PERDAGANGAN

PARTNER

PERUSAHAAN

DAILY ANALYSIS

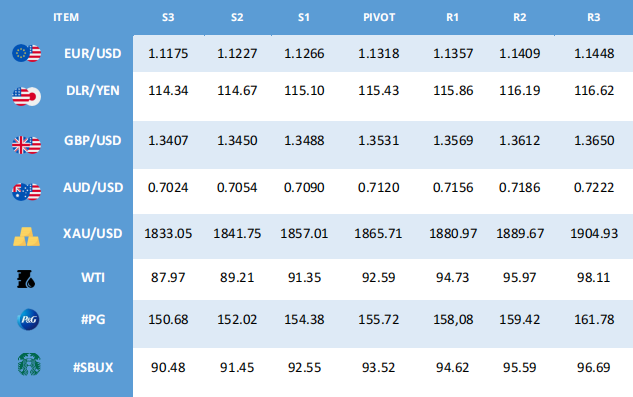

PIVOT

Forecasting Strategy for Short Term Trade

EUR/USD

Pasangan EUR/USD turun untuk hari kedua berturut-turut, diperdagangkan di dekat terendah harian 1.1279. Mata uang Amerika melonjak di tengah penghindaran risiko yang terus-menerus, mendorong investor menjauh dari aset berimbal hasil tinggi. Pada hari Senin, Menteri Luar Negeri Rusia Sergey Lavrov mengatakan kepada Presiden Putin bahwa AS telah mengajukan proposal konkret untuk mengurangi risiko militer dan bahwa dia dapat melihat cara untuk melanjutkan pembicaraan, meskipun dia menambahkan bahwa tanggapan UE dan NATO belum memuaskan. Sementara itu, Presiden ECB Christine Lagarde bersaksi tentang Laporan Tahunan ECB di hadapan Parlemen Eropa. Dia mencatat bahwa bank akan mengambil tindakan pada waktu yang tepat untuk mencapai sasaran inflasi 2% dalam jangka menengah.

USD/JPY

USD/JPY - 115.48.. Pasangan ini berayun dalam mode berombak dalam perdagangan yang fluktuatif pada Senin. Meskipun pelemahan awal ke 115.20 di Australia setelah aksi jual intra-hari Jumat di sore NY bersamaan dengan imbal hasil AS dari 115.98 ke level 115.02 karena pembelian safe-haven yen di tengah meningkatnya ketegangan di Ukraina, harga dengan cepat pulih di tengah obrolan pasar BOJ dovish yang akan segera terjadi operasi pasar terbuka. Dollar naik ke 115.59 menjelang pembukaan Tokyo dan meskipun mundur ke 115.31, harga rebound ke 115.57 di tengah berita BOJ mengumumkan pihaknya menawarkan untuk membeli JGB dalam jumlah tak terbatas langsung pada tingkat bunga tetap dengan sisa jatuh tempo lebih dari 5 tahun dan hingga 10 tahun dari 2/15. Harapkan ayunan berombak untuk melanjutkan tetapi kelemahan intra-hari di Nikkie (N225 saat ini turun 2.25% pada 27.072) Saham Asia akan membebani saham Eropa nanti, jadi pertarungan pembelian yen lainnya harus dilihat.

