kembali kekhawatiran atas konflik militer yang berkepanjangan. Indeks FTSE 100 Inggris tetap datar pada awal Jumat dan Indeks Dolar AS mengkonsolidasikan kenaikan Kamis di dekat pertengahan 98.00-an, tidak memungkinkan GBP/USD untuk mendapatkan daya tarik. The Fed tidak terlalu peduli dengan pertumbuhan lapangan kerja dan kecuali jika angka inflasi upah meleset dari ekspektasi pasar dengan selisih yang lebar, dolar akan terus mengungguli para pesaingnya. Selanjutnya, investor mungkin ingin menjauh dari aset sensitif risiko menjelang akhir pekan di tengah ketidakpastian seputar krisis Rusia-Ukraina.

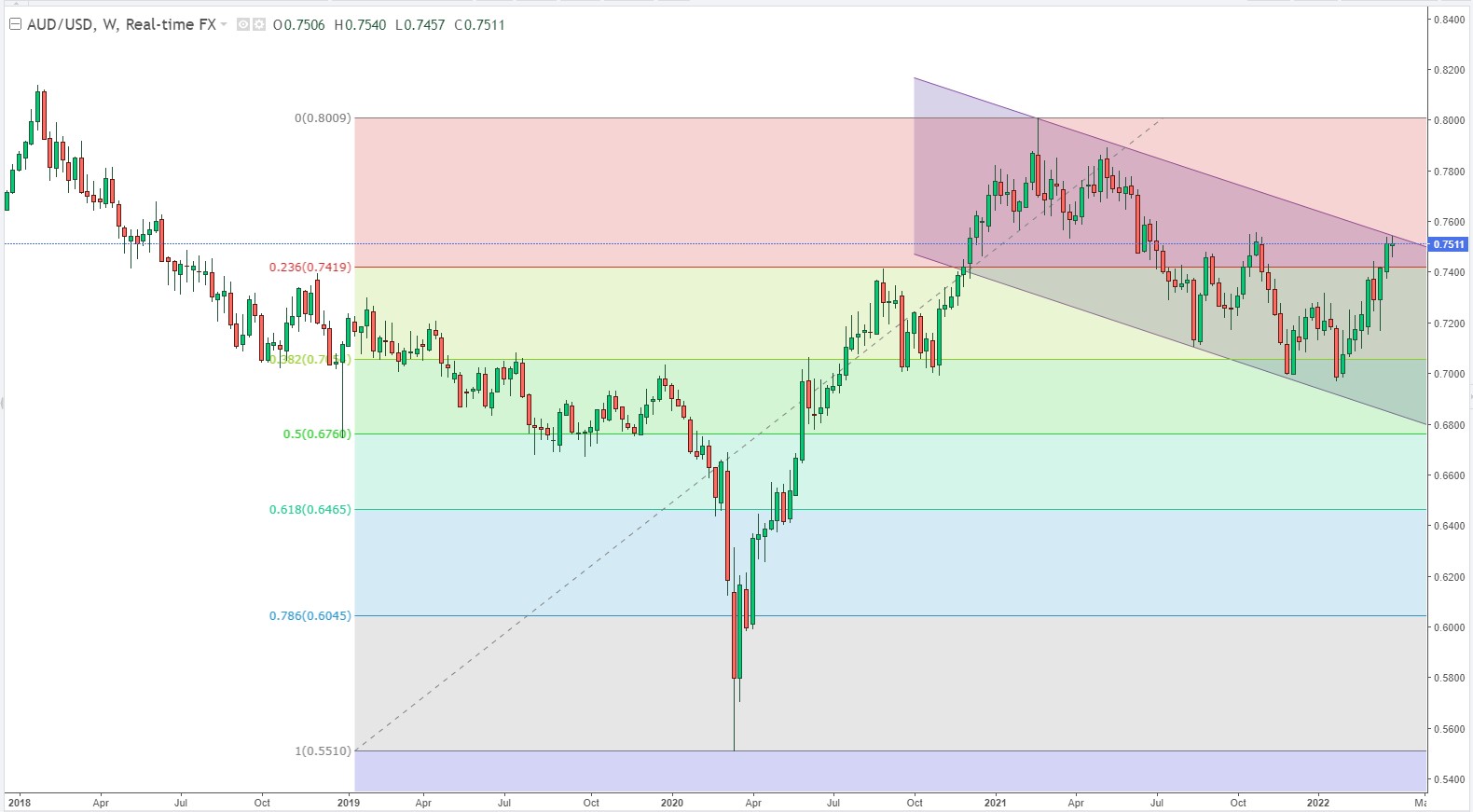

AUD/USD

Pasangan AUD/USD telah berada di bawah tekanan pada hari Kamis karena harga komoditas turun. Harapan dari awal pekan ini bahwa pembicaraan damai akan mengarah pada gencatan senjata di Ukraina lima minggu setelah invasi Rusia telah berkurang, namun, harga minyak berada di bawah tekanan karena AS mengumumkan mereka akan melepaskan hingga 180 juta barel minyak dari cadangan strategis mereka di atas enam bulan ke depan dalam upaya memerangi lonjakan harga minyak.

Sebagai akibat dari invasi Rusia ke Ukraina, harga minyak spot telah naik dari sekitar $75/bbl pada awal tahun 2022 ke puncak di atas $130/bbl, tetapi setelah pengumuman AS, harga minyak turun lebih dari 5% semalam, dengan perdagangan WTI di USD99.69/bbl terendah hari ini. Selain itu, saham AS siap untuk mengakhiri penurunan kuartalan terbesar dalam dua tahun dengan catatan penurunan pada hari Kamis karena kekhawatiran tentang konflik yang berkelanjutan di Ukraina.

USD/CAD

