PERDAGANGAN

PARTNER

PERUSAHAAN

ANALISA HARIAN

PIVOT

Prediksi Strategi untuk Perdagangan Jangka Pendek

EUR/USD

Mata uang bersama naik-turun pada sesi Amerika Utara Kamis, berkat suasana pasar yang positif, sementara penguatan dolar AS secara luas membantu greenback untuk menjaga pasangan EUR/USD terbatas pada area 1.0960-1.1000. Pada saat pers, EUR/USD diperdagangkan pada 1.1000. Risk appetite meningkat di sesi New York, seperti yang digambarkan oleh ekuitas AS yang meningkat, berbanding terbalik dengan bursa Eropa yang berfluktuasi. Greenback telah didukung sepanjang hari, sebagaimana tercermin oleh Indeks Dolar AS naik 0.16%, di 98.766, didukung oleh peningkatan imbal hasil Treasury AS, dengan imbal hasil obligasi 10-tahun hingga empat basis poin, berada di 2.348%.

USD/JPY

Kombinasi faktor pendukung membantu pasangan USD/JPY untuk membangun momentum penembusan minggu ini melalui angka psikologis 120.00 dan meningkat lebih tinggi untuk hari kelima berturut-turut pada hari Kamis. Nada risiko yang umumnya positif melemahkan safe-haven yen Jepang, yang selanjutnya terbebani oleh perbedaan antara pandangan kebijakan moneter Bank of Japan dan The Fed.

Faktanya, sejumlah anggota FOMC yang berpengaruh, termasuk Ketua The Fed Jerome Powell, meningkatkan kemungkinan kenaikan suku bunga 50 bps pada pertemuan kebijakan mendatang di bulan Mei. Hal ini, bersama dengan kekhawatiran bahwa lonjakan harga minyak mentah akan memberikan tekanan ke atas pada inflasi yang sudah tinggi, mendorong imbal hasil obligasi pemerintah AS bertenor 10 tahun kembali mendekati level tertinggi sejak 2019.