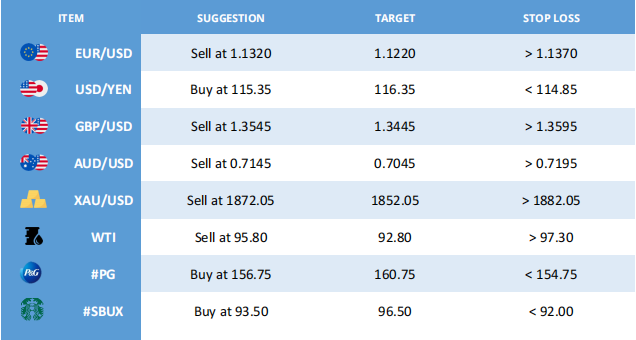

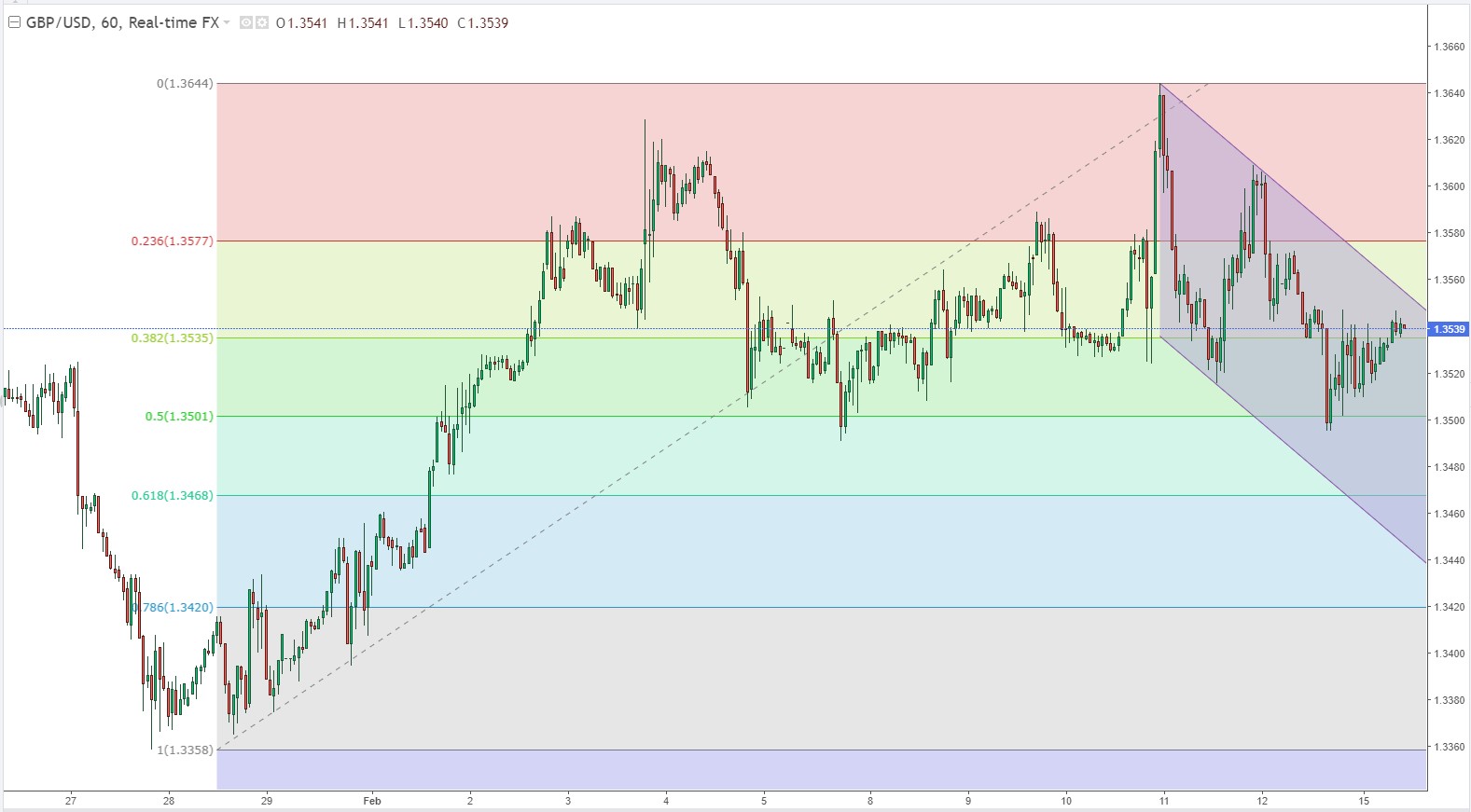

GBP/USD

GBP/USD telah menghadapi tekanan bearish baru setelah menutup minggu sebelumnya di wilayah positif dengan aliran safe-haven mendominasi pasar keuangan. Pasangan ini terakhir terlihat menguji 1.3500 dan tekanan bearish bisa meningkat jika level berubah menjadi resistance. Laporan yang mengklaim bahwa Rusia dapat menginvasi Ukraina minggu ini menyebabkan investor mencari perlindungan di awal minggu. Pada gilirannya, Indeks FTSE 100 Inggris turun 2.2% di awal sesi Eropa. Pada hari Selasa, Kantor Statistik Nasional Inggris akan merilis laporan pasar tenaga kerja. Pasar memperkirakan inflasi upah tahunan dalam tiga bulan hingga Desember, yang diukur dengan Pendapatan Rata-Rata Termasuk Bonus, turun menjadi 3.9% dari 4.2%. Angka yang lebih kuat dari perkiraan dapat membantu pound Inggris menemukan permintaan dan sebaliknya.

AUD/USD

Karena pasar tetap gelisah pada prospek kemungkinan serangan militer Rusia yang akan segera terjadi ke Ukraina, sentimen makro tetap defensif dan dengan demikian AUD/USD terus diperdagangkan dengan bias negatif. Pasangan ini turun sekitar 0.2% hari ini di area 0.7125, setelah pulih sedikit dari penurunan singkat di bawah level 0.7100 pada awal perdagangan Eropa, tetapi gagal untuk pulih kembali ke level 0.7150. Sebelumnya pada hari itu, Rusia menunjukkan preferensi untuk melanjutkan diplomasi, tetapi citra satelit yang dikutip oleh pers AS menunjukkan bahwa pasukan Rusia di dekat perbatasan Ukraina bergerak ke posisi menyerang. Sementara itu, Presiden Ukraina dengan bercanda menyebut Rabu sebagai kemungkinan tanggal ketika Rusia mungkin menyerang, sebuah pernyataan yang pada awalnya dianggap serius oleh pasar, tetapi sekarang tidak yakin apa yang harus dilakukan.