USD/CAD diperdagangkan ke terendah baru tahunan (1.2429) karena mata uang blok komoditas terus mengungguli Greenback, dan nilai tukar dapat terdepresiasi selama sisa minggu ini karena gagal mempertahankan kisaran pembukaan untuk 2022. USD/CAD muncul untuk tidak terpengaruh oleh laporan Ketenagakerjaan ADP yang lebih baik dari perkiraan saat melewati terendah Januari (1.2450), dan peningkatan selera risiko dapat terus mempengaruhi nilai tukar karena Federal Reserve memberikan sedikit detail seputar pengetatan kuantitatif (QT) siklus.

Akibatnya, masih harus dilihat apakah pembaruan pada Indeks Harga Pengeluaran Konsumsi Pribadi (PCE) inti AS akan mempengaruhi USD/CAD karena pengukur inflasi pilihan Fed diperkirakan akan melebar untuk enam bulan berturut-turut, dengan pengukur diproyeksikan meningkat menjadi 5.5% dari 5.2% per tahun di bulan Januari, yang akan menandai angka tertinggi sejak 1983.

XAU/USD

Harga emas berada di jalur untuk menguji tertinggi minggu lalu ($1966) karena pemulihan selera risiko terurai, dan memudarnya harapan untuk kesepakatan damai Rusia-Ukraina dapat membuat emas tetap bertahan karena harga ekuitas global berada di bawah tekanan. Berita utama seputar perang Rusia-Ukraina sebagian besar dapat memengaruhi harga emas karena konflik yang sedang berlangsung meningkatkan ruang lingkup untuk melarikan diri ke tempat yang aman, dan emas batangan dapat terus mencerminkan tren bullish karena tampaknya berbalik arah setelah menguji SMA 50-Hari ($1896).

Dengan demikian, pergerakan di atas tertinggi minggu lalu ($1966) dapat mendorong harga emas kembali ke level tertinggi tahunan ($2070), dan tahap logam mulia lebih lanjut mencoba untuk menguji rekor tertinggi ($2.075) jika pemulihan selera risiko berlanjut untuk terungkap.