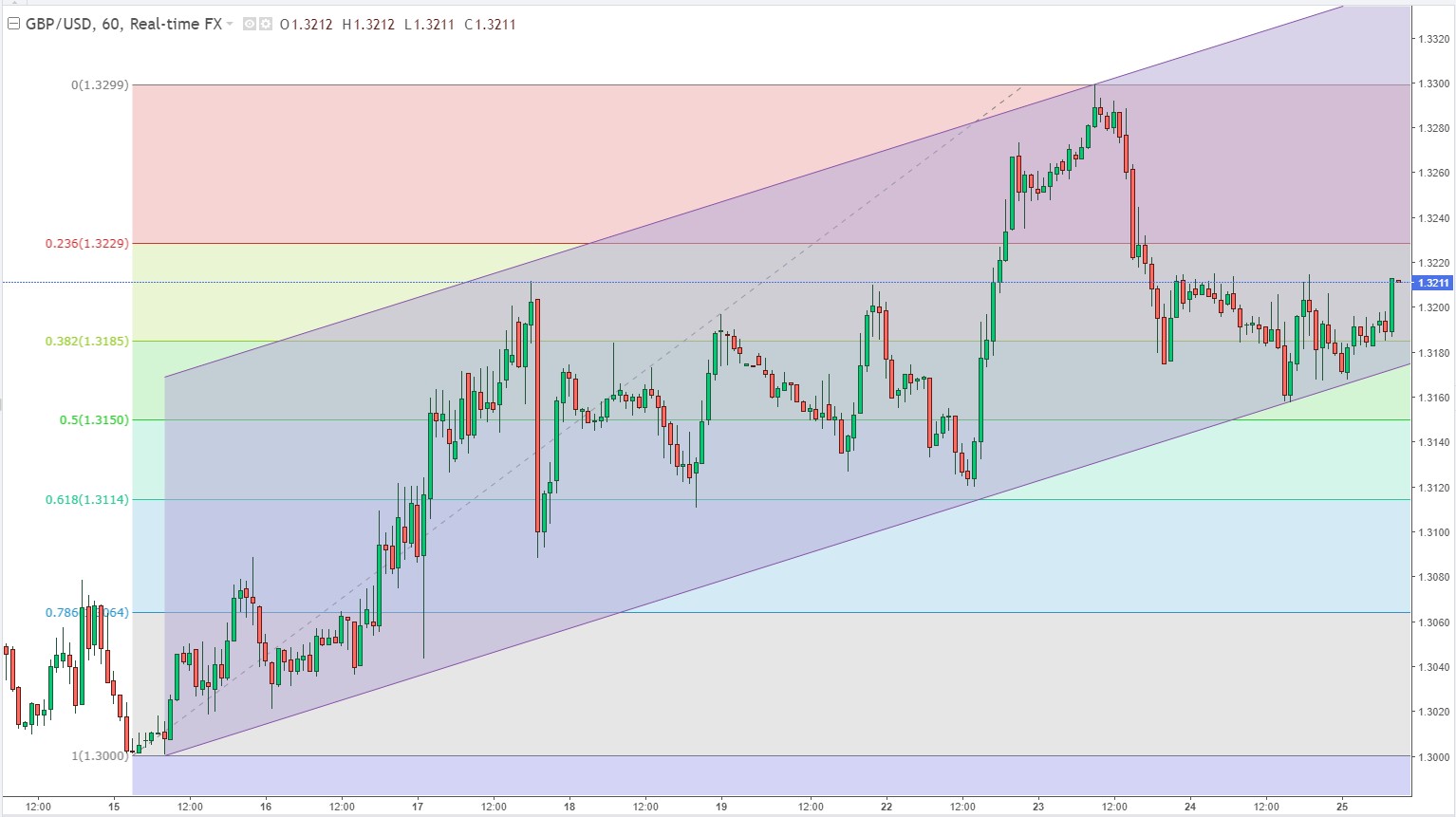

GBP/USD

Pasangan GBP/USD meluncur untuk hari kedua berturut-turut pada hari Kamis dan turun di bawah 1.3200 di tengah suasana pasar risk-on, yang biasanya mendukung pound Inggris, tetapi sikap hawkish bank sentral AS dan kekuatan dolar AS yang luas membebani pasangan ini. Pada saat penulisan, GBP/USD diperdagangkan di 1.3173. Seperti disebutkan di atas, sentimen pasar akhir-akhir ini berubah suram. Indeks Eropa menutup sesi Kamis dengan kerugian, meskipun saham AS tetap hijau.

Di ruang FX, greenback tetap kokoh di sekitar 98.89 per Indeks Dolar AS, mendekati angka 99.00, sementara imbal hasil Treasury AS naik. Di awal sesi Amerika Utara, Presiden Fed Minnesota Neil Kashkari menyatakan bahwa ada risiko berlebihan pada kenaikan suku bunga. Selanjutnya, dia menambahkan bahwa dia melihat tingkat netral di sekitar 2%.

AUD/USD

AUD/USD naik lebih tinggi, tetapi reli tampaknya terhenti, seperti yang ditunjukkan oleh aksi harga hari Kamis, akan membentuk candle doji, yang berarti tarik-menarik antara bull dan bear dimulai, karena ketidakpastian membayangi. Pada saat penulisan, AUD/USD diperdagangkan pada 0.7510. Suasana pasar berisiko di sesi Amerika Utara, meskipun indeks saham Eropa ditutup dengan kerugian.

Pada sisi lainnya, ekuitas AS naik, sementara dolar menunjukkan ketahanan untuk jatuh, karena diperdagangkan dengan keuntungan yang tercermin oleh Indeks Dolar AS naik 0.20%, di 98.82. Imbal hasil Treasury AS melanjutkan kenaikannya setelah kerugian hari Rabu, dengan imbal hasil T-note 10-tahun naik hampir lima basis poin, berada di 2.341%. Tidak adanya data ekonomi Australia akan membuat pedagang AUD/USD terpaut dengan data AS pada hari Jumat.