XAU/USD

Emas lebih tinggi di jam-jam terakhir perdagangan Wall Street karena ketegangan tetap tinggi di sekitar ancaman invasi Rusia ke Ukraina. Emas naik 0.68% dan telah rally dari terendah $1.850.84 ke tertinggi $1.874.19 sejauh AS terus melaporkan kemungkinan peningkatan serangan Rusia meskipun upaya diplomatik yang sejauh ini belum membuahkan hasil. Presiden Ukraina Volodymyr Zelensky dilaporkan telah mengatakan bahwa Ukraina "telah diberitahu" bahwa Rabu, 16 Februari "akan menjadi hari penyerangan". Namun, selera risiko namun seperti koin menjadi berubah ketika seorang pejabat senior Ukraina menyangkal bahwa Presiden Zelensky secara harfiah mengatakan dalam sebuah pidato kepada bangsa bahwa “dia telah diberitahu bahwa serangan Rusia akan dimulai pada 16 Februari” Mykhailo Podoliak, seorang penasihat Presiden.

WTI

Patokan minyak mentah AS, Western Texas Intermediate (WTI) nyaris tidak naik, menyusul lonjakan Jumat 3.78%. Pada saat penulisan, WTI diperdagangkan pada $94.00 hampir datar. Peristiwa geopolitik mengurangi suasana pasar di pasar keuangan. Berdasarkan fakta bahwa perang dapat memicu sanksi Rusia ke negara-negara barat, termasuk memotong pasokan gas alam dan minyak. (Rusia adalah produsen gas alam dan minyak mentah terbesar ketiga.) Dengan minyak mentah menembus angka $90/bbl, obrolan tentang $100+ minyak telah meningkat lebih lanjut. Apakah pasokan minyak puncak di cakrawala? Menurut ahli strategi di Bank of Montreal, mungkin terlalu dini untuk menyatakan pasokan minyak puncak telah tiba. Ini telah mendorong kami untuk merevisi perkiraan WTI kami menjadi $85/bbl pada tahun 2022 dan $80 pada tahun 2023 (sebelumnya masing-masing $75 dan $77.50).