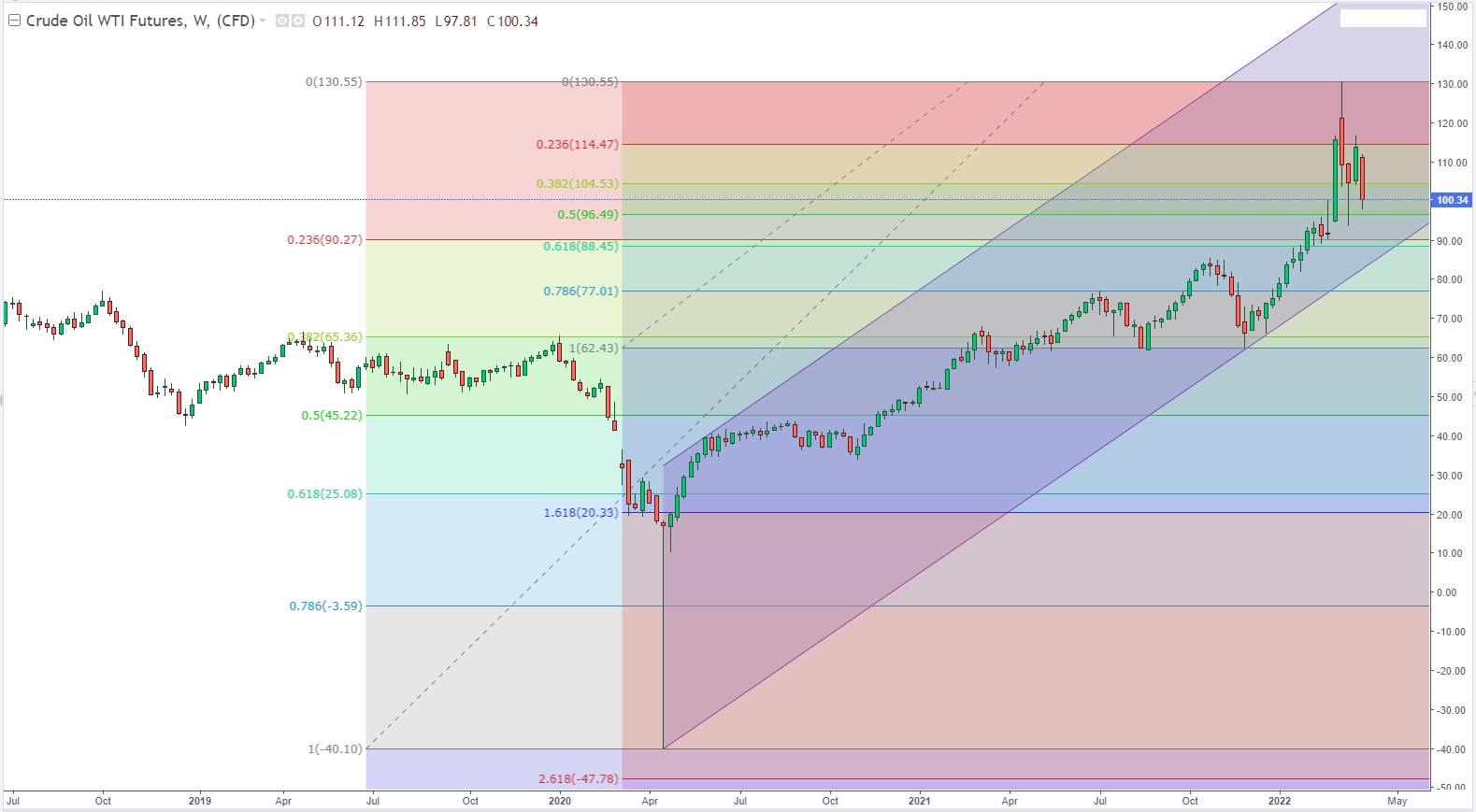

WTI

Harga minyak naik pada hari Jumat menjelang pertemuan negara-negara anggota Badan Energi Internasional (IEA) yang akan membahas pelepasan cadangan minyak darurat di samping rencana pelepasan besar-besaran oleh Amerika Serikat. Minyak mentah berjangka Brent naik 72 sen, atau 0.7%, menjadi $105.45 per barel, setelah jatuh 5.6% pada hari Kamis. Minyak mentah berjangka West Texas Intermediate (WTI) AS naik 49 sen, atau 0.5%, menjadi $ 100.77 per barel.