XAU/USD

Emas (XAU/USD) telah memperpanjang kenaikannya setelah melampaui level resistance $1.950.00 karena investor telah mendukung logam mulia pada sikap hawkish dari Presiden AS Joe Biden dalam pertemuan NATO pada hari Kamis. Selain itu, pelaku pasar memarkir dana mereka di counter logam mulia karena tekanan inflasi. Ketidakpastian seputar krisis Ukraina meningkat pada hari Kamis ketika invasi Rusia ke Ukraina menyelesaikan bulan pertamanya. Pendekatan agresif yang dilakukan oleh para pemimpin Barat di Brussel untuk membentuk empat kelompok pertempuran baru di Slovakia, Rumania, Bulgaria, dan Hongaria, yang dapat memperkuat pertahanan kolektif mereka, terutama di sayap Timur, tampaknya dapat mempertahankan cengkeraman mereka di Rusia. Ini telah meningkatkan ketegangan geopolitik dan telah menopang harga emas lebih jauh.

WTI

Pasar minyak telah mengalami perdagangan yang bergejolak pada hari Kamis, dengan para pedagang menyulap banyak tema. WTI berayun antara tertinggi multi-minggu di atas $116 dan area $112, dan pada level saat ini sekitar $113 diperdagangkan sekitar satu dolar lebih rendah pada sesi tersebut. Penurunan menuju $110 menarik permintaan yang solid karena pelaku pasar energi terus mempertimbangkan besarnya kerugian pasokan minyak Rusia. Direktur Eksekutif IEA Fatih Birol mengatakan pada hari Kamis bahwa negara-negara IEA bersatu dalam upaya untuk secara radikal mengurangi impor minyak dan gas Rusia, dengan negara-negara Barat telah memberlakukan sanksi keras terhadap ekonomi Rusia atas invasinya ke Ukraina. Menjadi catatan adalah, Kamis terlihat kesibukan KTT NATO dan UE di mana sanksi tersebut sedikit diperketat, meskipun tidak ada pengumuman UE tentang embargo UE terhadap minyak Rusia.

#INTC

Intel (INTC) ditutup pada $48.27 pada hari Rabu, menandai pergerakan -0.25% dari hari sebelumnya. Perubahan ini lebih sempit dari kerugian harian S&P 500 sebesar 1.23%. Di tempat lain, Dow kehilangan 1.29%, sedangkan Nasdaq yang padat teknologi kehilangan 0.34%. Menjelang Kamis, saham pembuat chip terbesar dunia telah naik 8.28% selama sebulan terakhir, melampaui kenaikan sektor Komputer dan Teknologi sebesar 4.45% dan kenaikan S&P 500 sebesar 5.04% pada waktu itu.

Pada hari itu, Intel diproyeksikan melaporkan pendapatan $0.80 per saham, yang akan mewakili penurunan dari tahun ke tahun. sebesar 42.45%. Sementara itu, Estimasi Konsensus Zacks untuk pendapatan memproyeksikan penjualan bersih sebesar $18.32 miliar, turun 6.88% dari periode tahun lalu. Untuk setahun penuh, Estimasi Konsensus Zacks memproyeksikan pendapatan sebesar $.,49 per saham dan pendapatan $75.39 miliar, yang akan mewakili perubahan masing-masing sebesar -36.2% dan -3.38%, dari tahun sebelumnya. Saham INTC lebih tinggi 3.35 (+6.94%) ditutup di 51.62 pada hari Kamis.

#MCD

McDonald's Corporation MCD berfokus pada ekspansi internasional, program loyalitas, dan digitalisasi untuk mendorong kinerja. Perusahaan mendapat manfaat dari pertumbuhan perusahaan yang kuat. Pada tahun lalu, saham perusahaan telah naik 8.5%, dibandingkan penurunan industri sebesar 7.2%. Namun, utang yang tinggi dan perusahaan China yang suram merugikan perusahaan.

MCD berencana untuk membuka lebih dari 1.800 restoran secara global pada tahun 2022, yang mencakup 500 pembukaan di Amerika Serikat dan segmen IOM, dan 1.300 (termasuk hampir 800 di China) restoran baru di pasar IDL. Perusahaan mengharapkan pertumbuhan restoran hampir 3.5% untuk 2022. Saham MCD lebih tinggi 4.14 (+1.75%) ditutup di 240.26 pada hari Kamis.

PERDAGANGAN

PARTNER

PERUSAHAAN

MEMBANTU

Disclaimer: Trading derivatif mengandung risiko kerugian tinggi dan belum tentu cocok untuk semua investor. TIDAK ADA JAMINAN KEUNTUNGAN dari investasi Anda.

ID

ID

-

English

-

Bahasa Indonesia