#PG

Procter & Gamble Company PG mempertahankan kejutan pendapatan yang kuat selama lebih dari tiga tahun, sementara pendapatannya melampaui perkiraan untuk ketujuh kalinya berturut-turut pada kuartal kedua fiskal. Penjualan bersih meningkat 6% dari tahun ke tahun, berkat kekuatan di semua segmen, ditambah dengan peningkatan volume dan harga yang kuat. Procter & Gamble tetap fokus pada produktivitas dan rencana penghematan biaya untuk meningkatkan margin. Perusahaan telah menyaksikan penghematan biaya dan peningkatan efisiensi melalui investasi berkelanjutan dalam bisnis di samping upaya untuk mengimbangi hambatan biaya. Akibatnya, ia mengharapkan penghematan COGS $ 800 juta tahun ini. Margin kotor dan operasi inti netral mata uang mencerminkan keuntungan 80-bps dari penghematan produktivitas dan 130 bps dari manfaat penetapan harga pada fiskal kuartal kedua 2022. Saham PG lebih tinggi 0.45 (+0.29%) ditutup pada 156.74 pada hari Senin.

#SBUX

Procter & Gamble Company PG mempertahankan kejutan pendapatan yang kuat selama lebih dari tiga tahun, sementara pendapatannya melampaui perkiraan untuk ketujuh kalinya berturut-turut pada kuartal kedua fiskal. Penjualan bersih meningkat 6% dari tahun ke tahun, berkat kekuatan di semua segmen, ditambah dengan peningkatan volume dan harga yang kuat. Procter & Gamble tetap fokus pada produktivitas dan rencana penghematan biaya untuk meningkatkan margin. Perusahaan telah menyaksikan penghematan biaya dan peningkatan efisiensi melalui investasi berkelanjutan dalam bisnis di samping upaya untuk mengimbangi hambatan biaya. Akibatnya, ia mengharapkan penghematan COGS $ 800 juta tahun ini. Margin kotor dan operasi inti netral mata uang mencerminkan keuntungan 80-bps dari penghematan produktivitas dan 130 bps dari manfaat penetapan harga pada fiskal kuartal kedua 2022. Saham PG lebih tinggi 0.45 (+0.29%) ditutup pada 156.74 pada hari Senin.6% dari tahun ke tahun, berkat kekuatan di semua segmen, ditambah dengan peningkatan volume dan harga yang kuat. Procter & Gamble tetap fokus pada produktivitas dan rencana penghematan biaya untuk meningkatkan margin. Perusahaan telah menyaksikan penghematan biaya dan peningkatan efisiensi melalui investasi berkelanjutan dalam bisnis di samping upaya untuk mengimbangi hambatan biaya. Akibatnya, ia mengharapkan penghematan COGS $ 800 juta tahun ini. Margin kotor dan operasi inti netral mata uang mencerminkan keuntungan 80-bps dari penghematan produktivitas dan 130 bps dari manfaat penetapan harga pada fiskal kuartal kedua 2022. Saham PG lebih tinggi 0.45 (+0.29%) ditutup pada 156.74 pada hari Senin.

PERDAGANGAN

PARTNER

PERUSAHAAN

MEMBANTU

Disclaimer: Trading derivatif mengandung risiko kerugian tinggi dan belum tentu cocok untuk semua investor. TIDAK ADA JAMINAN KEUNTUNGAN dari investasi Anda.

ID

ID

-

English

-

Bahasa Indonesia