Kedua kontrak itu turun di awal sesi. Dua kontrak acuan juga menuju kerugian mingguan terbesar mereka dalam dua tahun masing-masing sebesar 14% dan 13%. Pada hari Kamis, Presiden AS Joe Biden mengumumkan pelepasan 1 juta barel per hari selama enam bulan, mulai Mei. Itu akan menjadi rilis terbesar yang pernah ada dari Cadangan Minyak Strategis (SPR) AS.

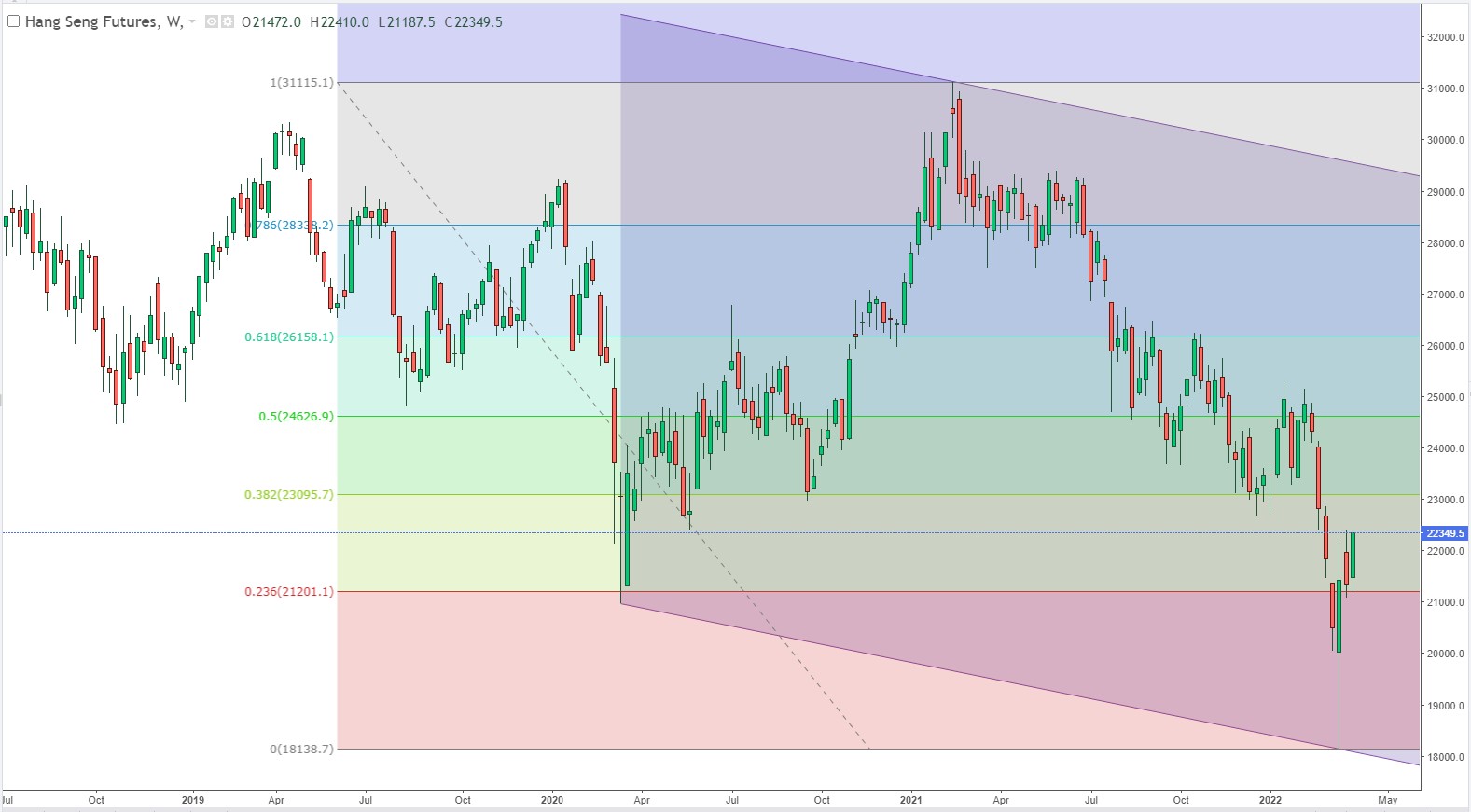

HSI

Saham China berakhir lebih tinggi pada hari Jumat, dengan pengembang properti memimpin kenaikan di tengah ekspektasi lebih banyak stimulus ekonomi setelah data menunjukkan aktivitas pabrik merosot pada laju tercepat dalam dua tahun di bulan Maret. Indeks CSI300 blue-chip naik 1.3% menjadi 4,276.16, sedangkan Shanghai Composite Index naik 0.9% menjadi 3,282.72. Indeks Hang Seng naik 0.2% menjadi 22,039.55, sedangkan Indeks China Enterprises naik 0.2% menjadi 7,537.16.

Untuk minggu ini, Indeks CSI300 naik 2.4%, kenaikan mingguan terbesar sepanjang tahun ini, sementara Indeks Hang Seng naik hampir 3%. Indeks Manajer Pembelian (PMI) Manufaktur Caixin/Markit, yang lebih berfokus pada perusahaan kecil di wilayah pesisir, turun menjadi 48.1 pada bulan Maret, secara umum sejalan dengan PMI resmi yang dirilis pada hari Kamis, karena kebangkitan COVID-19 domestik dan ekonomi dampak dari perang Ukraina ditimbang.

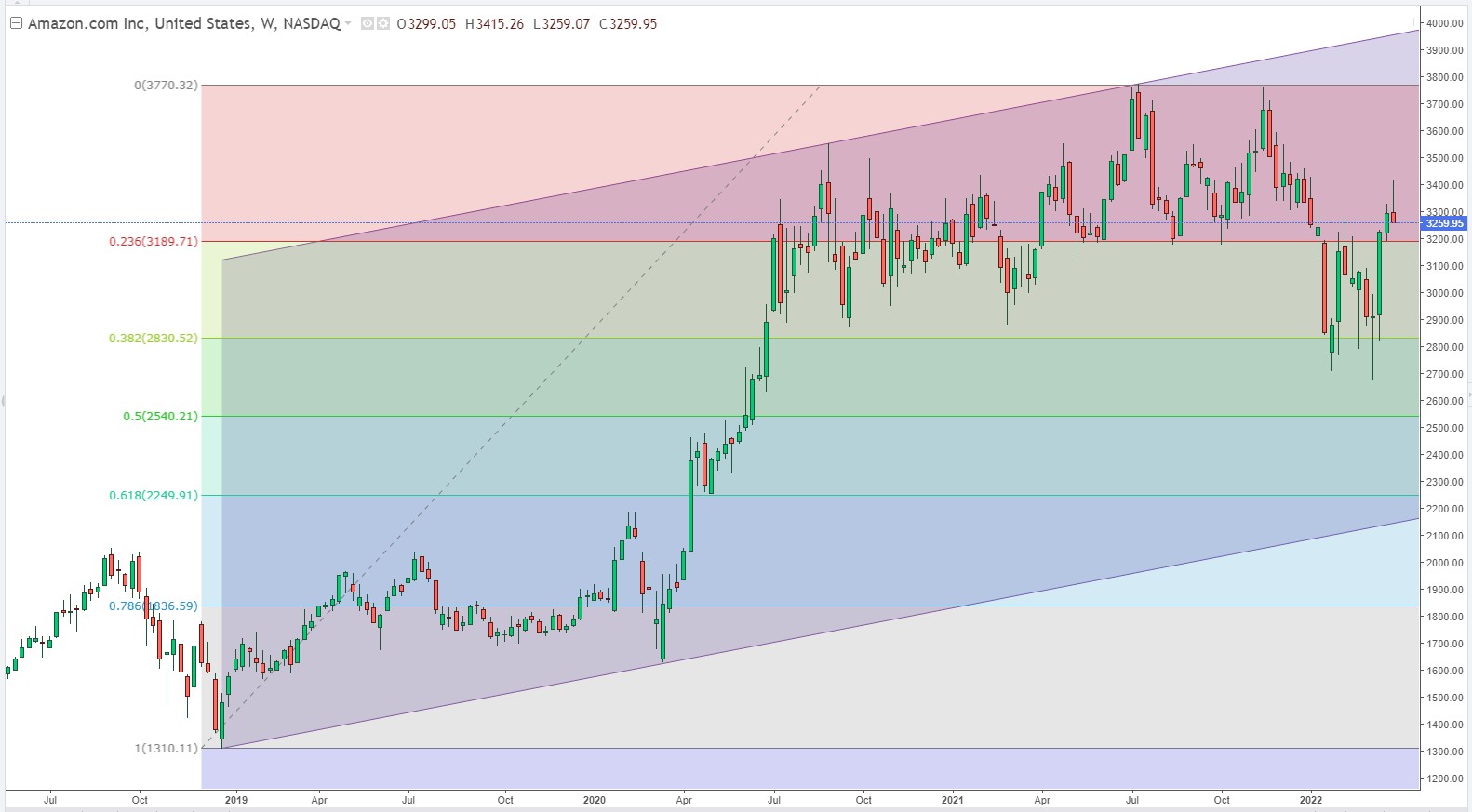

#AMZN

Tidak perlu banyak pemikiran kritis untuk memahami bagaimana bisnis e-commerce Amazon mendapat manfaat dari pandemi. Sekarang itu datang melawan perbandingan yang sulit. Untuk kuartal keempat tahun 2021, penjualan Amerika Utara hanya tumbuh 9%, dan penjualan internasional sebenarnya turun 1% dari tahun ke tahun. Sementara dua segmen ini menguntungkan dari sudut pandang pendapatan operasional selama kuartal tahun lalu, masing-masing merugi pada kuartal keempat tahun 2021.

Pernyataan sepanjang pendapatan Q4, CFO Brian Olsavasky mengatakan perusahaan mengalami biaya $4 miliar karena tekanan inflasi. Dia mengutip kenaikan upah, harga yang lebih tinggi untuk pengiriman pihak ketiga, dan kendala tenaga kerja sebagai alasan kerugian. Namun, Amazon juga mengumumkan kenaikan harga $20 untuk layanan berlangganan Amazon Prime. Dengan lebih dari 200 juta anggota Perdana di seluruh dunia, itu sama dengan peningkatan pendapatan murni Amazon sebesar $4 miliar. Saham AMZN lebih rendah 66.07 (-1.99%) ditutup pada 3,259.95 pada hari Kamis.

#AXP

American Express (AXP) ditutup pada $187 di sesi perdagangan terbaru, menandai pergerakan -1.45% dari hari sebelumnya. Perubahan ini lebih kecil dari kerugian harian S&P 500 sebesar 1.57%. Sementara itu, Dow kehilangan 1.56%, dan Nasdaq, indeks teknologi berat, kehilangan 0.09%. Menuju hari ini, saham penerbit kartu kredit dan perusahaan pembayaran global telah naik 5.24% selama sebulan terakhir, melampaui kenaikan sektor Keuangan sebesar 3.25% dan tertinggal dari kenaikan S&P 500 sebesar 5.37% pada waktu itu.

Wall Street akan mencari hal positif dari American Express saat mendekati tanggal laporan pendapatan berikutnya. Ini diharapkan menjadi 22 April 2022. Pada hari itu, American Express diproyeksikan melaporkan pendapatan $2.43 per saham, yang akan mewakili penurunan tahun-ke-tahun sebesar 11.31%. Perkiraan konsensus terbaru kami menyerukan pendapatan kuartalan sebesar $11.62 miliar, naik 28.18% dari periode tahun lalu. Melihat setahun penuh, Perkiraan Konsensus Zacks kami menyarankan analis mengharapkan pendapatan $9.73 per saham dan pendapatan $49.94 miliar. Jumlah ini akan menandai perubahan masing-masing -2.89% dan +17.83%, dari tahun lalu.

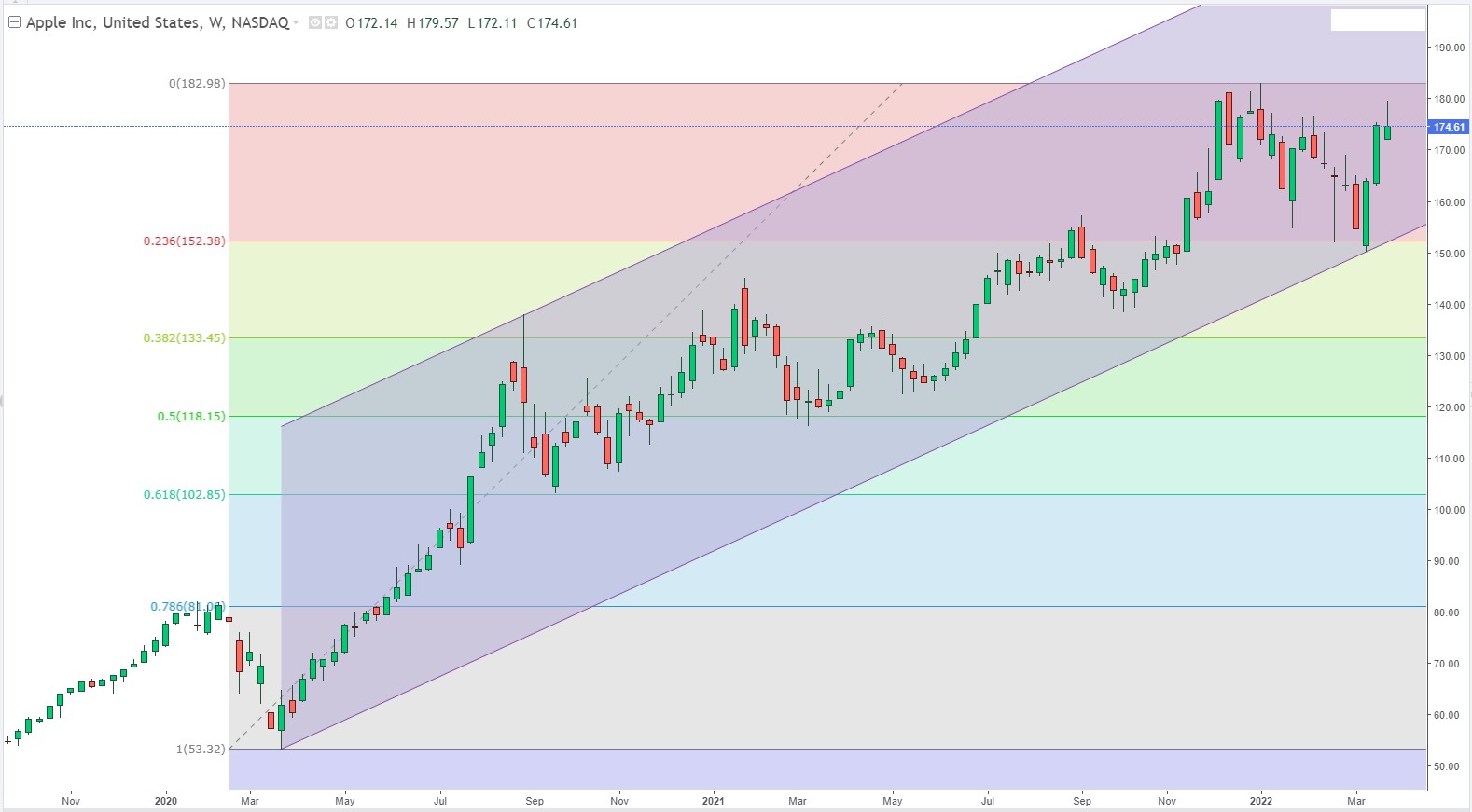

#AAPL

Bank dan fintech harus membiasakan diri: Apple (AAPL) - Get Apple Inc. Report akan segera menjadi pesaing mereka. Merek teknologi telah menjadikan layanan sebagai salah satu area pertumbuhan terpentingnya. Apple mencatatkan pendapatan sebesar $124 miliar untuk tiga bulan yang berakhir pada Desember. Pendapatan jasa, yang mencakup pembayaran, naik 24% ke rekor $19.5 miliar. Margin kotor jasa adalah 72.4%. AAPL lebih rendah 3.16 (-1.78%) ditutup pada 174.61 pada hari Kamis.

#BA

Jet Boeing Co. 737 akan mendapatkan kehidupan baru sebagai kargo yang dikonversi dengan pesanan dari perusahaan layanan penerbangan Dublin, ASL Aviation Holdings. Kesepakatan itu akan mencakup 10 pesanan awal untuk 737-800 kargo yang dikonversi dan hak pembelian untuk menambah 10 lagi. ASL saat ini mengoperasikan 11 dari 737 yang dikonversi dan mengharapkan untuk menguasai sembilan lagi pada awal 2023. Saham BA lebih rendah 3.41 (-1.75%) ditutup pada 191.50 pada hari Kamis.

Boeing mencatatkan pesanan untuk pesawat kargo baru dan yang dikonversi pada tahun 2021 dan sejauh ini telah mencatat 13 pesanan untuk 777 jet kargo sejak awal tahun. Perusahaan intelijen penerbangan IBA memperkirakan pasar global untuk jet kargo yang dikonversi akan mencapai 2.750 pesawat pada tahun 2033, dari sedikit lebih dari 2.000 pada Juni 2021. Perusahaan menyebut Boeing 737-800 dan 767-300ER sebagai beberapa pesawat teratas dalam permintaan untuk konversi kargo.

WEEK AHEAD

Senin, 4 April

Retail Sales MoM Final Feb AU, perkiraan 1.8%, sebelumnya 1.6%.

Balance of Trade Feb DE, perkiraan 7.1 milyar euro, sebelumnya 3.5 milyar euro.

Pidato dari Bank of England Gov. Andrew Bailey.

Factory Orders MoM Feb US, perkiraan -0.5%, sebelumnya 1.4%.

Selasa, 5 April

Reserve Bank of Australia Interest Rate Decision, perkiraan 0.1%, sebelumnya 0.1%.

Balance of Trade Feb CA, perkiraan 2.4 milyar $Cad, sebelumnya 2.62milyar $Cad.

Balance of Trade Feb US, perkiraan $-88 milyar, sebelumnya $-89.7 milyar.

ISM Non-Manufacturing PMI Mar, perkiraan 58.1, sebelumnya 56.5.

Pidato dari US Fed Kashkari dan US Fed Brainard.

Rabu, 6 April

Caixin Services PMI Mar, perkiraan 49.3, sebelumnya 50.2.

Ivey PMI s.a. Mar CA, perkiraan 60.6, sebelumnya 61.

Kamis, 7 April

FOMC Minutes US.

Balance of Trade Feb AU, perkiraan A$10 milyar, sebelumnya A$12.891 milyar.

Industrial Production MoM Feb DE, perkiraan -0.4%, sebelumnya 2.7%.

Initial Jobless Claims 02/Apr US, perkiraan 205K, sebelumnya 202K.

Pidato dari Fed James Bullard.

Jumat, 8 April

RBA Financial Stability Review AU.

Consumer Confidence Mar JP, perkiraan 34, sebelumnya 35.3.

Unemployment Rate Mar CA, perkiraan 5.5%, sebelumnya 5.5%.

PERDAGANGAN

PARTNER

PERUSAHAAN

MEMBANTU

Disclaimer: Trading derivatif mengandung risiko kerugian tinggi dan belum tentu cocok untuk semua investor. TIDAK ADA JAMINAN KEUNTUNGAN dari investasi Anda.

ID

ID

-

English

-

Bahasa Indonesia